- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I have never worked in GA, but my company took GA State tax out of my check. Now trying to file to get back the $32 it wants me to pay $1028. Why?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have never worked in GA, but my company took GA State tax out of my check. Now trying to file to get back the $32 it wants me to pay $1028. Why?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have never worked in GA, but my company took GA State tax out of my check. Now trying to file to get back the $32 it wants me to pay $1028. Why?

You should be able to file a Georgia non-resident tax return and receive back your Georgia state withholding tax.

You will file a full-year resident tax return for your state of residence.

Does your W-2 only withhold Georgia tax or does the box 16 of the Georgia line of the W-2 assign income to Georgia? It sounds like your employer should report $0 to state income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have never worked in GA, but my company took GA State tax out of my check. Now trying to file to get back the $32 it wants me to pay $1028. Why?

- It assigns Box 16 - 705.25. Box 17 - 31.26. I have never worked or lived in GA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have never worked in GA, but my company took GA State tax out of my check. Now trying to file to get back the $32 it wants me to pay $1028. Why?

TurboTax may say you owe $1,028 to Georgia if you did not indicate you are filing a nonresident return and/or did not allocate your income. Check those two.

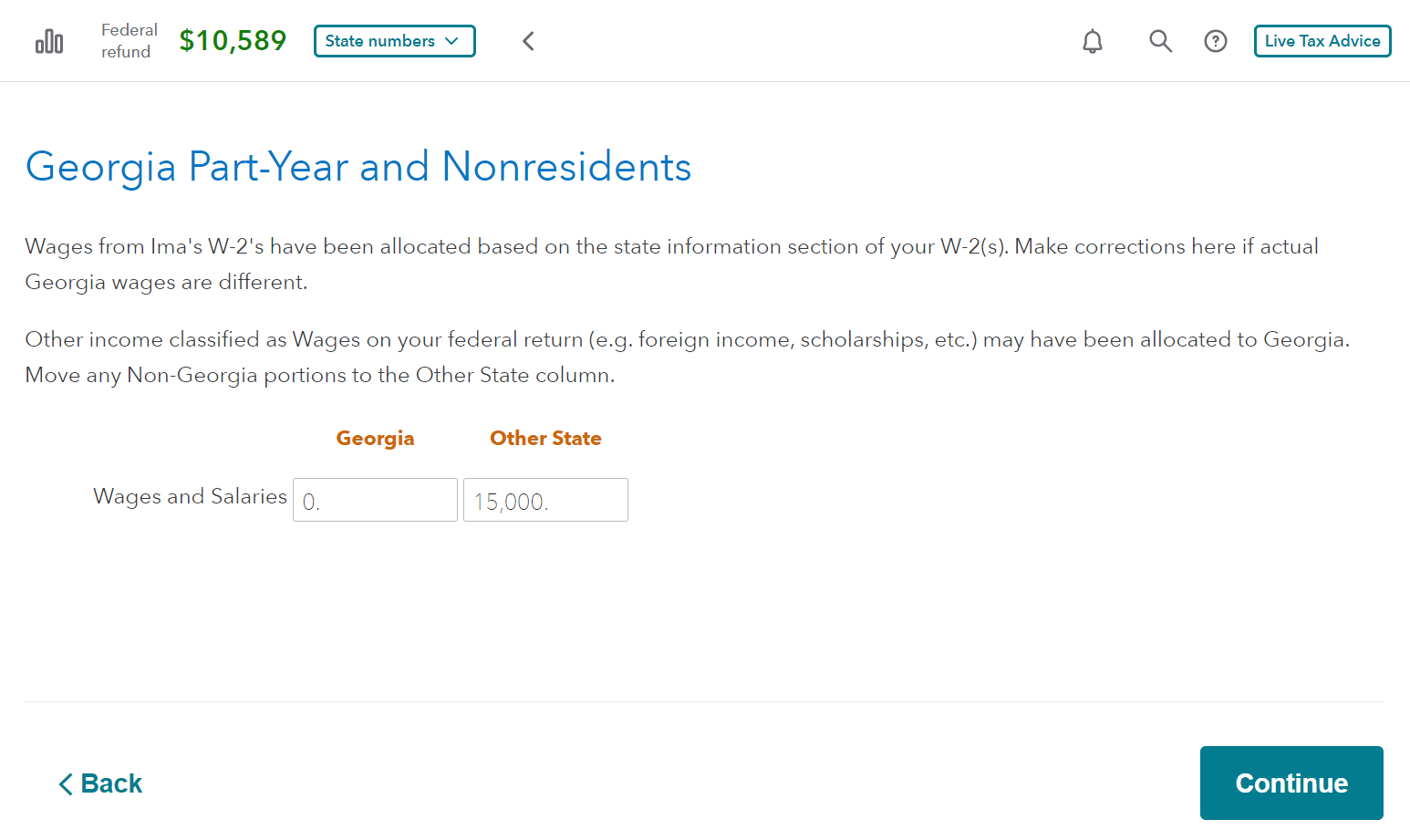

In the Georgia section,

- On “Did you make money in Georgia in 2022, but never live there?” say YES (even though you never lived or worked there)

- On “Georgia Part-Year and Nonresidents” change the Georgia amount to $0.

You’ll know it’s right if the GA refund is $32.

Consider filing GA by mail with a note explaining that your company withheld tax by mistake so GA knows what’s going on. If you do this, file by certified mail with proof of delivery.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have never worked in GA, but my company took GA State tax out of my check. Now trying to file to get back the $32 it wants me to pay $1028. Why?

If you have not already done so, have a conversation with your employer about why they put GA on your W-2.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RushMan

Level 2

corivoo

New Member

corivoo

New Member

mandybryant0818

New Member

travismatheson74

New Member