- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Income portion for second state is greyed out, shows full year's income and I cannot change it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income portion for second state is greyed out, shows full year's income and I cannot change it

I cannot change the income from the full year's income already populated in the box, it is greyed out- this is for the 2nd half of the year when I moved from Illinois to Indiana

Any help?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income portion for second state is greyed out, shows full year's income and I cannot change it

I'm assuming your are preparing a part-year Indiana return. Part-year residents are only taxed on income earned while living in Indiana (unless you also worked there while living in Illinois).

TurboTax will show you a Federal amount and a box for an Indiana amount. You can't change the federal amount because that comes from your federal return.

Just enter the amounts you earned while living in Indiana in the Indiana box, plus any income earned in IN while you lived in IL, such as income from a rental property located in IN.

Indiana will only tax you on the amounts entered in the IN boxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income portion for second state is greyed out, shows full year's income and I cannot change it

Thanks for the reply but that's the issue, I cannot change the amount for the Indiana portion, it's set to the full federal amount and cannot be changed, the box is grey/ locked

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income portion for second state is greyed out, shows full year's income and I cannot change it

It sounds like on your W2, box 16 for Indiana has the full amount of wages matching box 1 which may be correct in some circumstances. Whatever is in box 16 for IN cannot be changed however adjustments may be made elsewhere if needed.

If you would answer some clarifying questions we will be able to see the situation more clearly and give more specific instruction.

Did you work for the same employer while living in IL and IN?

Where is the employer located?

Did you get two W2's or one W2 with two state lines?

What is being reported to IL on your W2(s)?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income portion for second state is greyed out, shows full year's income and I cannot change it

I am sole proprietor so I have 1099's

I worked 50% of the year in each state, earning an equal amount

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income portion for second state is greyed out, shows full year's income and I cannot change it

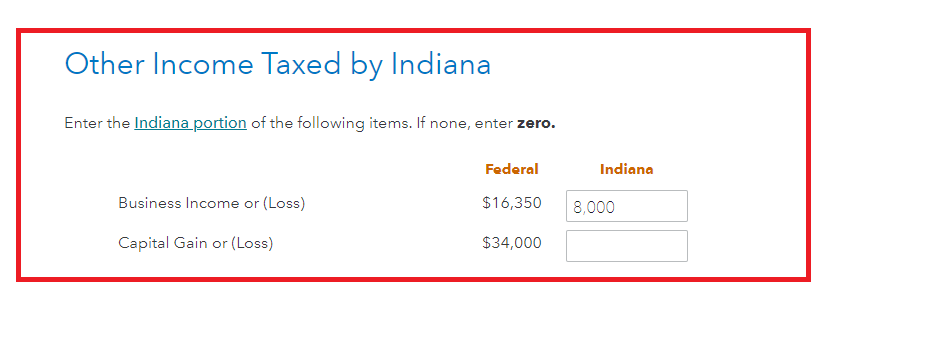

The Indiana (IN) return in my example does allow the entry of the portion of income that was earned during the IN residency for a part year resident tax return. In my example the TurboTax Self-Employed Online version is being used.

First I went to My Info and selected Indiana as Other State, next I went to the State tab to complete my IN return and came to the image below with no issue. I was asked about my dates of residency at the beginning of the state interview.

Let's try clearing some pieces of information your computer may be remembering and causing interference.

Here are the official instructions for the most popular browsers:

- Google Chrome

- Mozilla Firefox

- Microsoft Internet Explorer 11 (use the drop-down on the upper right corner of that page for earlier versions)

- Microsoft Edge

- How to delete cookies

Please update here if you need further assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income portion for second state is greyed out, shows full year's income and I cannot change it

Thanks again.

I am at the same part for income as you show, but don't have the capital gain section, just income.

I cleared history in Chrome. I deleted Indiana and started over but still get the greyed-out box with grey box amount matching the federal amount (don't know how to share a screenshot).

I moved 6-20-21 so when I am asked where did I work/ live on Jan 1 I entered "out of state- Illinois" for both if that helps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income portion for second state is greyed out, shows full year's income and I cannot change it

Just like @DianeW777 I am unable to get the same error that you are experiencing Tim3320070. It isn't a known error. That leads me to believe that you have entered something in error to get here.

Make sure that you are doing the tax return for Indiana first BEFORE the return for Illinois. You'll do a 'part year resident' return for each and tell them what dates you lived there.

Also, go back to your 'Personal Info' section and make sure that the question "Did you earn income in any other states?" is marked "Yes" and has Indiana selected.

If all of that looks good then you are probably better off having someone walk through the return with you to look at your entries so I recommend getting live expert help.

Here is a link to finding a TurboTax expert.

However, that requires upgrading your product which may be an expense you don't want. In that case you can call an expert and ask questions over the phone.

Here is a link to the TurboTax Phone Number.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

seandallas

New Member

petersaddow

Returning Member

bradjmc5dad

New Member

Young23

New Member

charlesaldridge73

New Member