- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: I have never worked in GA, but my company took GA State tax out of my check. Now trying to fi...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have never worked in GA, but my company took GA State tax out of my check. Now trying to file to get back the $32 it wants me to pay $1028. Why?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have never worked in GA, but my company took GA State tax out of my check. Now trying to file to get back the $32 it wants me to pay $1028. Why?

You should be able to file a Georgia non-resident tax return and receive back your Georgia state withholding tax.

You will file a full-year resident tax return for your state of residence.

Does your W-2 only withhold Georgia tax or does the box 16 of the Georgia line of the W-2 assign income to Georgia? It sounds like your employer should report $0 to state income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have never worked in GA, but my company took GA State tax out of my check. Now trying to file to get back the $32 it wants me to pay $1028. Why?

- It assigns Box 16 - 705.25. Box 17 - 31.26. I have never worked or lived in GA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have never worked in GA, but my company took GA State tax out of my check. Now trying to file to get back the $32 it wants me to pay $1028. Why?

TurboTax may say you owe $1,028 to Georgia if you did not indicate you are filing a nonresident return and/or did not allocate your income. Check those two.

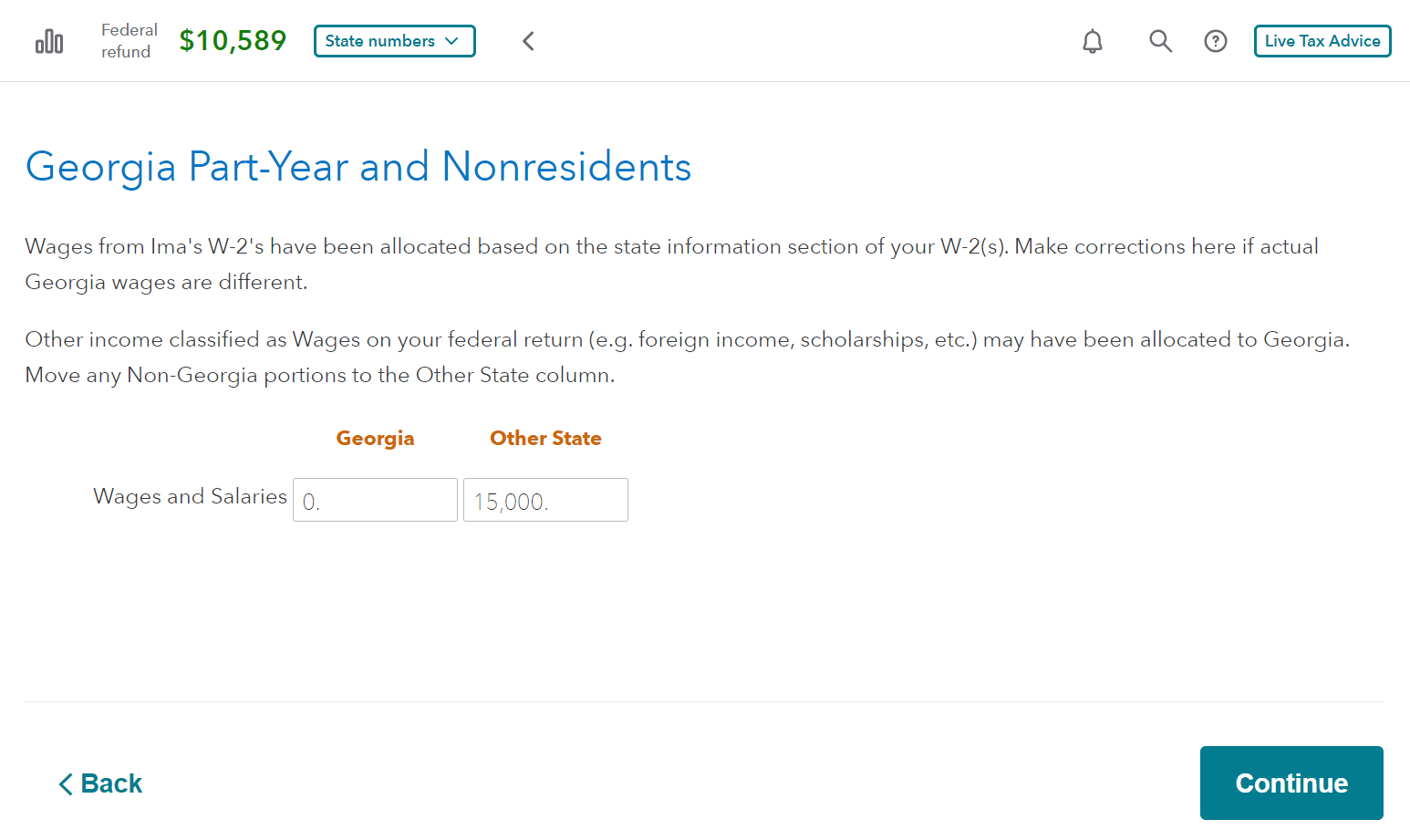

In the Georgia section,

- On “Did you make money in Georgia in 2022, but never live there?” say YES (even though you never lived or worked there)

- On “Georgia Part-Year and Nonresidents” change the Georgia amount to $0.

You’ll know it’s right if the GA refund is $32.

Consider filing GA by mail with a note explaining that your company withheld tax by mistake so GA knows what’s going on. If you do this, file by certified mail with proof of delivery.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have never worked in GA, but my company took GA State tax out of my check. Now trying to file to get back the $32 it wants me to pay $1028. Why?

If you have not already done so, have a conversation with your employer about why they put GA on your W-2.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

QueenFlappy

Returning Member

ochie629

Level 1

ochie629

Level 1

conncarla1

New Member

MarkMcH

New Member