- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- NY State 2020 Non-Resident Allocation is Zero, but TurboTax says NY State will reject the return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State 2020 Non-Resident Allocation is Zero, but TurboTax says NY State will reject the return

I retired in September 2019. I did not work in 2020, in New York or any other state. I received deferred compensation in 2020 (first payment of ten over ten years) and a performance bonus which was related to performance in 2019. My former employer withheld NY State tax (as well as my home state tax) from the bonus payment. But in 2020, I did not work in NY state. All the questions in TurboTax and the NY State forms ask the about number of days worked in 2020. When I enter $0 for the allocation to NY of my income, TurboTax says that NY will reject the return. What is the remedy for this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State 2020 Non-Resident Allocation is Zero, but TurboTax says NY State will reject the return

Ahh, more information is great. Thank you. NY does tax NY income with exceptions. Begin the trail here, Information for retired persons. This shows NY has a pension exclusion up to $20k and a special section for Nonresidents.

Which state you must file NY if you have New York source income greater than the New York standard deduction.

For the NY source income, we see that some pensions are exempt New York State taxation by reason of U.S. Code, Title 4, section 114. Finally on page 22 of the source income, we find:

New York State amount column Certain pension income received while a nonresident is not taxable to New York State and should not be included in the New York State amount column.

• U.S. Code, Title 4, section 114, prohibits states from taxing nonresidents on income they receive from (a) pension plans recognized as qualified under the IRC and (b) certain deferred compensation plans that are nonqualified retirement plans but which meet additional requirements.

• A pension or other retirement benefit that is not exempt under Title 4 of the U.S. Code, is exempt if it meets the New York definition of an annuity.

You stated that yours was tied to your performance which does not sound like it qualifies under section 114 - predominantly defined benefit plans. Please read through and see what else you know that we don't know. There are more exceptions and you may fit into one of them.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State 2020 Non-Resident Allocation is Zero, but TurboTax says NY State will reject the return

Your W-2 is correct. Do not allocate days. Say 100% of income is taxable to NY.

New York deferred compensation is taxable to nonresidents if it is related to income you received while pursuing a business, trade, profession, or occupation previously carried on in this state, whether or not as an employee, including but not limited to, covenants not to compete and termination agreements. See page 7 of the Instructions for IT-203, Nonresidents – New York source income.

Your former employer did not have to withhold both NY and other state tax. Your home state will give you credit for tax paid to NY.

File a nonresident NY return and a resident return in your home state.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State 2020 Non-Resident Allocation is Zero, but TurboTax says NY State will reject the return

Thanks for the response, but I don't understand the answer.

I don't believe that 100% of my income is taxable by NY State. I have never lived in NY. Only once in my career did I have to file a NY State tax form to pay taxes for days that I spent physically working in NY. I live in Virginia and while I was employed by a NY-headquartered firm, I worked for clients in many states including my home state.

Also, there are several sources that state that a typical 409A non-qualified plan distribution that is paid out over 10 or more years is only subject to state tax in a person's home state. I know NY doesn't say that in their form, but it seems to be in the federal code (section 114 of Title 4 of the US Code)

So I still can't understand why I would allocate these earnings to NY state instead of Virginia.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State 2020 Non-Resident Allocation is Zero, but TurboTax says NY State will reject the return

Ahh, more information is great. Thank you. NY does tax NY income with exceptions. Begin the trail here, Information for retired persons. This shows NY has a pension exclusion up to $20k and a special section for Nonresidents.

Which state you must file NY if you have New York source income greater than the New York standard deduction.

For the NY source income, we see that some pensions are exempt New York State taxation by reason of U.S. Code, Title 4, section 114. Finally on page 22 of the source income, we find:

New York State amount column Certain pension income received while a nonresident is not taxable to New York State and should not be included in the New York State amount column.

• U.S. Code, Title 4, section 114, prohibits states from taxing nonresidents on income they receive from (a) pension plans recognized as qualified under the IRC and (b) certain deferred compensation plans that are nonqualified retirement plans but which meet additional requirements.

• A pension or other retirement benefit that is not exempt under Title 4 of the U.S. Code, is exempt if it meets the New York definition of an annuity.

