- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

@BeepopM - You will only get that screen, if you had an entry in box 11 of your 1099-Div or box 8 of your 1099-INT. After entering your 1099, it will show up 3 screens later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

this answer is confusing and does not address the problem

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

With several different problems being posted here, you're going to have to describe your "Issue" more completely and exactly.

It would be best if you started and entirely new question form scratch....this original question (up top) was transferred in here from several years ago (transferred with a phoney posting date) when box 10 on a 1099-DIV was used for exempt-interest dividends. Some of the years-later follow-ups do use the currently proper box 11.

Many of the responses here should lead you to what you need to do if you read them and then go thru the interview for the entry of your 1099-DIV, or 1099-INT form...but we really can't know for sure because you may be complaining about something we cannot guess at, so you need to state clearly what you are trying to clear up/display/correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

@SteamTrain wrote:Did have one person the other day for Indiana, who insisted the Indiana breakout didn't work, in that the "Multiple States" dividends didn't add back to the Indiana tax return......but instead there was an Indiana interview section that the taxpayer had to specifically include the Other state dividends before they were added to Indiana income.

I had this same issue when filing 2019 returns for New York. The tax exempt interest entered on the 1099-DIV would never seem to carry over to the New York return as an adjustment increase, no matter how I entered the data on the federal side (tried splitting appropriately with New York + "Multiple States", entirely as "Multiple States", and entirely as a Non NY state). I didn't see any specific interview questions in the New York return interview that helped to fix this though.

However, I did find that I was eventually able to get things working by finding an alternate 1099-DIV entry form that was buried in the Topic List view found under "Tax Tools" > "Tools", and clicking the entry in the Federal Taxes subtree that corresponded to the 1099-DIV with the tax exempt interest on it. Navigating in this manner brought up a slightly different version of the 1099-DIV entry form than the one presented through the normal interview UI navigation (I think it matched the appearance of the pre-2019 version), and after saving the correctly entered data with the NY + "Multiple States" split on this version of the form, the entry was immediately carried forward to the NY return and the displayed dollar amount up top for the State was visibly affected.

I double checked this in the final result of the output state return, and saw that it finally correctly populated the expected field (IT-201 (2019) Line 20: Interest income on state and local bonds and obligations (but not those of NYS or its local governments)).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

Hi Metzen, I'm having the exact same issue as you but for PA instead of NY. Trying to replicate your solution, but it won't work for me, alas. Thanks for sharing it, though.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

The adjustment below does not follow the guide in TT Premium.

I have the same situation with dividends that are federally tax exempt, but there is no indication where I add back the 5.33% of NY State dividends which are taxable.

Please advise how to do this

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

There is a place to enter tax-exempt interest dividends in TurboTax. Here is how to find it:

- Login and continue your return.

- Select Federal from the menu on the left, then Dividends.

- Add a new 1099-DIV or edit the one you have already entered.

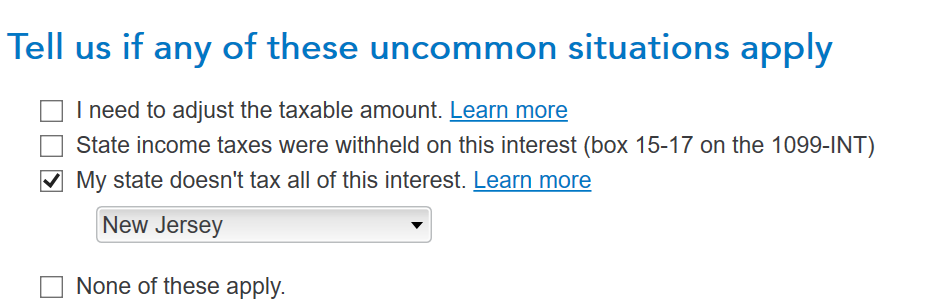

- The next screen should show Tell us if any of these uncommon situations apply

- Click on 3rd option. My State doesn't tax all of this interest

- Then select in the box below New Jersey (screenshot 1)

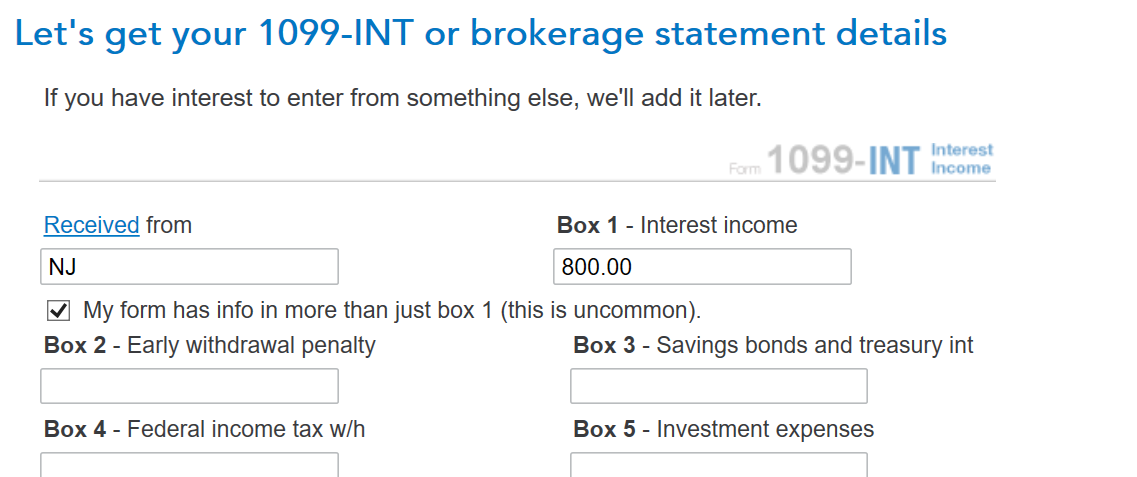

- On the next screen click on My form has info in more than just box 1, this will open the detail where you will add the exempt interest on box 14 (screenshot 2)

You would enter NY in the drop-down in both screenshots below:

If the above steps do not work, you might have to delete and reenter as indicated in the link below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rhartmul

Level 2

RicN

Level 2

tianwaifeixian

Level 4

gborn

Level 2

rcohen-citrincoo

New Member