- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Earned one paycheck in NY and lived in PA full year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned one paycheck in NY and lived in PA full year

I moved from NY to PA. My PA residency started on 01/01/2019. My employer was informed of my move to PA. Because employer's payroll is one week behind, I received a paycheck on 01/04/2019 that was all attributed to NY. Thus, I received two W2 forms from the same employer, which are identical except for box 15-17. Box 20 shows New York, NY resident on both W2 forms. I need to file non-resident NY and resident PA. How can I properly allocate the wage for both states? I prep NY state first and allocate percentage of the total wage in box 1 to match the box 18. Is that the correct approach? Then, what should I do for PA? TurboTax takes both PA and NY wages shown in box 1 (which doubles the wage) and it says I'm due taxes to PA. Please help. Thank you in advance!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned one paycheck in NY and lived in PA full year

If you physically lived in New York until 12/31/19, then you need to file a full-year resident return for the state of New York and nothing for Pennsylvania. You will file a Pennsylvania state return in the 2020 tax year. However, if you lived in Pennsylvania until 12/31/19 then you would file a full-year resident return for that state.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned one paycheck in NY and lived in PA full year

Hi, Katrina. Thanks for reply. Just to make sure we have the dates correct. I physically lived in New York until 12/31/2018, and then in Pennsylvania since 01/01/2019. The first paycheck in 2019 was issued on 01/04/2019 that was attributed to New York. But, I was already a resident of PA since 01/01/2019. Furthermore, I was a resident of PA full year in 2019. The question is How to properly allocate the wage for both states? I prep NY state first and allocate percentage of the total wage in box 1 to match the box 18. Is that the correct approach? Then, what should I do for PA? TurboTax takes both PA and NY wages shown in box 1 of each W2 form (which doubles the wage) and it says I'm due taxes to PA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned one paycheck in NY and lived in PA full year

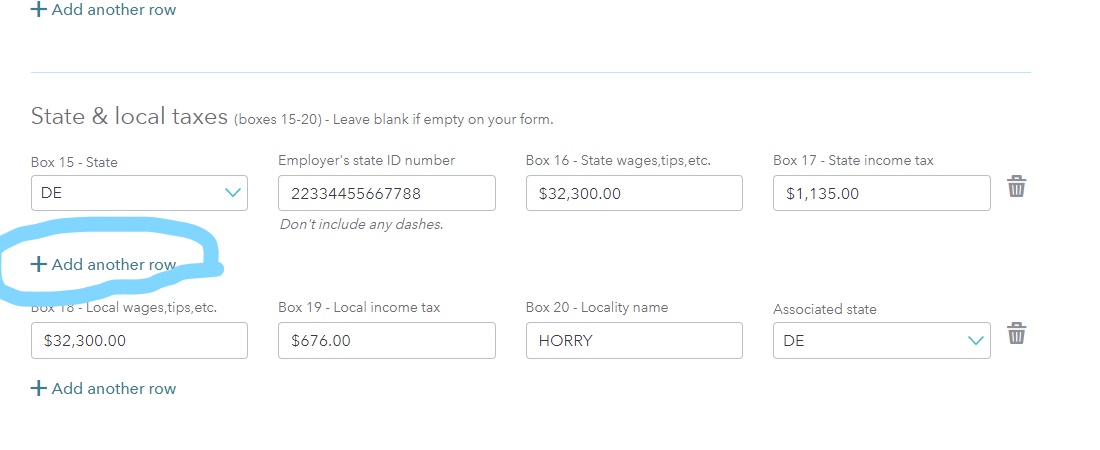

You were correct to prepare your nonresident state return first however, you should have included the income reported as state wages in box 16 for each state respectively. However, the information in box 18 may be the same. You are probably seeing double state wages for Pennsylvania because you entered both of your W-2 forms. Since the information on each is identical except for the boxes 15-17, you should only input one W-2 and add another row to report your additional state information. Please view my screenshot below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned one paycheck in NY and lived in PA full year

That is correct. TurboTax has only one W2 form entered, but has two rows capturing information from boxes 15-17 from both W2 forms. So, when I switch to PA state, it adds box 16 from one W2 form and box 16 from the second W2 form. And, this makes as if I made twice from what I actually earned in 2019. There is an option to make NY wages on PA as non-taxable in PA. Is this the option I should pick? When I pick this option, it captures the correct state wage from PA W2 form. But, I'm not sure if this is correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned one paycheck in NY and lived in PA full year

You should be filing as a NY nonresident and a PA resident.

On the NYS return you will allocate as mentioned above.

On the PA return you have an option to choose how much of the NY income is taxable to PA.

Enter the same amount that you used for your NY income.

A few screens later you will see the Credit for taxes paid to another state.

Enter the information you will then be credited @ 3.07% of income taxable to both states on your PA return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

carsonschafer

New Member

srobinet1

Returning Member

russellkent7

New Member

juham2013

Level 3

alicjaczaja

New Member