- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

TurboTax will not distinguish multiple accounts but it will allow you to enter up to $2,500 as a deduction on your Maryland income taxes.

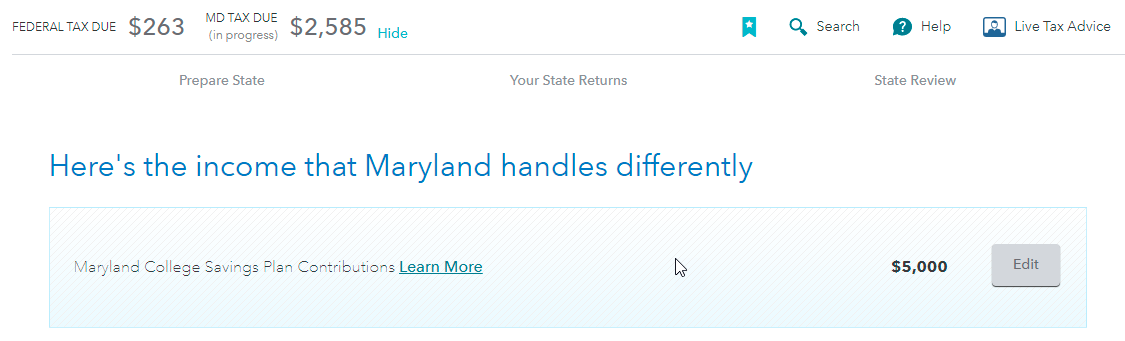

You can see the subtraction on the screen Here's the income that Maryland handles differently.

If you are the account holder or a contributor, you can deduct up to $2,500 of payments each year from your Maryland State income per account - $5,000 for two, $7,500 for three, etc. Payments in excess of $2,500 per account can be deducted in future years until the full amount of payments has been deducted.

Related Resource:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 22, 2021

1:58 PM