- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Correcting information for NC Itemized deduction when standard was used for Federal?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Correcting information for NC Itemized deduction when standard was used for Federal?

For 2019 North Carolina State income tax, TurboTax did not include Qualified Charitable Deductions from an IRA as part of the Charitable Contributions used in calculating the itemized deduction. Also, it incorrectly imported from the federal information the amount of property taxes paid, and instead used the Federal cap of $10,000. How do I correct those amounts? There appears to be a glitch in the program here.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Correcting information for NC Itemized deduction when standard was used for Federal?

There is not a glitch in the TurboTax NC return, some things have changed in NC.

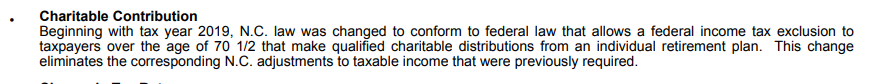

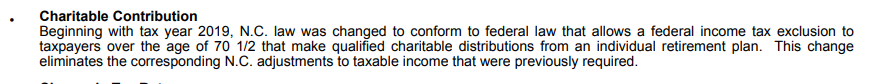

There was a change in the NC law with regard to Qualified Charitable Contributions. See the following excerpt from the NC Individual Income Tax instruction booklet. This was under the section labeled What's New for 2019:

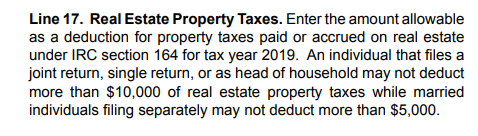

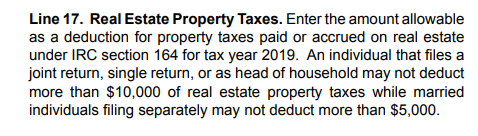

Also, here is an excerpt stating that the allowable Real Estate Property Tax deduction under NC Itemized Deductions is limited to $10,000 for a Married Filing Joint return:

For your reference, here is a link to the full instruction booklet: 2019 D-401 Instructions

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Correcting information for NC Itemized deduction when standard was used for Federal?

North Carolina does not allow a charitable deduction for QCD because the amount was excluded from taxable income.

Also, North Carolina does NOT allow more than the federal deduction under 164 for Real Property Taxes.

See North Carolina Standard Deduction or North Carolina Itemized Deductions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Correcting information for NC Itemized deduction when standard was used for Federal?

I'm not sure that is correct. The link to the NC DOR site says, "Beginning with the 2018 tax year, an individual may claim North Carolina itemized deductions even if the individual does not claim federal itemized deductions." Also, the amount claimed as a QCD for the feds, IS included in NC taxable income, but NC allows a that amount to be included in the itemized deduction. TurboTax does not seem to accommodate this. It did last year.

Thanks,

-- Gil

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Correcting information for NC Itemized deduction when standard was used for Federal?

There is not a glitch in the TurboTax NC return, some things have changed in NC.

There was a change in the NC law with regard to Qualified Charitable Contributions. See the following excerpt from the NC Individual Income Tax instruction booklet. This was under the section labeled What's New for 2019:

Also, here is an excerpt stating that the allowable Real Estate Property Tax deduction under NC Itemized Deductions is limited to $10,000 for a Married Filing Joint return:

For your reference, here is a link to the full instruction booklet: 2019 D-401 Instructions

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Correcting information for NC Itemized deduction when standard was used for Federal?

Thanks much. I'd missed that change in NC regs/laws.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

pegmikeg

Level 1

Slemay925

Level 2

steve-kirby-cpa

New Member

gtchen66

Level 2

egretbob

New Member