- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- How do I get back to the NY IT-215 to correct an error?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get back to the NY IT-215 to correct an error?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get back to the NY IT-215 to correct an error?

As long as you haven't already mailed your 2020 paper return, you can switch back to the e-filing method.

To do so, please follow these instructions:

- In TurboTax Online, sign in to your account.

- Select Tax Home in the left menu.

- Scroll down to Your tax returns & documents.

- Select 2020, and then select Add a State (you're not actually adding a state, this just gets you into the right area).

- Select File in the left menu (expand your browser window if you don't see this, or select the menu icon in the top left corner).

- On the Just one more step screen, follow steps 1 and 2 if you haven't already.

- Select the Start button to the right of Step 3.

- On the Let's get ready to e-file screen, select I want to e-file.

- Follow the instructions to e-file your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get back to the NY IT-215 to correct an error?

I need to fix the error on NY IT-215. I'm not so concerned about the e-filing as I am about the fact that the error is preventing me from getting a refund. (>$1000) It's a yes/no check box about the IRS calculating earned income?????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get back to the NY IT-215 to correct an error?

As long as you have not submitted your tax return for electronic filing, you can still make changes in the program.

You will be able to edit your state tax return by doing the following:

- Select State in the black panel on the left after signing into TurboTax.

- Select Edit to the right of your state and go over the state again.

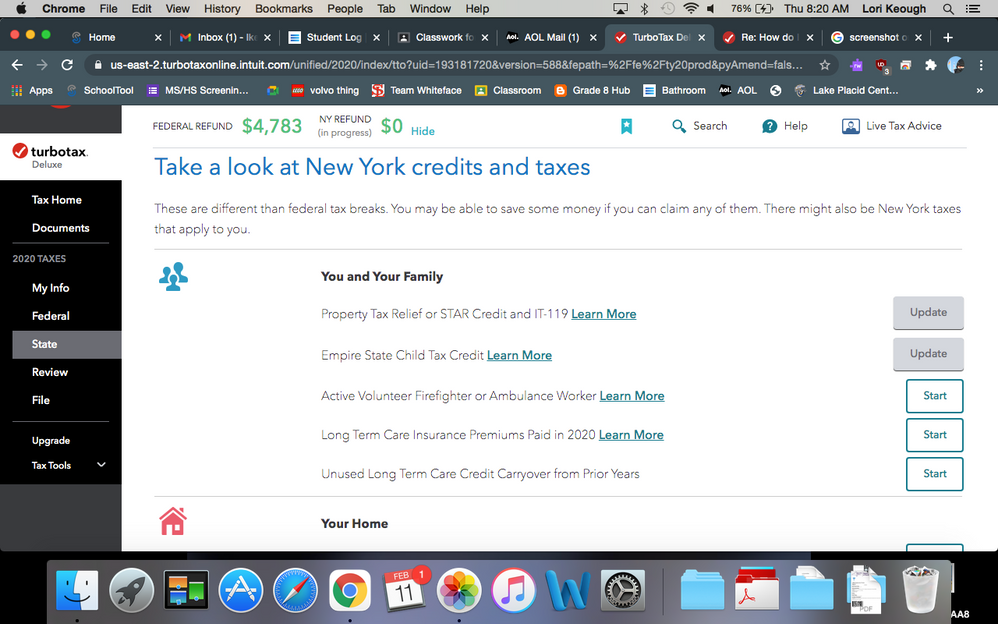

Continue through the screens until you see the screen titled Take a look at New York credits and taxes.

Select Earned Income Credit under the section titled You and Your Family to review your input.

Please see the attached link for more details form IT-215-I.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get back to the NY IT-215 to correct an error?

The problem being...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get back to the NY IT-215 to correct an error?

To claim the state EIC, you must be getting the federal EIC. It may help to go back to the federal and delete the EIC form, This should re-set the federal and state to ask again. See How to Delete

Thanks for the picture, it is absolutely missing the EIC! You might need to clear cookies and cache or change browsers after deleting. You can fill this form out for someone to call you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get back to the NY IT-215 to correct an error?

Finally!!!! That worked. Thank you so much for your help!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tvcconstruction

Returning Member

lastminuteidiot

New Member

user17604626649

New Member

Edge10

Level 2

traleej

New Member