- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

Column A of your NY IT-360.1 represents your income and adjustments reported on your federal return. These are amounts that represent your 1040 and should not be $0, unless it was $0 on your return.

Although I do not see your tax return, if you getting an error message for allocation of Federal Adjustments to Income, you will have to go back through the NYS screens and enter amounts that equal to your total federal adjustments. I have attached a picture below of a mock-up return I have created. In this example, your total federal adjustments would have to equal the amount of $1,813. You can allocate a portion to NYC, if necessary.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

thanks for your reply. I do have charitable contributions on my federal return surpassing $300. Currently column A shows $300 on NY IT-360.1 TP, which seems correct since that is consistent with the federal return, but Turbo tax is telling me to fix my NYS return and won't let me efile. when I click "Fix NY return", it says:

"Check this entry. IT-360.1TP-Change of City Resident Status Stmt-TP:Total Fed Adj, Federal-The amounts entered in Column A of the Line 17-Federal Adjustments to Income Worksheet do not agree with the total transferred from the Income Allocation Worksheet to Line 17 Column A. Above line(s) should total $0"

Why should it be $0 since I did have contributions for federal. They were all after I moved out of NY, so the column B and C are correctly showing $0. But Turbotax is telling me there is a problem because column A should total $0. How can I see where it is getting that $0 amount from and update it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

For the error you are experiencing, it would be helpful to have a TurboTax ".tax2020" file that is experiencing this issue.

You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions: Go to the black panel on the left side of your program and select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen and then you will get a Token number.

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

We will then be able to see exactly what you are seeing and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

thanks Lena. Token is 770957

I appreciate your help to finally resolve. It seems like such a small thing that has held me up from filing for several weeks now. Hopefully there is an easy fix!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

I went through your return and was able to fix the error on NY IT-360.1. Thank you for providing the token to help determine the issue.

Here are the steps I took to clear the error:

- Open your return.

- Delete the donations under Itemized Deductions (since you do not itemize - you get no benefit by entering it on this screen).

- Search charitable contributions with the magnifying glass tool at the top of the page.

- Click the Jump to charitable contributions link.

- Use the trash can icon to delete the three entries in this area.

- Added $300 on top of your standard deduction.

- Click Federal from the left side of your screen.

- Click Deductions &Credits on the top of the screen.

- Scroll down and click the Wrap up tax breaks button.

- Continue until you reach the Charitable Cash Contributions under Cares Act screen.

- Enter your charitable cash contributions.

- Rerun the Smart Check and your error should be eliminated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

I went through your return and noticed a problem with your HSA New York Source Portion.

Please follow the instructions below to clear the error:

- Click on State.

- Edit your New York return.

- Go through the allocation screens until you get to your Taxable HSA Distribution.

- Your NY Nonresident HSA is listed as a negative amount. Enter 0 for the NY source portion.

- When you get to the error screen, please delete the amounts in Federal Column and the New York Column.

- This amount is listed no where on your federal return or on your W-2's. This should not be an adjustment in the program.

- The error will be cleared once you delete these amounts.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

Hi Lena

thanks for looking into this some more. Unfortunately, I don't believe this has solved my problem

What makes you believe that I don't itemize? By changing it to standard deduction (which is not what turbotax recommends on that screen), it increases my tax due quite a bit.

Regardless, I still tried your suggestion and deleted all of the charitable contributions and then changed it to standard deduction and put the 300 in the cares act contribution screen, and although that makes the tax due higher, it still doesn't stop the endless "fix NY return" error that I started with on IT-360.1 TP, which still shows up when it reviews my return.

Please help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

Yes. There is an issue with the contributions deduction and TurboTax is working to fix it. We do not have an estimated date of correction, at this time. I suggest you check back often to see if the correction has been made.

There is a problem with the Contributions section of the Itemized deductions and also the above the line $300.00 deduction. Because of the many changes due to the CARES Act, IRS is still developing the forms and publications on this issue. Last update was January 13th where everything is still in draft. Once IRS finalizes the forms, we will be able to update TurboTax to accurately reflect your Contributions deduction.

