- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

If you are only amending your state return to reflect the estimated tax payments, you don't need to. You would only need to amend your return if there are additional sources of income or deductions to report. Please see the link below for more details on when you would amend your return.

If you determine you still need to amend, please see the link below for instructions on how to start your amended state return.

Once you are in the input section of the program for the amended return, you can enter the estimated tax payments as follows under the federal interview section:

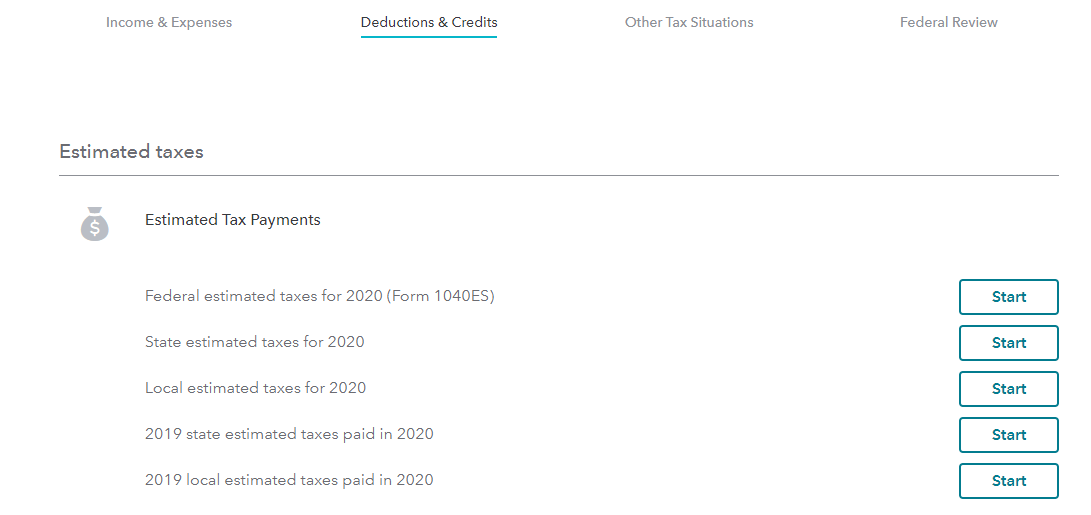

- Select Deductions & Credits

- Scroll down through All Tax Breaks and select Estimates and Other Taxes Paid

- Select Estimated Tax Payments

- Select State estimated taxes for 2020

- Select Yes to indicate you did pay estimates for 2020

- Proceed to enter your payments with the date paid as applicable

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 20, 2021

7:29 PM