- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Md. taxes: How can I be sure that contributions my wife

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Md. taxes: How can I be sure that contributions my wife

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Md. taxes: How can I be sure that contributions my wife

TurboTax will not distinguish multiple accounts but it will allow you to enter up to $2,500 as a deduction on your Maryland income taxes.

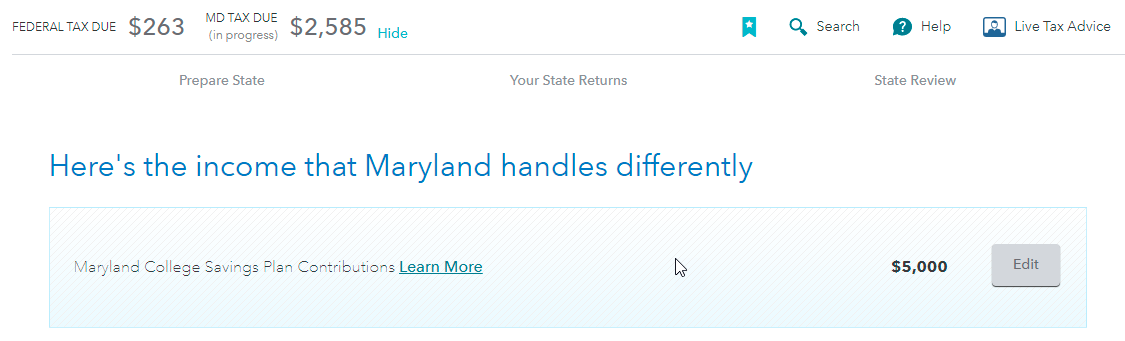

You can see the subtraction on the screen Here's the income that Maryland handles differently.

If you are the account holder or a contributor, you can deduct up to $2,500 of payments each year from your Maryland State income per account - $5,000 for two, $7,500 for three, etc. Payments in excess of $2,500 per account can be deducted in future years until the full amount of payments has been deducted.

Related Resource:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Md. taxes: How can I be sure that contributions my wife

Thanks for the reply. I'm still not clear, however, whether we will successfully receive the full $5,000 tax credit in Maryland we are entitled to if we submit our Maryland tax return using Turbo Tax. (Last year, we used a private accountant.) To be clear, we have two separate Maryland College Savings Accounts for our son Theo. One is in my name (Erik Robelen). The other is in my wife's name (Sheila Walsh). In 2020, we contributed more than $2,500 to each account.

As noted, Turbo Tax allowed me to indicate an overall amount for Maryland College Savings Account contributions, but it did NOT allow me to indicate that this was from two separate accounts. Can you please clarify whether we will be able to get credit for the full $5,000 if we file our Maryland return using Turbo Tax? Thanks you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Md. taxes: How can I be sure that contributions my wife

Yes, you should enter $5,000 as that is the maximum allowed for the 2 accounts. The state allows it as one deduction regardless of the number of accounts. The maximum allowed for the number of accounts is what should be entered.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cramanitax

Level 3

ammon626

New Member

josephmarcieadam

Level 2

lawrencedorsey074

New Member

stefaniestiegel

New Member