- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

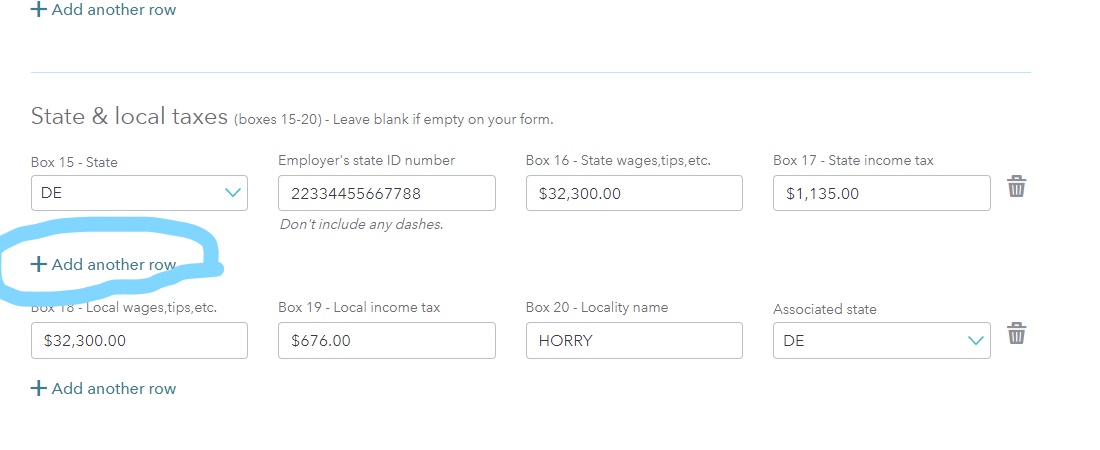

You were correct to prepare your nonresident state return first however, you should have included the income reported as state wages in box 16 for each state respectively. However, the information in box 18 may be the same. You are probably seeing double state wages for Pennsylvania because you entered both of your W-2 forms. Since the information on each is identical except for the boxes 15-17, you should only input one W-2 and add another row to report your additional state information. Please view my screenshot below.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 11, 2020

8:25 AM