- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Minnesota M1PR instructions confusing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota M1PR instructions confusing.

Only have SSN as income. Line 1 of form asks for Federaly adjusted income, Line 2 asks for Nontaxable SSN amount. Do I subtract the Federal adjustment from the amount in box 5 of on the 1099 form from SSN and enter that number on line 2 or do I put in the amount that's in box 5 from the SSN 1099 form. In box 7 you add line 1 and two.

In the M1PR instructions, they just say to put in the amount from Box 5 of the SSN 1099 from. Wouldn't you be inflating your income by the amount of whatever your Federaly adjusted income is?

WHAT DO I DO? Tried calling the Minnesota Department of Revenue and was on hold for 50 minutes and they just hung up on me when they answered.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota M1PR instructions confusing.

If you only have social security income, it is not taxable, so for the adjusted gross income (AGI) you would enter zero (0). This would make your nontaxable social security the Box 5 amount from your SSA-1099.

If you are using TurboTax, it guides you through the tax return by asking you the questions to create the forms needed to file with the state. The instructions from the state for the M1PR do not always follow the way TurboTax asks the questions so it can get confusing- you can post if you have additional questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota M1PR instructions confusing.

Thanks for the feedback. I downloaded the M1PR instructions from the Minnesota state website. It specifically says to enter the Federaly adjusted gross income on line 1 from the federal return. I think you may be wrong on that. Because my Federally adjusted income is very low because of the standard deduction, I have no tax on it but there still is a number for the adjusted gross income on the federal return when you fill it out. I'm assuming that when they see no adjustment on line one it will flag it. Thats another quesiton. If my income is below the threshold for taxes and I don't have to submit taxes, do I have to send in a filled out Federal tax form to prove that I had income from SSN so I can claim the property tax rebate or do I just send in a filled out form with the M1PR form to show my calculations?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota M1PR instructions confusing.

You are correct and I apologize for missing that detail regarding the federal AGI. (Sometimes I think more like TurboTax than a human.) The instructions do say:

"If the amount is a negative number, enter as a negative number. If you did not file a 2024 federal income tax return, use the federal return and instructions to determine what your federal adjusted gross income would have been."

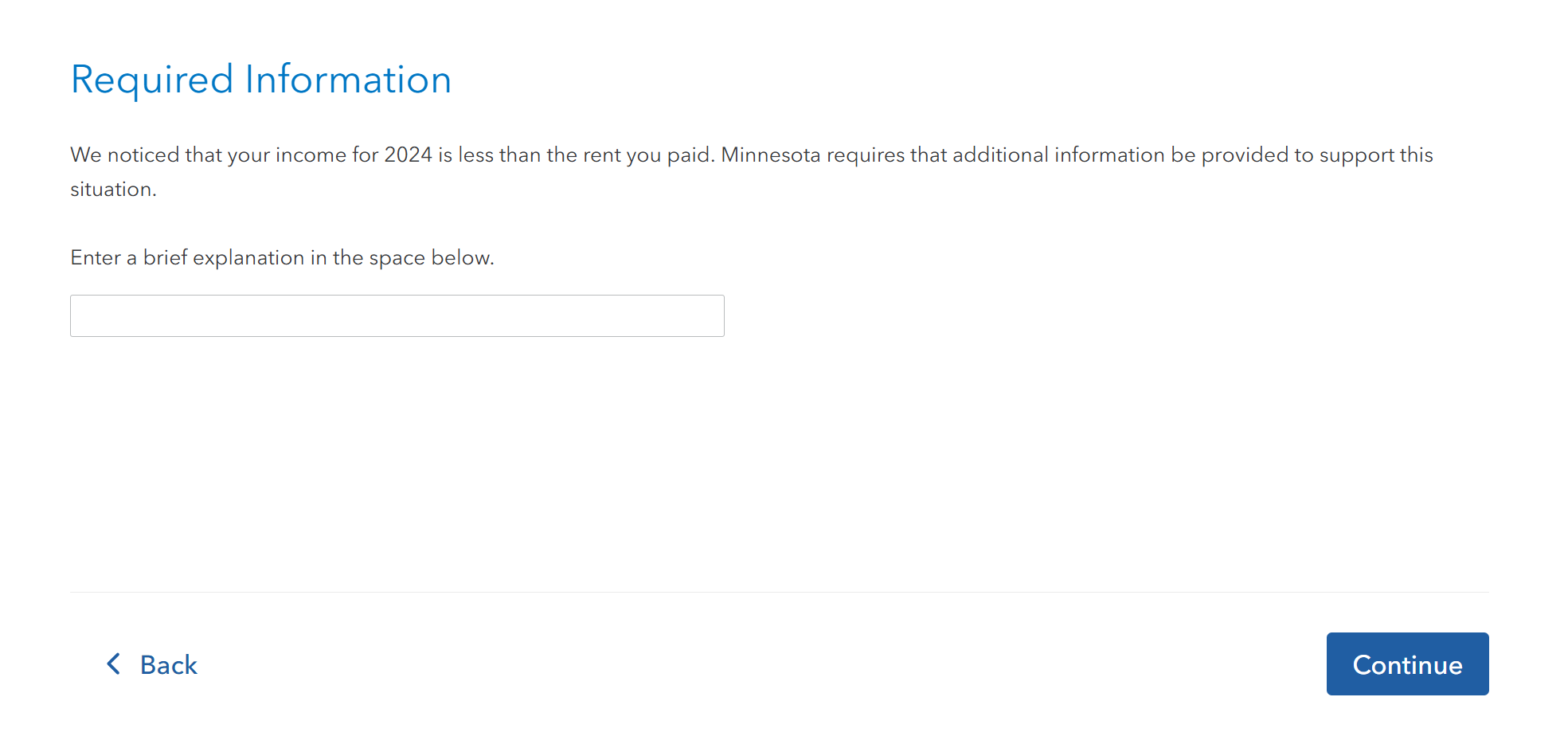

This is your exact situation- you would not be required to file the federal tax return. The instructions say if line 1 does not match your federal adjusted gross income, enclose an explanation- in TurboTax, you can indicate this in the explanation as requested in the entry below. You can say something like "I was not required to file a federal return because there was not taxable income, but the calculated AGI was $--".

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota M1PR instructions confusing.

So back to my original question, after I put in my adjusted income in line 1, do I put in the difference between what’s in box 5 of my ssa-1099 form or do I put what’s in box 5? If you follow the instructions to the letter, you put in the full amount. Which would inflate your income by the amount of the adjusted income in line 1.

Since my original post, I noticed in the instructions for worksheet 5 in the instructions for the a co-occupants income, they have you put in the difference between AGI and box 5 of the SSA-1099 form.

See why I’m confused.! I see a lot of people getting jipped out of some rebate money if that is the case.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota M1PR instructions confusing.

You would include the Box 5 amount since you did not have taxable social security benefits on the 1040. @sparky2006

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Eddie66

Level 1

atdickson

New Member

no-name1

Level 3

DerringDo

Level 2

ktramo17

Level 2