- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: CA 540 X

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CA 540 X

need to amend CA 540. Error on original filing resulted in refund of all my estimated quarterly tax payments. How do I indicate on amended 540 that quarterly estimated tax payments were paid then refunded?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CA 540 X

If you are only amending your state return to reflect the estimated tax payments, you don't need to. You would only need to amend your return if there are additional sources of income or deductions to report. Please see the link below for more details on when you would amend your return.

If you determine you still need to amend, please see the link below for instructions on how to start your amended state return.

Once you are in the input section of the program for the amended return, you can enter the estimated tax payments as follows under the federal interview section:

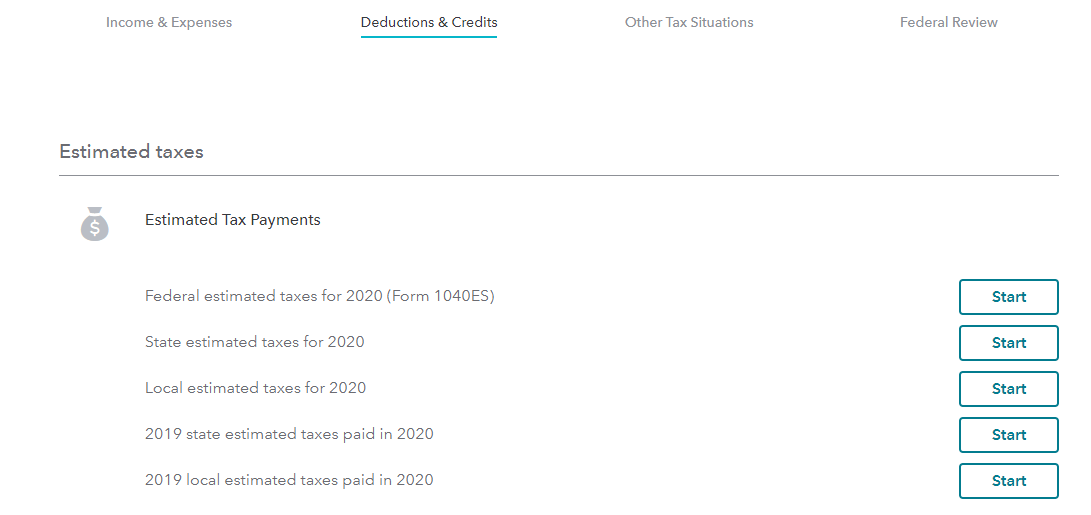

- Select Deductions & Credits

- Scroll down through All Tax Breaks and select Estimates and Other Taxes Paid

- Select Estimated Tax Payments

- Select State estimated taxes for 2020

- Select Yes to indicate you did pay estimates for 2020

- Proceed to enter your payments with the date paid as applicable

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CA 540 X

that was not my question. I pay only estimated taxes and due to an unwarranted deduction on original filing, I received a full refund of all taxes paid, whereas, I actually owed a small amount. In trying to rectify, I do not see where/how to indicate this refund in amended form 540. As I see it, I can either 1. go to forms and override the estimated tax I paid to reflect 0 on amended form 540 or B) complete the 540 to reflect the amount I should have paid had the refund not occurred, then reconcile on the attached form CA schedule X line 2, by adding in the amount of "overpaid tax" from original 540. perhaps there's another option. input appreciated re: correct way to proceed

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tomcat4

New Member

tz3019

Returning Member

ava-nasseri

New Member

user17674020775

New Member

user17620428287

New Member