- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

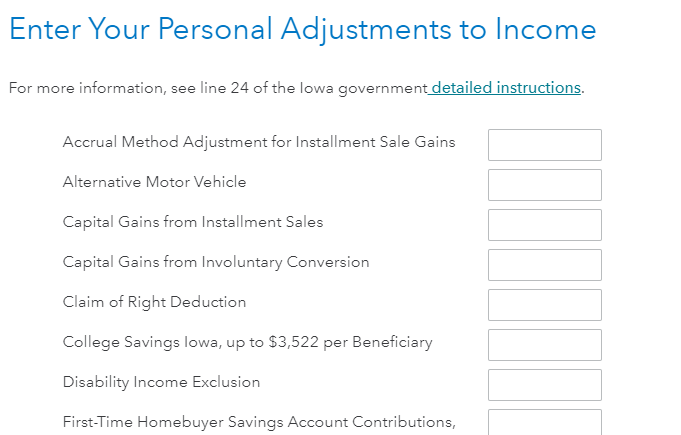

Qualifying contributions are deducted on line 24, item "g" of your Iowa income tax return.

Here is how to enter on TurboTax online. Go to the state and follow the interview as below.

529 Plans, administered by the Iowa Treasurer of State, help Iowans save money to pay for certain educational expenses for a specific beneficiary. Any money contributed to the account during a given year may be deducted on the account holder's Iowa income tax return for that year, subject to an annual contribution cap.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 28, 2023

6:52 AM