- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

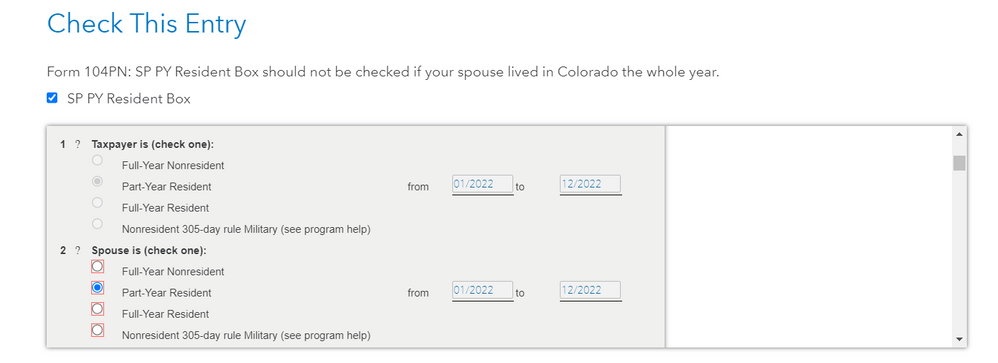

I've done some research and, in my opinion, the Colorado Income Tax Guide is fairly clear that we are Part-Year Residents because we were "domiciled outside of Colorado at the beginning of the tax year, but then moves to Colorado during the tax year and establishes domicile in the state." Therefore, my guess is it's a bug in TurboTax saying that we shouldn't have chosen Part-Year Resident. They're not accounting for people moving to the state during January. I can't find anything on Colorado's tax site or the official forms saying that January to December is invalid for Part-Year Resident.

As for why changing from Part-Year to Full-Year changes our refund by $400, I have no idea, since it's a black box in TurboTax. I'd love to compare the actual forms. But I'm leaning toward the option with the bigger refund, especially since it seems technically correct.

Screenshot of the form flagged by TurboTax: