- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

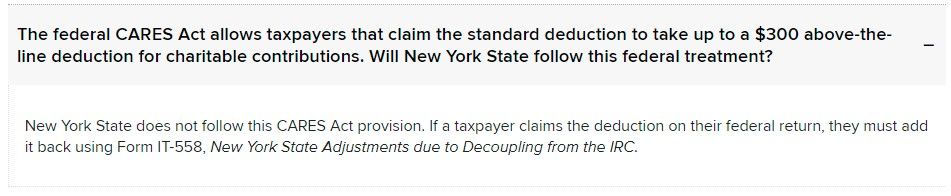

NYS does not conform to the $300 above the line deduction on the federal tax return. When completing the NYS allocations the $300 adjustment on the federal return is not allowed on the NYS tax return & you have to make sure it is not included as a deduction on the NYS tax return. It will usually automatically be removed if NYS is the only state return. But if there is another state other than NY & allocations are required you have to enter $0 for NYS portion. I am a registered preparer in NYS & I have had quiet a few of these & I had to make sure the deduction was not on the NYS return. NYS does not conform with many Federal allowances on the state tax return.

March 27, 2021

5:24 PM