- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- How do I get my Oregon Kicker check? It didn't get added to my state return. Did I do something wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get my Oregon Kicker check? It didn't get added to my state return. Did I do something wrong?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get my Oregon Kicker check? It didn't get added to my state return. Did I do something wrong?

Instead of issuing a Kicker check in 2019, the State of Oregon will issue the credit on your Oregon State Tax return. If you are eligible for the Kicker Credit, Turbo Tax will determine what the amount of your credit is.

According to the following link, the kicker credit is available for 2019. This State of Oregon document explains how the credit is determined. Here are the highlights of the document:

1) To calculate the amount of your credit, multiply your 2018 tax liability before any credits—line 22 on the 2018 Form OR-40—by 17.171 percent according to OR-40 full year instructions. This information is found on page 16 in this link.

2) Taxpayers who claimed a credit for tax paid to another state will need to subtract the credit amount from their liability before calculating the credit. This is if you filed a state return in any other state besides Oregon.

Turbo Tax will perform any subtractions

3) You're eligible to claim the kicker if you filed a 2018 tax return and had tax due before credits. Even if you don't have a filing obligation for 2019, you still must file a 2019 tax return to claim your credit. Please review this link on page 17 for detailed instructions on how your kicker credit is determined. you don't need to do any calculations. Turbo Tax will determine this for you.

Lastly, to enter your kicker information into Turbo Tax, please log into your Turbo Tax account and perform the following steps:

1) Select state in the left navigational pane.

2) Once you make the selection, Turbo Tax, will transfer the information in your federal return to your state return.

3) next screen will ask you what Oregon return you wish to file. If you were a full year resident, you will select full year Oregon Resident return. Press Continue

4) press continue on the next screen

5) press Done with Income on the screen that says, Here's the income that Oregon handles differently.

6) The very next screen will begin the interview questions to see if you are eligible for the kicker credit. This is going to ask you questions about your 2018 Oregon return to see if you are eligible for the credit. If you are eligible for the credit, Turbo Tax will determine the amount of credit you are eligible for.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get my Oregon Kicker check? It didn't get added to my state return. Did I do something wrong?

Good job Dave F. You are the man.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get my Oregon Kicker check? It didn't get added to my state return. Did I do something wrong?

Please see the post by @Wretched1234,just above this post, excellent job.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get my Oregon Kicker check? It didn't get added to my state return. Did I do something wrong?

i used the 2019 turbotax and it failed to direct me to the correct line on the 2018 oregon tax return form to get my tax liability for 2018. subsequently i did not get my kicker refund added to my 2019 return. i believe this is turbotax software fault. how do i amend my return and where are the specific and correct instructions on how to get my kicker refund using the free edition turbotax software?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get my Oregon Kicker check? It didn't get added to my state return. Did I do something wrong?

To amend, follow these instructions:How do I amend my 2019 TurboTax Online return? - Community

To get the 2019 Oregon kicker refund, you would enter the information in the Oregon state tax section under Credits.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get my Oregon Kicker check? It didn't get added to my state return. Did I do something wrong?

The Oregon kicker is not being added to my return. I have the same Oregon refund before and after I completed the kicker section and my kicker was calculated to be $1,537.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get my Oregon Kicker check? It didn't get added to my state return. Did I do something wrong?

Turbox Tax Deluxe is not adding my Oregon sate kicker to my refund. My state refund was the same both before and after I completed the kicker category. Think there is a problem with the software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get my Oregon Kicker check? It didn't get added to my state return. Did I do something wrong?

Same as others who have already posted - my Oregon Kicker was not added to my state refund amount. This looks like a software error that has been in place for the last 2 weeks. Is there any move to fix it? If not, I'll have to file my Oregon tax return with an alternative software provider. Please help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get my Oregon Kicker check? It didn't get added to my state return. Did I do something wrong?

It is working in my test, so let's see what you have:

On your OR-40, what are the values in lines 34 and 36?

On your Kicker Credit worksheet, what are the values on all lines that have a value in them?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get my Oregon Kicker check? It didn't get added to my state return. Did I do something wrong?

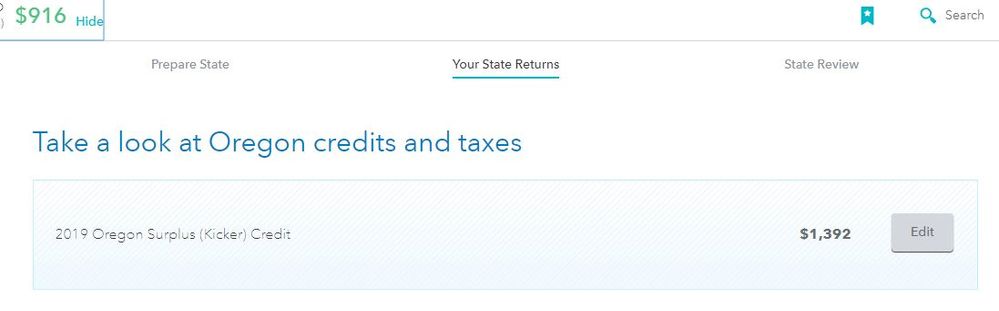

I am also having this problem. My OR kicker credit is $1,392.00, but not adding into my OR refund. The number stays the same. Shouldn't the OR Refund number go up by the exact amount stated? I tried to continue on hoping it would add in later. It didn't. I did not finish filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get my Oregon Kicker check? It didn't get added to my state return. Did I do something wrong?

Is anyone using the CD/download software? If so, can you look at your Oregon return and tell me what values are on the lines I asked about just above?

And can I ask a silly question? Is it possible that you asked the kicker to be contributed to the State School Fund?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get my Oregon Kicker check? It didn't get added to my state return. Did I do something wrong?

I am not using the software. I am doing it online.

I didn't donate. I triple checked that. 🙂

When Turbotax asked for line 22 from OR 40 it auto filled and it was correct. That number was $8,107.00

Line 34 is Reserved

Line 36 is $6,648.00

I hope this helps. I am lost. I called and after 3 long holds was hung up on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get my Oregon Kicker check? It didn't get added to my state return. Did I do something wrong?

Any chance you paid taxes to other states?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get my Oregon Kicker check? It didn't get added to my state return. Did I do something wrong?

I did not pay any taxes to other states.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sapp-aw

New Member

gowen

New Member

megolaniac

New Member

schirgerdaniel3

New Member

canalessuzette

New Member