- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- My MN state tax return is applying income I made in VA as taxable earnings in MN even though I know it's non-taxable. How can I remove it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My MN state tax return is applying income I made in VA as taxable earnings in MN even though I know it's non-taxable. How can I remove it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My MN state tax return is applying income I made in VA as taxable earnings in MN even though I know it's non-taxable. How can I remove it?

Minnesota, like most states, will use your total income to calculate your state tax rate. Your base tax is calculated as if all your income was earned in MN. Your actual tax is the MN percentage of total tax.

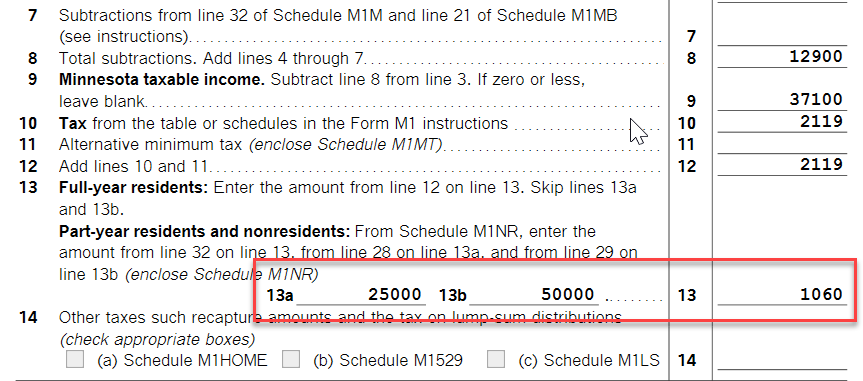

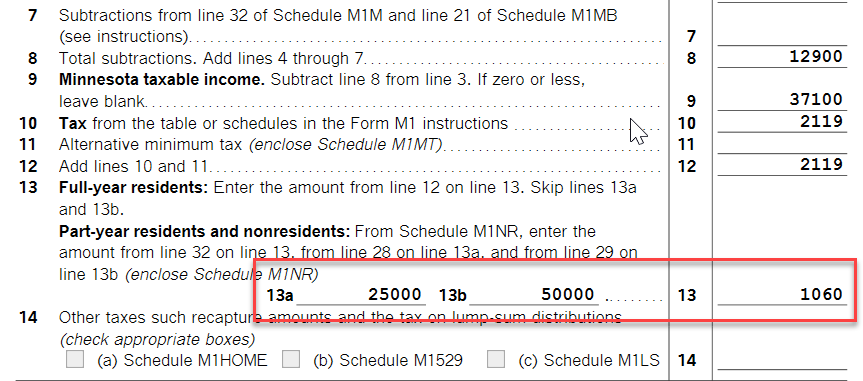

For example, if you made $25,000 in MN and $50,000 in total, you will pay half the tax on $50,000. Check line 13 of Form M1 to see your tax computation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My MN state tax return is applying income I made in VA as taxable earnings in MN even though I know it's non-taxable. How can I remove it?

Each state handles non-resident income a little differently. For Minnesota, the starting point is the Federal Adjusted Gross Income (AGI) which includes all income regardless of where it was earned.

Then, for Minnesota non-residents, there is an adjustment made before the income tax is calculated. The adjustment is made on Line 13 of the Minnesota Form M1. From the 2022 Minnesota Individual Income Tax Instructions, "Line 13 —Part-Year Residents and Nonresidents (Schedule M1NR) -- Your tax is determined by the percentage of your income that is assignable to Minnesota."

You should see a Form M1NR included as part of your Minnesota return where the income is divided between Minnesota source and non-Minnesota source income. This is where the fact that not all of your income is from Minnesota is taken into account.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My MN state tax return is applying income I made in VA as taxable earnings in MN even though I know it's non-taxable. How can I remove it?

Thanks for the quick response AnnetteB6! I've tried adjusting that value within the TurboTax software, but for some reason, Turbo Tax doesn't apply my changes. It keeps just taking the full AGI and subtracting only the standard deduction instead of the 5o% of my salary that I procured in Virginia. Should I reach out to TurboTax IT for assistance?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My MN state tax return is applying income I made in VA as taxable earnings in MN even though I know it's non-taxable. How can I remove it?

Is there an update on this? I am also seeing MN taxing based off more money then I made in the state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My MN state tax return is applying income I made in VA as taxable earnings in MN even though I know it's non-taxable. How can I remove it?

Minnesota, like most states, will use your total income to calculate your state tax rate. Your base tax is calculated as if all your income was earned in MN. Your actual tax is the MN percentage of total tax.

For example, if you made $25,000 in MN and $50,000 in total, you will pay half the tax on $50,000. Check line 13 of Form M1 to see your tax computation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My MN state tax return is applying income I made in VA as taxable earnings in MN even though I know it's non-taxable. How can I remove it?

Physic,

I ended up reviewing the tax forms right before submission and came to the conclusion that Ernie just posted. MN calculates your total tax liability based on the percentage of your income earned in MN instead of solely on the income earning in MN. It's weird and unituivitve, but that's how the tax code is written in MN. ¯\_(ツ)_/¯

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cindycash945

New Member

gk5040

Level 3

bleseye

New Member

danielht98

New Member

jackkgan

Level 5