- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I'm not being prompted to enter my 529 contributions for Iowa on my state return. Has anyone been able to figure this out?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm not being prompted to enter my 529 contributions for Iowa on my state return. Has anyone been able to figure this out?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm not being prompted to enter my 529 contributions for Iowa on my state return. Has anyone been able to figure this out?

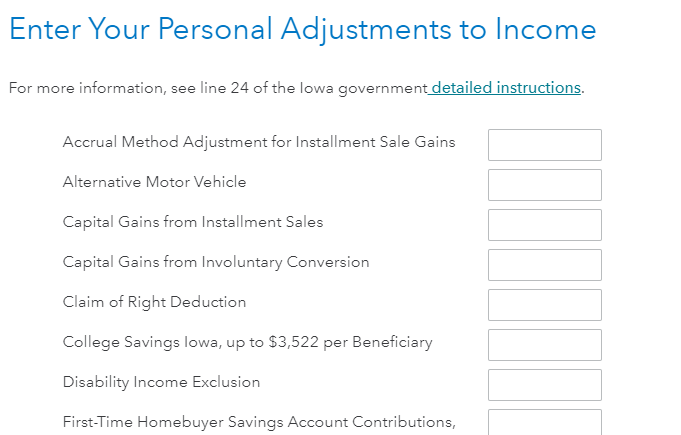

TurboTax has a place to enter your 529 contributions for Iowa.

- In Iowa keep going until you see the screen Do You Have Any Personal Adjustments?

- On the next screen, Enter Your Personal Adjustments to Income, find College Savings Iowa, up to $3,474 per Beneficiary

- Enter your 529 contribution

Learn more at College Savings Iowa (529 Plan) Deduction

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm not being prompted to enter my 529 contributions for Iowa on my state return. Has anyone been able to figure this out?

TurboTax is not letting me go line byline through my Iowa return, nor does it provide an opportunity to enter my 529 contributions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm not being prompted to enter my 529 contributions for Iowa on my state return. Has anyone been able to figure this out?

Qualifying contributions are deducted on line 24, item "g" of your Iowa income tax return.

Here is how to enter on TurboTax online. Go to the state and follow the interview as below.

529 Plans, administered by the Iowa Treasurer of State, help Iowans save money to pay for certain educational expenses for a specific beneficiary. Any money contributed to the account during a given year may be deducted on the account holder's Iowa income tax return for that year, subject to an annual contribution cap.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

CTinHI

Level 1

michaelmoran

New Member

wresnick

New Member

Cozmo20077

New Member

aaronvaughn1

New Member

in Education