- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: 140NR - Arizona

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona Filing - Other Income

Hello,

Turbotax wants me to enter the "portion of total other federal income" for Arizona, which I am filing in for the first time after buying a rental property there in 2019. Do I list my rental income here, or is "other income" referring to something else?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona Filing - Other Income

Arizona Instructions for line 21 rather unhelpfully says "Rent or royalty income earned on Arizona properties".

However, it is clear in looking at the previous lines, that the income desired on line 21 is "net" income, that is, income after expenses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona Filing - Other Income

No, your rental income is not in the "Other Income" category on Arizona Form 104-NR. If you rental income is your only Arizona source income, you leave that "box" blank.

Your rental income is reported on line 21 of the 104-NR, "Rents, royalties, partnerships, estates, trusts, small business corporations from federal Schedule E".

This link for Form 104-NR may help you visualize what is being asked in TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona Filing - Other Income

Is line 21 on 104-NR asking for gross rental income or income after expenses?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona Filing - Other Income

Gross income indicates that it is income before expenses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona Filing - Other Income

Yes, but is Line 21 asking for that, or income after expenses?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona Filing - Other Income

Arizona Instructions for line 21 rather unhelpfully says "Rent or royalty income earned on Arizona properties".

However, it is clear in looking at the previous lines, that the income desired on line 21 is "net" income, that is, income after expenses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona Filing - Other Income

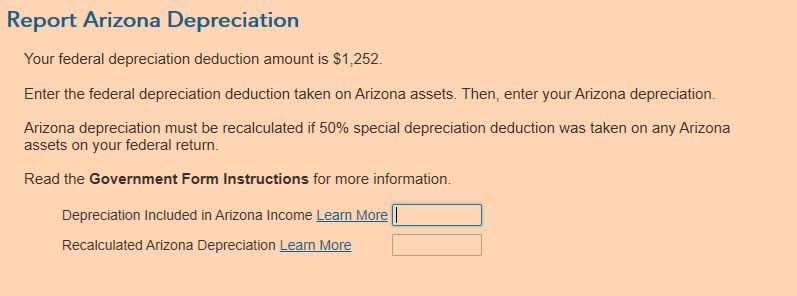

Hello, I am stuck on how to answer the following:

I see that TurboTax has calculated on the associated worksheets for Schedule E for this asset a current depreciation of $1233. Is this the amount that should be entered into the first box? And how do I figure the recalculated amount?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona Filing - Other Income

You are being asked this because as of 2013, Arizona does not permit bonus that has been taken on the federal return. You can read a thoroughly detailed description here.

As the link states, you have to add back any federal bonus depreciation and then subtract the Arizona depreciation that is calculated without the bonus.

So what do you enter?

- Do you know how much depreciation was taken on the federal return on Arizona-only assets? Enter that in the first box.

- Can you recalculate what the depreciation on that Arizona asset would have been had no bonus deprecation been applied? Enter that in the second box.

So, IF this Arizona assets was the only asset you had on your Arizona return, then enter $1,233. And if you took no bonus depreciation on the federal return, then enter $1,233. in the second box. Clear?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cdtucker629

New Member

intuit

New Member

azmscpa

New Member

svmunoz2

New Member

james

New Member