Here are some of the changes due to the CARES ACT

The new legislation allows tax deductions on two types of charitable gifts. First, it allows up to $300 given to a qualified charity to be claimed as an above-the-line deduction. After the Tax Cuts and Jobs Act, which went into effect in 2018, increased the standard deduction, many taxpayers had less incentive to donate to charities. Instead, they took the standard deduction and stopped itemizing.

For taxpayers who will itemize deductions, the CARES Act effectively suspends the limit on deductions for cash contributions to public charities for 2020. “That allows individuals to completely wipe out their AGI, and their tax liability, with a charitable contribution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

thanks for the update, Cynthia. I had a feeling there was a problem with the software or forms beyond anything I could fix

that's frustrating because it's the NYS return that turbotax is telling me needs to be fixed and hasn't let me efile (either federal or NYS!) for almost a month already as a result, yet I had zero contributions during the part year period that I lived in NYS, so I'm not looking for any kind of contribution deduction there at all.

Before I saw your reply, I had decided I was going to just buy another tax prep software this weekend and do my taxes all over again so I can file (I'm betting I don't run into the same issue with another one). I've used turbotax for 10+ years, but I'm not interested in paper filing this year, so I'll have to buy another brand software and re-do the taxes again since turbotax has this glitch (I'm sure the experts on this board don't consider it a glitch, but I bet I could efile today with another prep software and my same data). I already paid for turbotax so I'll definitely push for a refund if I have to buy a second product this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

After a month of waiting for turbotax to fix this, I signed up with a different brand tax prep software today and did my taxes all over again. The dollar amounts were essentially the same, and there was no glitch telling me to fix my NYS return. I was able to file both federal and state, no problem.

Frustrating that I had already paid for turbotax federal and state before I knew there was going to this turbotax glitch, and I had to wait a full month later than I should have to file.

What are the odds that turbotax refunds my payment for 2020 since I didn't file with them and had to pay for another brand's software because turbotax wasn't working? Or at least credits me the cost to use for my 2021 taxes next year. I'm not holding my breath. If they aren't able to do so, I'm sure I'll continue to use the other brand for the next 50 years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

@Cynthiad66 @LenaH When will this be fixed? Will we receive a refund if we've already paid for TurboTax but can't file our taxes because of this bug?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

My token is 788846 and I’m having the same issue. After completing my state tax I get the message: IT-360.1 TP -- Change of City Resident Status Stmt - TP: Total Fed Adj, Federal -- The amounts entered in Column A of the Line 17 - Federal Adjustments to Income Worksheet do not agree with the total transferred from the Income Allocation Worksheet to Line 17 Column A. Above line(s) should total $0

I have checked multiple times and I did not enter any charitable donations, can you help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

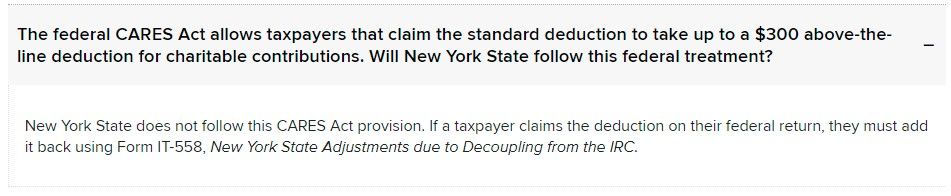

NYS does not conform to the $300 above the line deduction on the federal tax return. When completing the NYS allocations the $300 adjustment on the federal return is not allowed on the NYS tax return & you have to make sure it is not included as a deduction on the NYS tax return. It will usually automatically be removed if NYS is the only state return. But if there is another state other than NY & allocations are required you have to enter $0 for NYS portion. I am a registered preparer in NYS & I have had quiet a few of these & I had to make sure the deduction was not on the NYS return. NYS does not conform with many Federal allowances on the state tax return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

atn888

Level 2

johnba1

New Member

MICKEY79

Level 3

MS461

Returning Member

leviton11

Level 3