- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

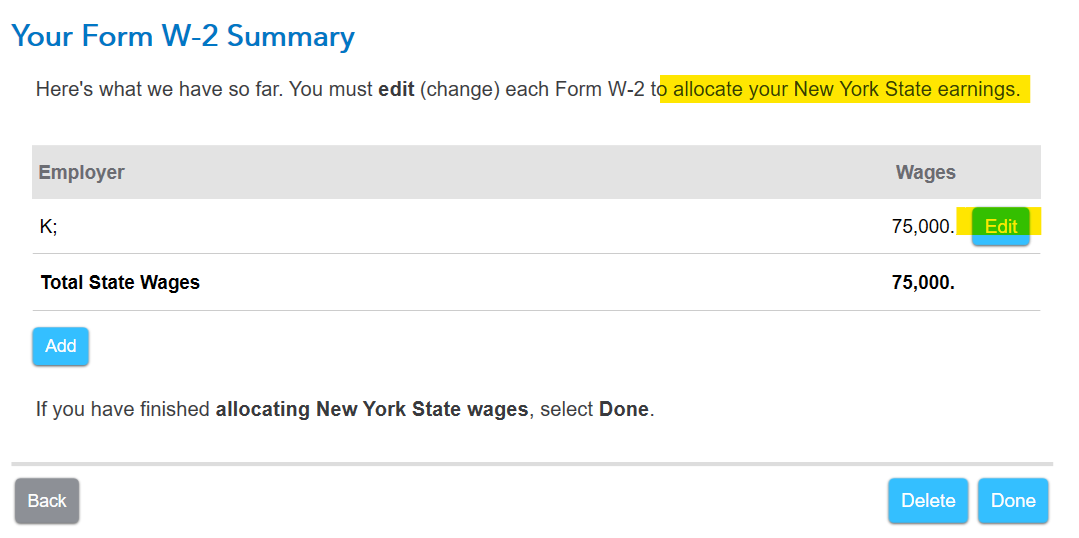

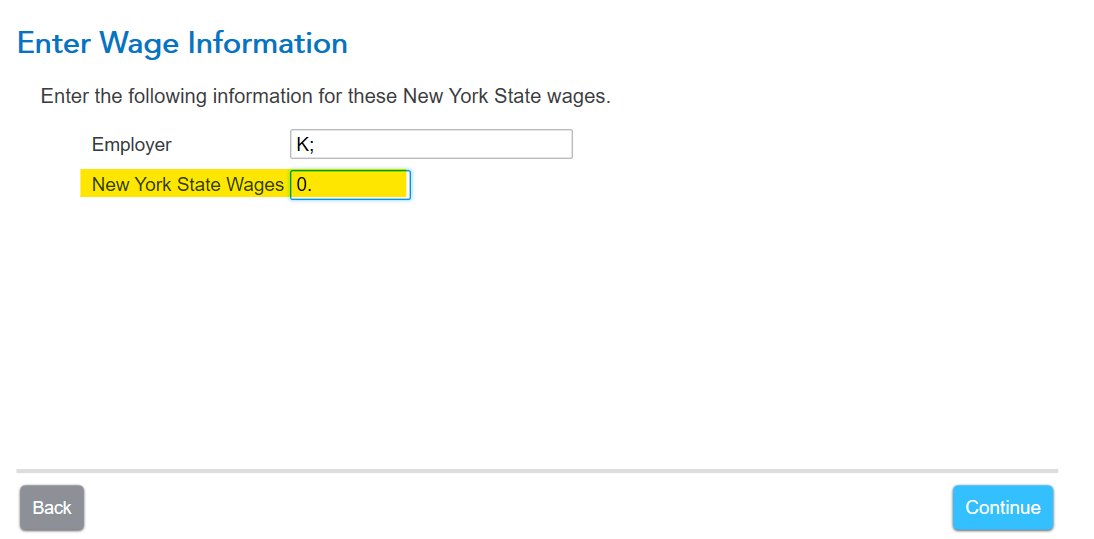

Last year's program and this year are a little different. The program asks for you to enter the NY state wages. If you were there for zero days, are you entering $0 income? Next I am asked about days to allocate. Select Continue. If I have zero income for NY, I am done.

