- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

You are correct and I apologize for missing that detail regarding the federal AGI. (Sometimes I think more like TurboTax than a human.) The instructions do say:

"If the amount is a negative number, enter as a negative number. If you did not file a 2024 federal income tax return, use the federal return and instructions to determine what your federal adjusted gross income would have been."

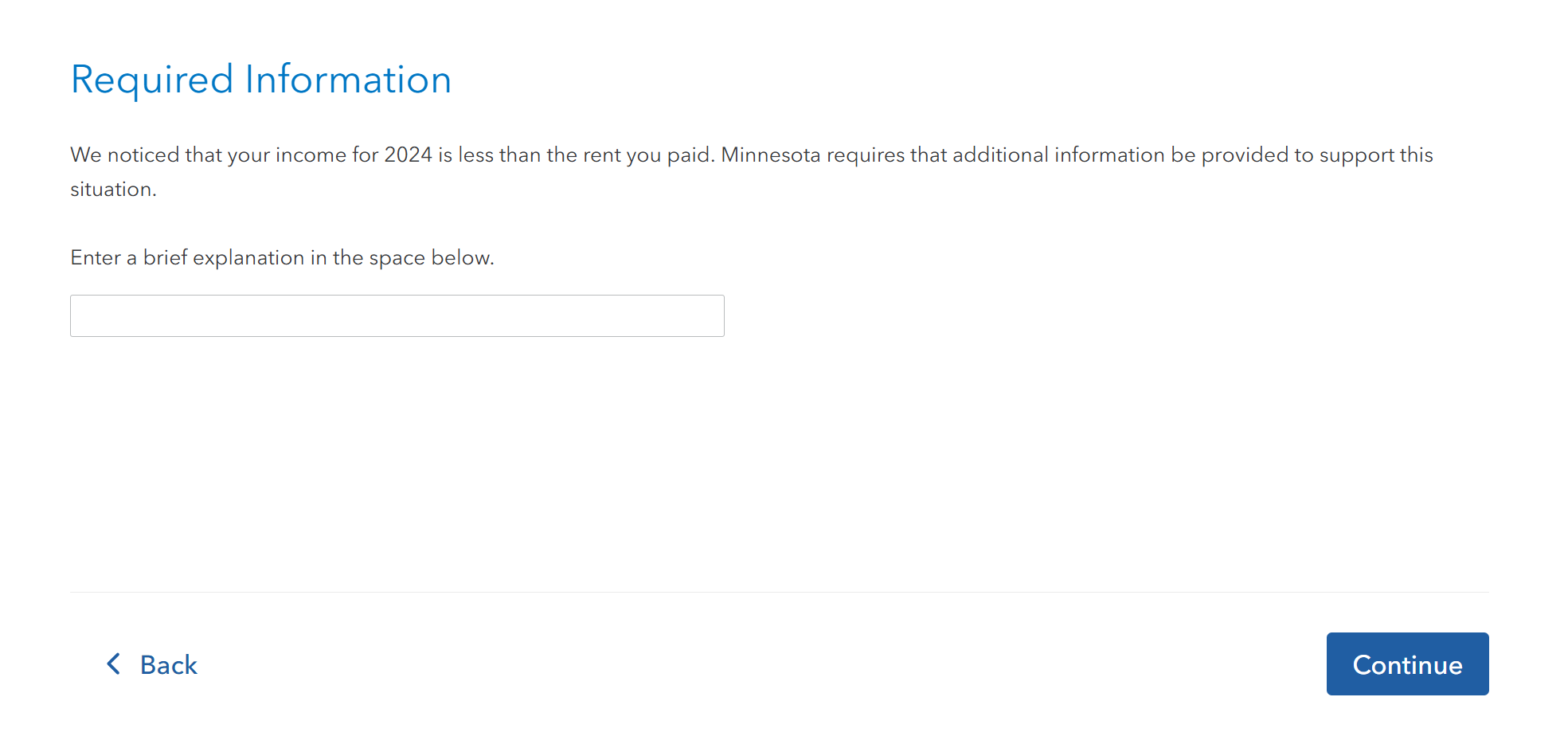

This is your exact situation- you would not be required to file the federal tax return. The instructions say if line 1 does not match your federal adjusted gross income, enclose an explanation- in TurboTax, you can indicate this in the explanation as requested in the entry below. You can say something like "I was not required to file a federal return because there was not taxable income, but the calculated AGI was $--".

**Mark the post that answers your question by clicking on "Mark as Best Answer"