- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I checked the box for Arizona form 310 (Solar Tax Credit) and it asks me the info, but I don't receive the $1000 tax credit on my taxes (my AZ tax due didn't change). Why

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I checked the box for Arizona form 310 (Solar Tax Credit) and it asks me the info, but I don't receive the $1000 tax credit on my taxes (my AZ tax due didn't change). Why

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I checked the box for Arizona form 310 (Solar Tax Credit) and it asks me the info, but I don't receive the $1000 tax credit on my taxes (my AZ tax due didn't change). Why

Every resident in Arizona who installs solar panels gets a State Tax Credit of 25% of the total system cost, up to $1,000, to be used toward State income taxes.

The credit is a non-refundable credit. A nonrefundable credit means that the credit can't be used to increase your tax refund or to create a tax refund when you wouldn't have already had one. The credit can only reduce your tax liability to zero.

If you can't claim the credit this year, you can carry it forward to future years.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I checked the box for Arizona form 310 (Solar Tax Credit) and it asks me the info, but I don't receive the $1000 tax credit on my taxes (my AZ tax due didn't change). Why

My AZ tax bill for due for 2020 was $44.00 prior to completing Form 310 (AZ Solar Tax Credit).

My installed solar system cost $37000, in 2020.

My AZ state tax credit should be $1000.00.

My tax bill still shows $44.00 due.

Your Form 310 seems unable to compute the tax credit. When I open the actual form on Turbotax, the calculations for the tax credit are missing and can not be amended.

Please explain.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I checked the box for Arizona form 310 (Solar Tax Credit) and it asks me the info, but I don't receive the $1000 tax credit on my taxes (my AZ tax due didn't change). Why

Please contact support via phone for assistance with this; contact details can be found here

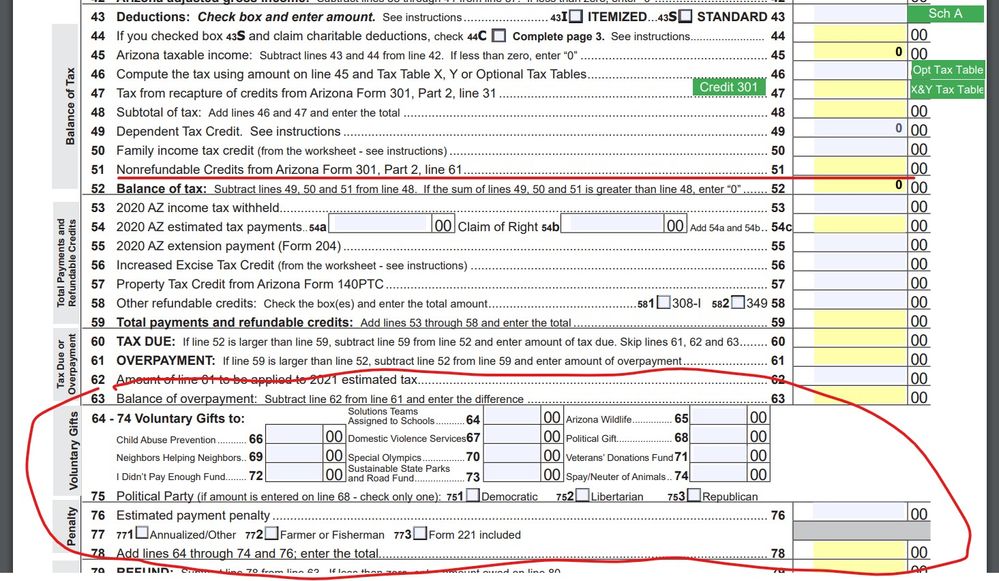

Look at lines 51 and 64 to 74 and 76 & 78 ... what amounts do you have on these lines ?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Greenemarci2

New Member

Meldenillo

New Member

ilenearg

Level 2

janaly304

New Member

geraldstarling65

New Member