- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Colorado - Form 104PN: SP PY Resident Box should not be checked if your spouse lived in Color...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado - Form 104PN: SP PY Resident Box should not be checked if your spouse lived in Colorado the whole year

I'm new to CO. While reviewing state taxes TurboTax flagged this as something to "fix." It says,

"Form 104PN: SP PY Resident Box should not be checked if your spouse lived in Colorado the whole year."

We moved to CO on January 5th of 2022. I'm guessing this is because I selected "Part-Year Resident" from 01/2022 to 12/2022. Since the form only cares about the range down to the month, should we have selected "Full-Year Resident"? Or have I done this form correctly since we technically didn't live in CO for the first 5 days of the year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado - Form 104PN: SP PY Resident Box should not be checked if your spouse lived in Colorado the whole year

Since the flag only comes up for spouse (SP) it is not related to rounding months.

Check My Info to make sure that you indicated that both you and your spouse were part-year residents, lived in another state and are showing a date when you became residents of Colorado.

- Select My Info in the left column

- Select Edit next to your name. State of residence should be Colorado. I lived in another state in 2022 should be Yes. Previous state of residence should have your old state and Date you became a resident of Colorado should be 01/05/2022.

- Then Edit next to your spouse and go through the same steps.

- Then go to the Colorado section. On the screen “Colorado” residency, the Part-Year Resident box should be checked for both of you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado - Form 104PN: SP PY Resident Box should not be checked if your spouse lived in Colorado the whole year

@ErnieS0 , I should have clarified that I don't know if this is coming up only for my spouse. TurboTax said there were 2 issues to review and this is the first that came up. I'm assuming that the other issue is the same but for me instead of my spouse. In fact, in the little form preview it shows that for both my spouse and I that we are Part-Year Residents from 01/2022 to 12/2022. I have checked the My Info section and it is correct.

Should we just say that we were full-year residents? We physically arrived on 1/5/2022, but we paid rent, had a mailing address, and had mail forwarding set up for the entire month of January. Perhaps specifying 1/5/2022 is splitting hairs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado - Form 104PN: SP PY Resident Box should not be checked if your spouse lived in Colorado the whole year

You are fine in claiming full-year Colorado residency. If you had income and withholding from another state, you can file a non-resident return. Colorado will give you credit for any tax paid to another state on double-taxed income for five days, if necessary.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado - Form 104PN: SP PY Resident Box should not be checked if your spouse lived in Colorado the whole year

@ErnieS0 , filing as a Full-Year resident makes sense, but when I choose that, it decreases my refund by $400 without explaining why. Is it equally valid for me to choose Part-Year Resident from 01/2022 to 12/2022 in order to get the better refund? None of my other state tax info changed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado - Form 104PN: SP PY Resident Box should not be checked if your spouse lived in Colorado the whole year

Your refund would go down if you had significant income for those first five days. Filing as a full-year resident will pull all your income into Colorado. Did you complete the Other State Tax Credit section?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado - Form 104PN: SP PY Resident Box should not be checked if your spouse lived in Colorado the whole year

@ErnieS0 hmm, no we didn't have any income during those first 5 days. We only received income while living in Colorado. Some of that income was earned in our old state but received in CO. A previous screen (which I cannot find) appeared to factor this in already. I don't see how the first 5 days could change how much we're taxed on. Also, the state we moved from doesn't have state taxes, so the only state taxes we're filing are for CO.

The first 5 days of the year were spent moving across the country from our old state.

I'm at a loss as to why claiming Part-Year vs. Full-Year is changing our refund so much. Perhaps I should try going back to my personal info and saying that we were in Colorado the whole year? Technically we woke up the morning of Jan 1 in our old state, but I don't know how much that matters.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado - Form 104PN: SP PY Resident Box should not be checked if your spouse lived in Colorado the whole year

I've done some research and, in my opinion, the Colorado Income Tax Guide is fairly clear that we are Part-Year Residents because we were "domiciled outside of Colorado at the beginning of the tax year, but then moves to Colorado during the tax year and establishes domicile in the state." Therefore, my guess is it's a bug in TurboTax saying that we shouldn't have chosen Part-Year Resident. They're not accounting for people moving to the state during January. I can't find anything on Colorado's tax site or the official forms saying that January to December is invalid for Part-Year Resident.

