- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: 457b NJ question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

457b NJ question

I left my employer and elected to take my non government 457b over 3 yearly distributions. The first occurred last year. New Jersey taxes were paid on the contributions ( I believe). I received a W2 (not 1099R) for the first distribution taken last year. Turbo tax wants to add the total W2 amount to my income. Using the General rule, I can calculate my taxable portion vs my excluded portion for NJ tax. How do I a report my income in Turbo tax as the program defaults to adding the complete W2 listed amount to my income?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

457b NJ question

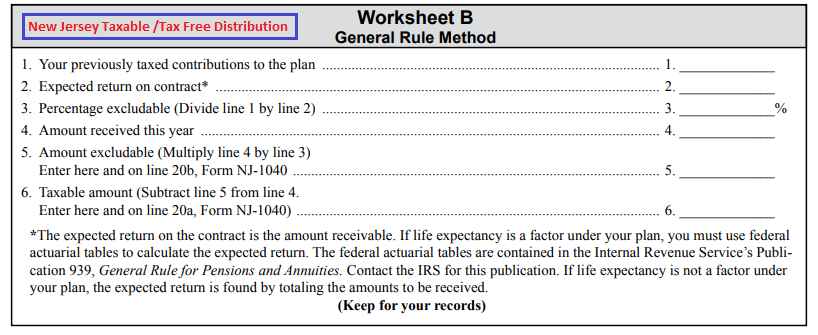

Yes, that is correct. You did pay tax on the contributions on the New Jersey return. You should use the General Rule worksheet to enter the correct taxable amount in the State section on the W-2. Then the taxable amount will carry correctly to the New Jersey return.

I advertently state 1099R in your other post, it should have said W-2.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

457b NJ question

Thanks that works in the TurboTax program. If I file electronically, should I be prepared for a state audit as won't this create a W2 mismatch as what is reported on the NJ-1040 will not match the totals of the W2s that NJ receives? Is it better to file by paper with supporting documents even if it takes three times as long to receive an refund or should I just file electronically and wait and see? If I buy the audit protection, is this something TurboTax would handle as a third party?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

457b NJ question

No, you would not be better off in mailing your returns. So, YES, you should definitely file electronically. You should always save your tax documents for at least 7 years in case of an audit. What will most likely happen is that you would receive in the mail a letter from the State Division of Taxation, stating that they noticed a discrepancy in the information provided by you. This could take anywhere from 3 months to 5 years but typically much sooner than later. State confirmations are far less labor intensive than IRS issues of the same type as this. It will all work itself out.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

WhatsTheDeal

New Member

dmheffron

Level 1

joannabanana6

Level 2

trust812

Level 4

Kirkbus20

New Member