- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Minnesota, like most states, will use your total income to calculate your state tax rate. Your base tax is calculated as if all your income was earned in MN. Your actual tax is the MN percentage of total tax.

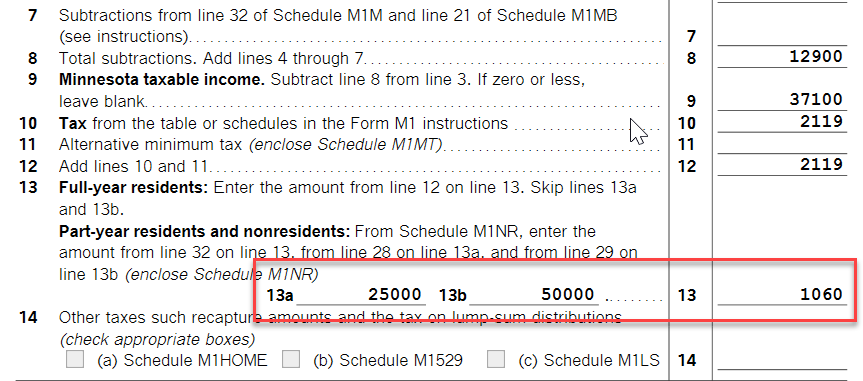

For example, if you made $25,000 in MN and $50,000 in total, you will pay half the tax on $50,000. Check line 13 of Form M1 to see your tax computation.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 20, 2023

4:56 PM

375 Views