- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Can i fill out a nyc 1127 on turbotax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i fill out a nyc 1127 on turbotax?

Exactly, I went through the exact same loop with turbotax a few years ago, ended up filing the 1127 myself. My residence was 7 months in NYC and the rest in Jersey, Turbotax needs to fix this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i fill out a nyc 1127 on turbotax?

Yes, you can fill out an NYC-1127 on TurboTax but it is available to print only. E-filing the NYC 1127 is not supported. Manually enter the allocation for NYC and print and mail the NYC-1127. The form became available for printing on January 26, 2023.

I hope the foregoing assists you in filing your NYC-1127. It may not be an optimal solution but it does allow you to print and file with New York City.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i fill out a nyc 1127 on turbotax?

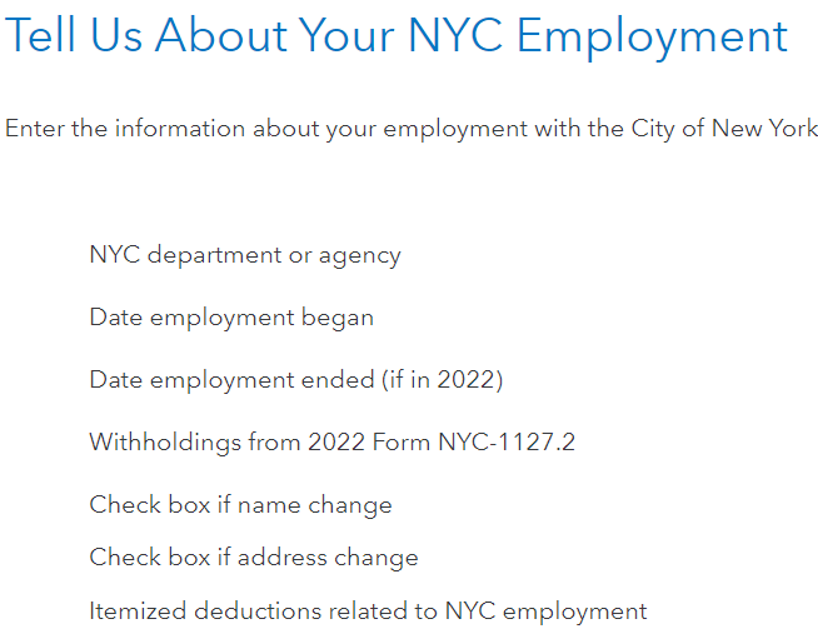

Thanks for the help. I was able to input the information per @JosephS1's description. My question is the following: is there a calculation that TurboTax is doing to see if I owe or am owed any monies to NYC? My box 25 on my Form 1127.2 shows an amount under "Amt Withheld Under Sec. 1127". I assume this means this was already taken out of my paycheck and may owe or be owed monies?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i fill out a nyc 1127 on turbotax?

Yes, the amount withheld is the amount already taken out of your paycheck.

Depending on whether your had too much or too little or just the right amount withheld, unless you made other payments, this would be the amount subtracted from your total tax liability to arrive at your refund or taxes owed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i fill out a nyc 1127 on turbotax?

Thank you - but to be clear, will TurboTax tell me if I owe anything to NYC or am owed a refund? I input the 1127 into TurboTax and am only seeing monies owed for NY State and Federal, nothing related to NYC one way or the other

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i fill out a nyc 1127 on turbotax?

Yes. When you print the form, you will see the calculations and amounts. You can adjust your withholdings at work as needed.

NYC states:

Personal Income Tax

New York City residents must pay a personal income tax, which is administered and collected by the New York State Department of Taxation and Finance.

Non-Resident Employees of the City of New York - Form 1127

Most New York City employees living outside of the five boroughs (hired on or after January 4, 1973) must file form NYC-1127. This form calculates the City waiver liability, which is the amount due as if the filer were a resident of NYC.

[Edited 2/22/23 |8:17 am]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i fill out a nyc 1127 on turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i fill out a nyc 1127 on turbotax?

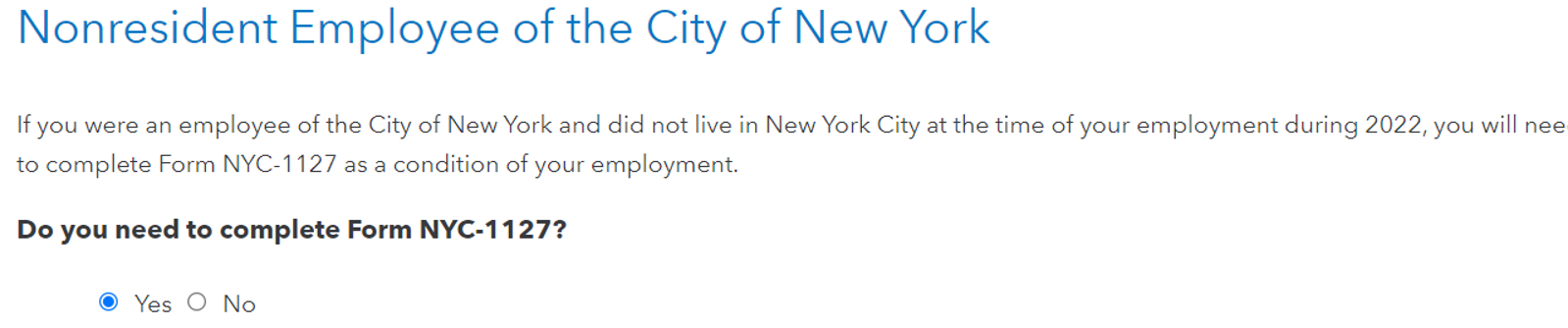

Yes, the 1127 form can be filled out on TurboTax, but you will need to print the form and mail it as it is not supported for e-file.

Please verify that you have correctly entered your residency as a nonresident employee of the city of New York. If your residence is entered correctly, you'll be prompted with the question, "Do you need to complete Form NYC-1127?"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

benzaquenbills

New Member

travisbens

New Member

Frank Scales

New Member

gtchen66

Level 2

petrickt13

New Member