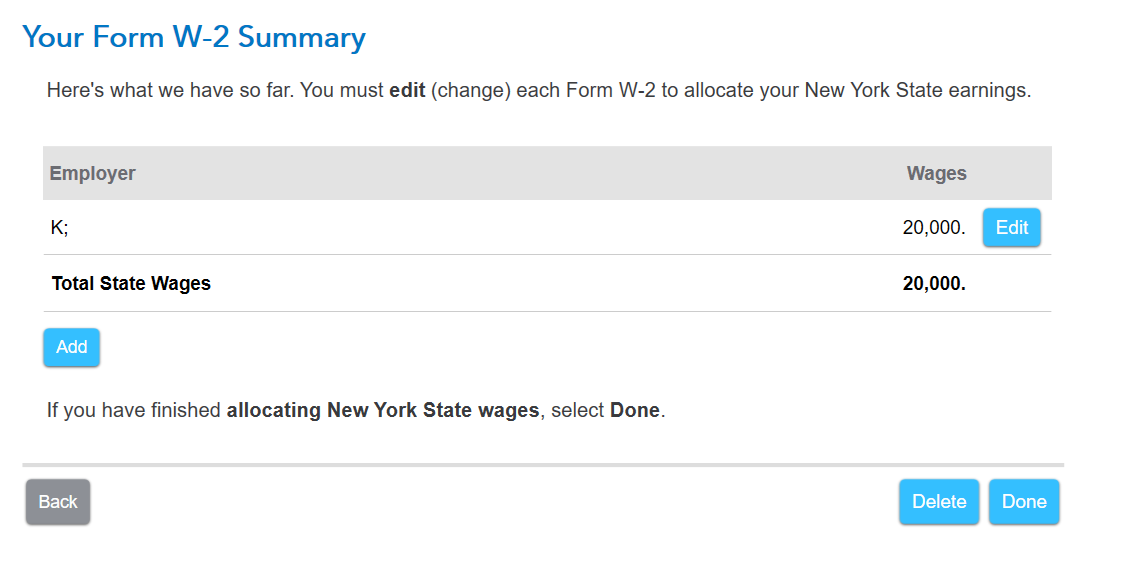

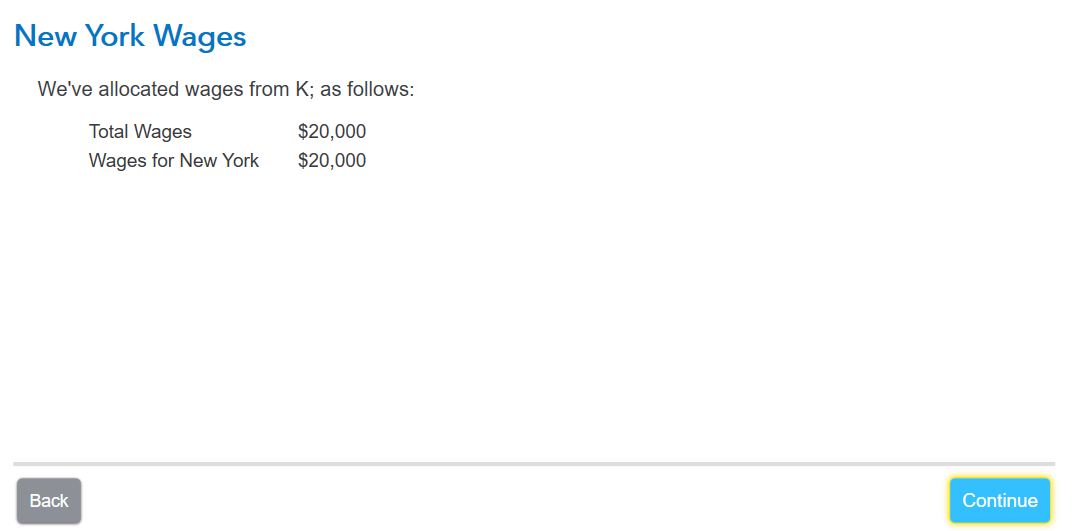

If I put in a NY income, then I am asked for days, when I finished, it stayed with the original amount I entered for NY of $20k.

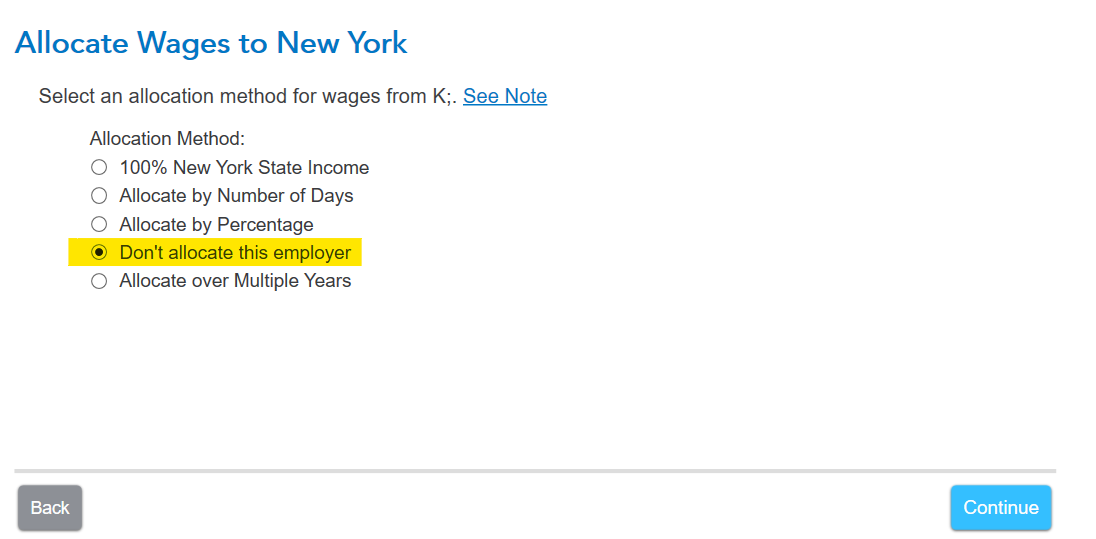

You can also choose to not allocate. The next screen is to edit your income to the correct NY amount.

When I enter zero wages, allocation of days moves to done.

If I have actual NY wages, that is the amount I am taxed on .

After going through all the days and allocations

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 29, 2024

8:30 AM