- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

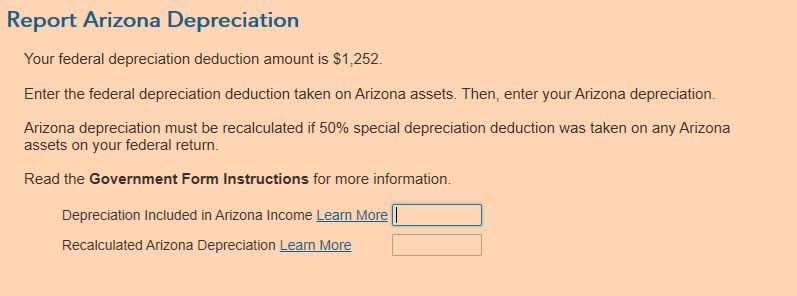

Hello, I am stuck on how to answer the following:

I see that TurboTax has calculated on the associated worksheets for Schedule E for this asset a current depreciation of $1233. Is this the amount that should be entered into the first box? And how do I figure the recalculated amount?

February 18, 2020

12:35 PM