You stated that yours was tied to your performance which does not sound like it qualifies under section 114 - predominantly defined benefit plans. Please read through and see what else you know that we don't know. There are more exceptions and you may fit into one of them.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State 2020 Non-Resident Allocation is Zero, but TurboTax says NY State will reject the return

I have the same problem. I live and work in Texas but in most years I work in NY and owe taxes for 3-6 days. In 2020 I did not step foot in NY state and did not conduct any business there. I cannot figure out how to claim my refund because Turbotax will not allow me to e-file with zero days worked in NY as a non-resident, even though that is correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State 2020 Non-Resident Allocation is Zero, but TurboTax says NY State will reject the return

We are having the exact same problem. My husband did not spend any days in New York, but the software is telling me to update my entries so that the number of days worked outside of New York is less than the number of days worked at this job. Were you able to figure out a solution? Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State 2020 Non-Resident Allocation is Zero, but TurboTax says NY State will reject the return

Unfortunately no. I finally gave up and entered 1 as days worked in NY as it was the only way I could figure out how to file and get my refund, less taxes on the one day. Good luck

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State 2020 Non-Resident Allocation is Zero, but TurboTax says NY State will reject the return

@ch2anna This should not be a problem. When you enter the NY program, it asks about residency. You said nonresident. It asks who has NY source income, then the program states that we need to separate income earned in NY from the the rest. NY taxes all NY sourced income. You select NY based income. You just mostly keep continuing through NY return without any real entries. I went through with no question about days since I chose nonresident return and part of my wages as NY. On the review, I entered my NY amount.

Maybe you should delete the state return and begin again. If you have already paid, delete the forms inside the return.

If you are using:

- Online: see How do I view and delete forms in TTO?

- Desktop: If you are working in the cd/download TurboTax program:

- On the top right, there is a FORMS button.

- Click on FORMS.

- Locate the form you want to delete.

- Click on the form name.

- Below the form, bottom left, select DELETE FORM button. For a mac, click the delete button on your keyboard.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State 2020 Non-Resident Allocation is Zero, but TurboTax says NY State will reject the return

Did claiming 1 day work? Did you get your money back? I need to get money back from my New York employer who mistakenly took out NY taxes on my first check with the company. Everything else was accurately paid to my home state of CA. Turbo Tax won't let me efile with a zero allocation. Putting 1 day sounds like the easy way to go.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State 2020 Non-Resident Allocation is Zero, but TurboTax says NY State will reject the return

Yes, it worked to put 1 day. We got all but 1 day’s taxes back. It seems to be a flaw in the software that you can’t put 0 though. Good luck!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State 2020 Non-Resident Allocation is Zero, but TurboTax says NY State will reject the return

@notapro yes it worked. I received my refund less one day of taxes. I looked at the paper forms to see if I could get 100% refunded but didn’t even know where to start. Agree this is a major flaw in the system. Make sure to check your 2024 withholding forms too. Good luck!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State 2020 Non-Resident Allocation is Zero, but TurboTax says NY State will reject the return

@AmyCit would be great if TurboTax worked that way but it doesn’t

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State 2020 Non-Resident Allocation is Zero, but TurboTax says NY State will reject the return