As for why changing from Part-Year to Full-Year changes our refund by $400, I have no idea, since it's a black box in TurboTax. I'd love to compare the actual forms. But I'm leaning toward the option with the bigger refund, especially since it seems technically correct.

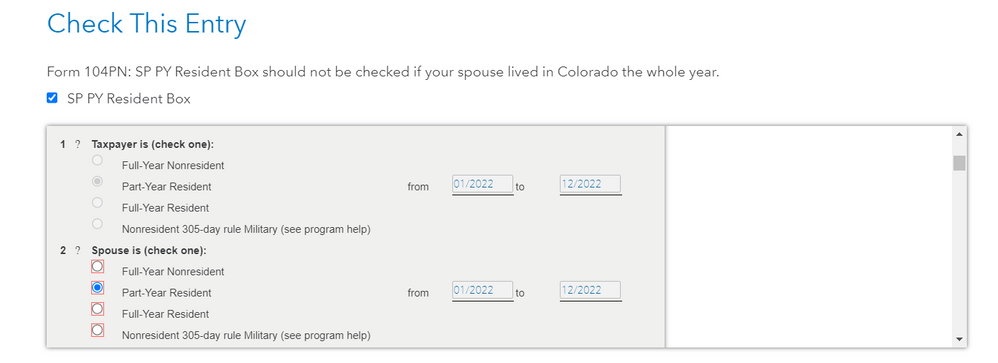

Screenshot of the form flagged by TurboTax:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado - Form 104PN: SP PY Resident Box should not be checked if your spouse lived in Colorado the whole year

You spent the first 5 days moving into the state so they are negligible if you want to be full year. However, since part-year is giving you a bigger refund with no income difference due to the 5 days, there is more going on.

Please take a look at your actual tax forms as resident and part-year to determine the difference and let us know so we can help. The full year return will use the federal AGI while the part year return will use the CO income. My guess would be you have other income that is not included in the CO part year - but should be. You may need to review your CO entries.

- In desktop, switch to Forms Mode.

- For online, see How do I preview my TurboTax Online return before filing?

I would be that you can change your part year to Feb for the move. Based on the dates for you to get your license, begin to feel established, register to vote, car insurance changed, etc. Even with Jan, you should be able to claim part year.

Reference: New Colorado Resident | Frequently Asked Questions

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado - Form 104PN: SP PY Resident Box should not be checked if your spouse lived in Colorado the whole year

@AmyC , thanks for the input. I think I've figured out the differences. We had considerable income earned in our old state that we did not receive until 2022 and was reported on a W-2 for our old state. Therefore, what I'm seeing is

When Part-Year Resident

- The old state's income is not counted toward our CO income, lowering our tax liability (apportioned tax on Line 36 of CO form 104PN for Part-Year residents).

- Part-Year residents don't qualify for CO's TABOR credit, some kind of sales tax reimbursement, so we don't get this credit.

When Full-Year Resident

- Our tax liability is higher because it includes the income on our W-2 for our old state

- Full-Year residents get the TABOR credit

In each scenario, there is a one factor which would increase our refund and one which would decrease our refund. In our case, the Part-Year Resident approach advantages us. However, I'm considering going with Full-Year refund because 2 CO tax help agents have recommended it as well as 1 agent from H&R Block. My understanding is that this may also qualify is for TABOR or similar benefits during the 2023 tax year. I've also heard that you're not technically supposed to file as Part-Year if you've lived for fewer than 6 months in CO, but each time it's been accompanied by a "yeah but you still can and people have done it for years" qualifier.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado - Form 104PN: SP PY Resident Box should not be checked if your spouse lived in Colorado the whole year

Thanks so much for the reply! Many states have rules about residency after so many days or months. CO does not have any such rules. The official definition of part year from CO states:

Part-Year Resident Definition

A part-year resident is an individual who was a resident of Colorado for only part of the tax year. This includes anyone who moved into Colorado with the intention of making his/her home here or a Colorado resident who moved out of Colorado with the intention of making his/her home elsewhere any time during the tax year.

Because your move was in 2022, you could be part year. Since 5 days is negligible, you could claim full resident. You can choose the best option for you. Personally, the full year is a bit cleaner. However, you will need to make sure you get credit for tax paid on the income to the other state on your resident CO return. See How do I file a nonresident state return?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

parachem

Level 2

yingmin

Level 1

ajm2281

Level 1

rodgerbruce

New Member

kpgrear

New Member