- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Muni Bond Interest

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Muni Bond Interest

I live in CA and have Muni bonds from other states. How do I determine taxes on muni interest paid by bonds from other states?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Muni Bond Interest

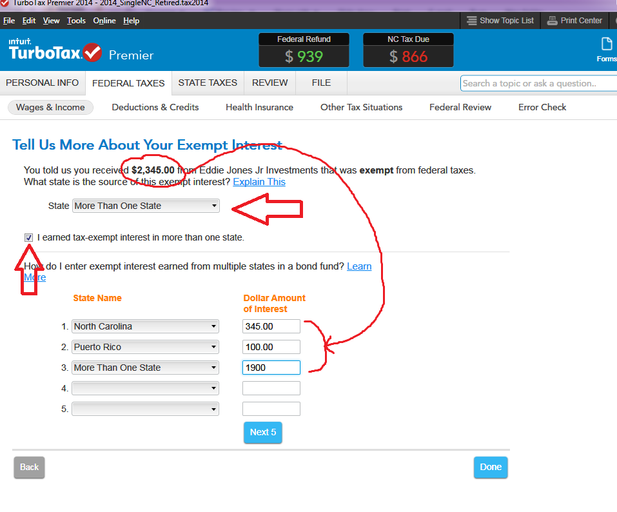

IF you have them all on one 1099-INT form, then you break out the CA Muni-exempt $$ of box 8 from the other states as follows (example for NC):

____________________________

________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Muni Bond Interest

You don't. You let the software do it.

IF these are individual bonds, and you don't have any CA bonds, then you enter the 1099-INT you get form the brokerage, whatever boxes are filled in....the Muni interest will be in box 8.....then continue to the following pages, and one of them will ask, "Which state is your $xxx of exempt interest from ? " ...and you will select "More than one state" from the end of the drop-down box list of states. You don' have to break them out individually.

Answer is different if you have some individual CA bonds that contributed to box 8 (but post back if that is the case)

__________________________

IF you own some Muni Bond Funds, then the tax-exempt interest from those is in box 11 of a 1099-DIV.....and you make the same selection when you get to the followup page that has the same question about the state source and you answer "More than one state" again...for this one the only exception is if you own a bond fund with more that 50% of its assets in CA-source bonds...then you can break out just the the CA sourced part from the rest and, perhaps, get some potential tax deduction from those CA-bonds exempt interest.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Muni Bond Interest

I have mostly CA Muni bonds but some Muni bonds from other states. how do I declare interest from other states?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Muni Bond Interest

IF you have them all on one 1099-INT form, then you break out the CA Muni-exempt $$ of box 8 from the other states as follows (example for NC):

____________________________

________________________

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jrbpab

New Member

HAWGFAN2655

New Member

thompsam

Level 2

Snowman65

New Member

Snowman65

New Member