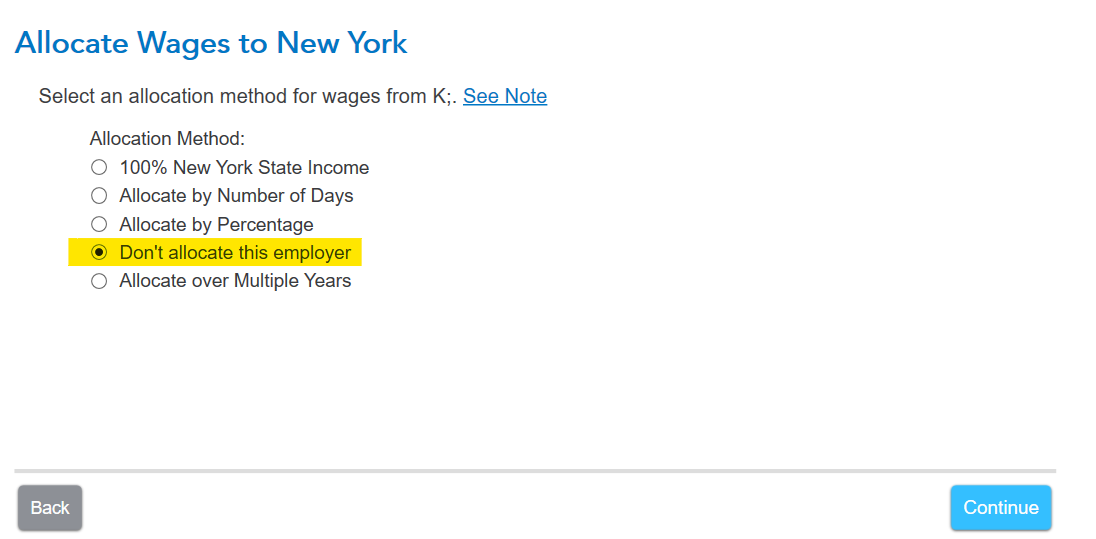

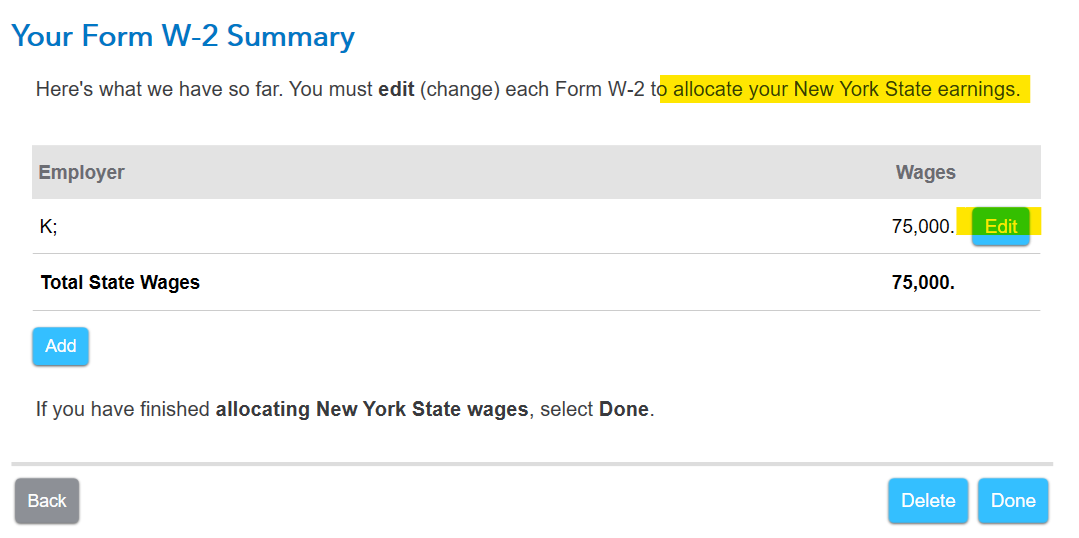

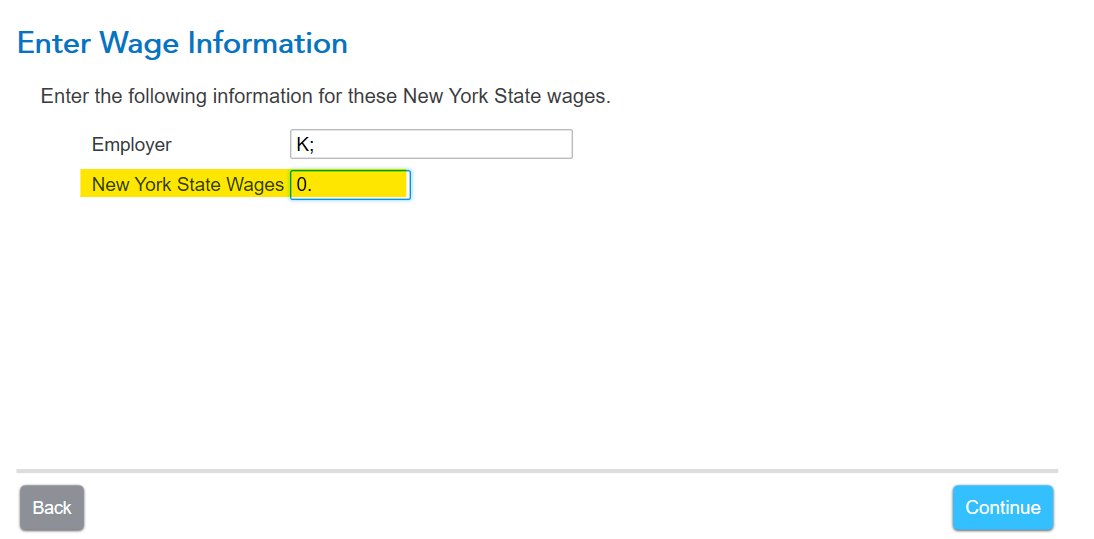

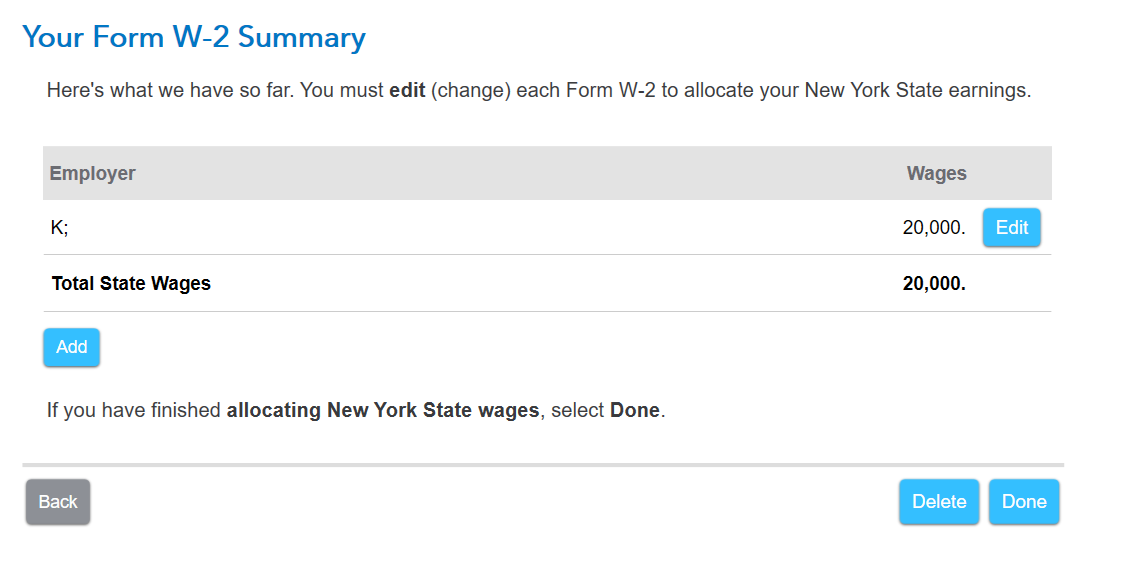

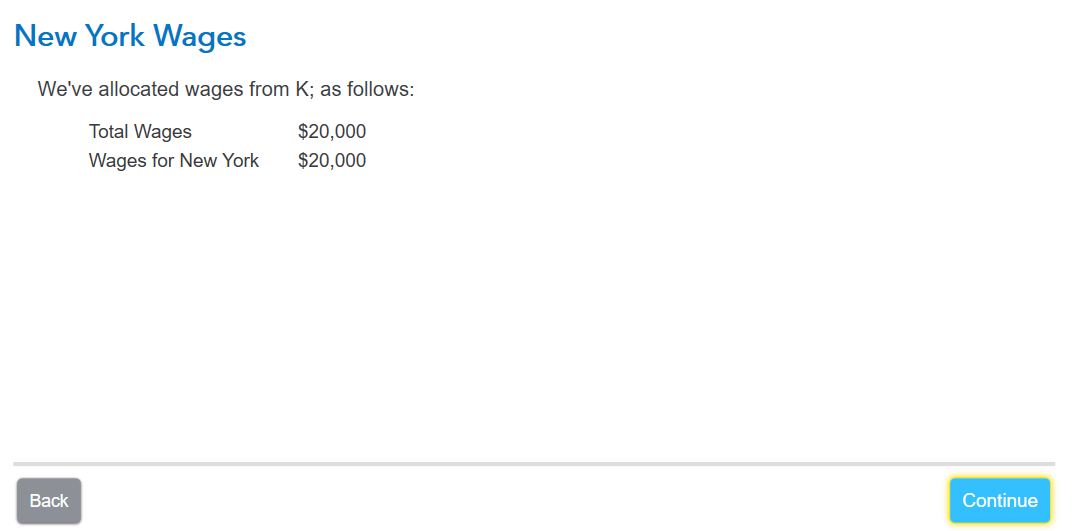

Last year's program and this year are a little different. The program asks for you to enter the NY state wages. If you were there for zero days, are you entering $0 income? Next I am asked about days to allocate. Select Continue. If I have zero income for NY, I am done.

If I put in a NY income, then I am asked for days, when I finished, it stayed with the original amount I entered for NY of $20k.

You can also choose to not allocate. The next screen is to edit your income to the correct NY amount.

When I enter zero wages, allocation of days moves to done.

If I have actual NY wages, that is the amount I am taxed on .

After going through all the days and allocations

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State 2020 Non-Resident Allocation is Zero, but TurboTax says NY State will reject the return

I appreciate your help with this. The program has determined that I have New York source income and it won't let me edit the wage information to 0. If I choose don't allocate, it puts the entire amount to New York. If I allocate by percentage (zero percent), Turbo Tax tells me my return will be rejected. I think I have to go with the 1 day trick that others have used.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RyanK

Level 2

ajm2281

Level 1

dpa500

Level 2

dpa500

Level 2

Questioner23

Level 1