- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Exempt interest dividends are entered from Form 1099-DIV,...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

Exempt interest dividends are entered from Form 1099-DIV, Box 10. In other words, these dividends, when so entered into TurboTax and thus onto your actual tax return, are federal tax-exempt income.

However, dividends that represent payments from otherwise federally tax-exempt entities (but from those outside of the state of New Jersey), are an "add-back" amount onto a New Jersey tax return return, such that the federal tax-exempt dividends are taxable to New Jersey. This is in contrast to fully-taxable dividend income, which is taxable on the federal level as well as on the state level.

In practice, such federal tax-exempt, but state-taxable, dividends often come from mutual funds or Exchange Traded Funds (ETFs) that hold a multi-state portfolio of municipal bonds. All of the income from those bonds, other than than those issued within your home state, are taxable by your home state. Thus, we need to "adjust" the Form 1099-DIV, Box 10 entry to account for that fact.

In TurboTax, this is manually done in the 1099-DIV interview. Because this is usually easier to visually demonstrate than to walk through the whole process in words, we provide this answer as a series of screen-capture images, which should be relatively easy to follow. The specific numbers we use will be different than yours, obviously, but you can make the appropriate adjustment(s) to your exact circumstances. The steps we demonstrate here are for entering $1,000 of federal tax-exempt interest, where $100 remains tax-exempt in New Jersey as well, and where $900 is taxable by New Jersey.

Simply click on the image files to open.

Thank you for asking this question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

Why not just add that federally exempt income on your state return where it asks for "additions" in the category of other tax situations on the state return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

1) Not all states forms have an easily accessible "Other" additions in order to do that. They all have particular lines in their forms where tax-exempt interest from other states is supposed to show up, and the state computers, and personnel, expect those add-back $$ to show up in those designated lines. (A few states even start everything from scratch, and don't use the Fed AGI as the starting point).

2) Bypassing the software interview ends up placing the addition in a place that the state does not expect to see that type of addition to income. Doing it as you suggest invites a manual review of your tax return, and perhaps other questions, or even an actual audit that you could otherwise have avoided had you done it properly.

____________

3) To anyone else, the original Question here is several years old (it refers to box 10 on a 1099-DIV.....which became box 11 for 2018 taxes). The transfer of old Q's to this new platform lost not only dates of the original Q's, but also many pictures being referenced in the old questions (Pics are "supposed" to be restored someday )

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

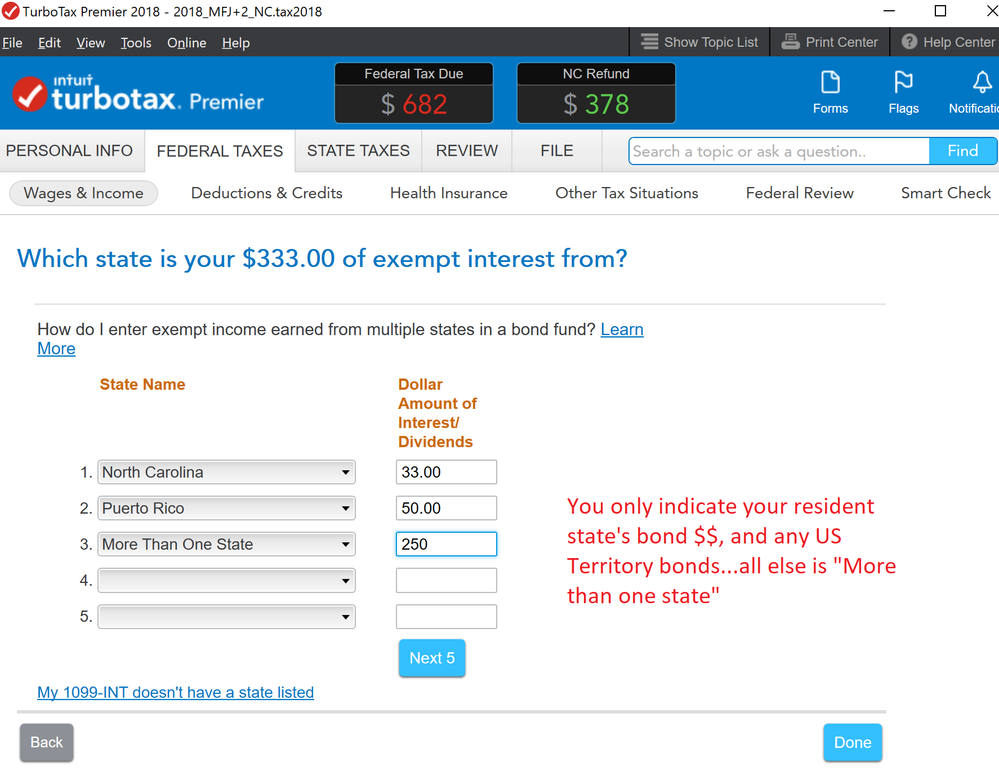

You get the state breakdown from your mutual fund company. If they did not provide a breakdown, in the federal section you check the box “I earned tax exempt dividends in more than one state” on the first screen after entering the 1099-INT or 1099-DIV. Then select "More than one state" ("Multiple States" in the online program) at the bottom of the state scroll down list.

If your mutual fund company provided you a breakdown, you are only interested in your home state*. Multiply the % for your state by your total tax exempt dividends to get a $ amount (you can't enter the % in TurboTax [TT]). When asked which state, check the box "I earned tax exempt dividends in more than one state". In the drop down menu, select your state and enter the $ amount you calculated. In the 2nd box, select "More than one state" (at the bottom of the scroll down list) and enter the remaining dollar amount.

These amount will transfer to the state return. There will not be a place to enter them in the state interview.

*Your state will tax all the dividends except the dividends from municipal bonds from your state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

I have done exactly as you suggest and I get an error "The total amount you entered doesn't equal your reported exempt-interest dividends in Box 11 of your 1099-DIV."

I also used my fund documentation to calculate the percentage for all states (47) with dividends reported and entered them all, one-by-one, such that the total equals exactly the reported exempt-interest dividends in Box 11 of my 1099-Div and I still get the same error. I have tried to split a few arbitrarily such that the total is the same as Box 11 and that seems to work. It just seems that if one gets over some number of rows that the application fails to add them up and throws and error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

you're not filing in 47 states. you only want to enter the amount that your state allows you to subtract.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

@msgrinnell Correct...not ALL states individually. Just your own state, and any US Territory bonds.

Here's an example of what you'd do if you lived in NC:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

I haven't tried it this year, but in the past listing Guam, PR and USVI separately didn't get you credit on the state return (Ohio for me). I add the territory dividends to my state and make one entry under Ohio.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

The territories worked OK in prior years for NC (haven't checked this year).

Did have one person the other day for Indiana, who insisted the Indiana breakout didn't work, in that the "Multiple States" dividends didn't add back to the Indiana tax return......but instead there was an Indiana interview section that the taxpayer had to specifically include the Other state dividends before they were added to Indiana income. This is strangely at odds with how the state software works for all other states....that I've ever worked with.

_______________________________

and inconsistency in terminology between Desktop and Online software. One uses "Multiple States" the other uses "More than one state"...but the user should be able to figure it out, once they know the selection is at the END of the list of states.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

Yeah, 7 or so years ago, my NC forms did not exempt the Territories properly (i.e. not at all). I pointed it out to TTX as a state software bug, and they fixed it so that the sate software treated the territories appropriately. But I guess now I need to re-check this year too.....so many subtle details.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter exempt interest dividends that are exempt from Federal tax, but taxable in NJ?

How do i open the screen dumps of the solution to this question foe a NJ resident that has exempt interest dividends that are exempt from Federal tax but taxable in NJ? I can not see the screens that contain your answer. I recall from prior years that there is an icon, etc that i click on to open the screen dump files. I cannot find it in the "original post"

Thanks.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gabollin

Level 2

user17723004348

New Member

jennysavakus6320

Returning Member

byrnejm

New Member

KBCPA1

Level 3