- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- 1099-B Proceeds for US Treasuries to avoid NJ state tax

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B Proceeds for US Treasuries to avoid NJ state tax

Hi @MonikaK1

I live in Maryland and need to subtract the gain from my Treasury bill sales (1099-B) in my state income. Where can I find the "Disposition of property" in the MD state interview just as you showed for New Jersey?

Thanks,

Van

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B Proceeds for US Treasuries to avoid NJ state tax

Since you are also in a state (MD) that doesn't tax interest or gains on Treasury bonds, you can exclude interest and gains from Form 1099-B from Treasury securities in the for your state without removing the form from your Federal return.

When you complete the Federal interview in TurboTax for Treasury interest, you are asked a series of questions about any items that need to be treated differently or allocated among different states, (e.g., "My state (ME, MD, MA, NH, NJ, or WV) doesn't tax all of this interest"; answer the questions. You shouldn't have to do anything else in the state return to exclude the items unless you need to allocate the subtraction amount among different states.

If, when you have prepared the Maryland return, you see an item being treated as taxable that should be tax-exempt, you can still make an adjustment on the state return under items treated differently by Maryland.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B Proceeds for US Treasuries to avoid NJ state tax

@MarilynG1 @After looking at the article you posted it doesn’t indicate that the capital gains are taxable by the state. Rather it indicates that it will be reported on 1099b..

it indicates this specifically on nj site, that its not taxable: “Gains or losses realized from the sale or exchange of exempt obligations such as United States Treasury bonds are not taxable, nor are capital gains distributions from a qualified investment fund attributable to exempt obligations.”

https://www.nj.gov/treasury/taxation/njit9.shtml

am I misunderstanding the NJ site?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B Proceeds for US Treasuries to avoid NJ state tax

No, you are not misinterpreting the New Jersey site. The link referenced above is a general article and not directly related to New Jersey. Each state has its own set of rules and taxation varies.

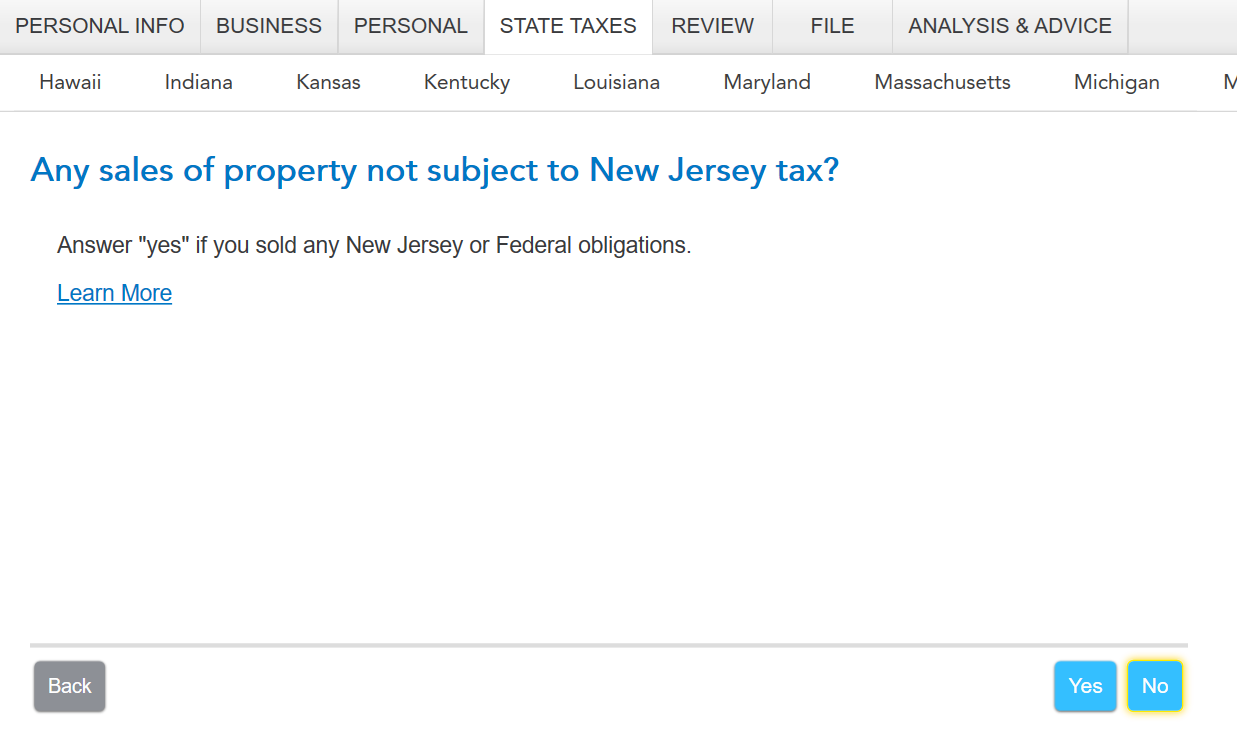

In TurboTax, you would need to go through the state interview section to make any adjustments as it relates to New Jersey. Proceed through the screens until you see the screen titled "any sales of property not subject to New Jersey tax?" Select yes.

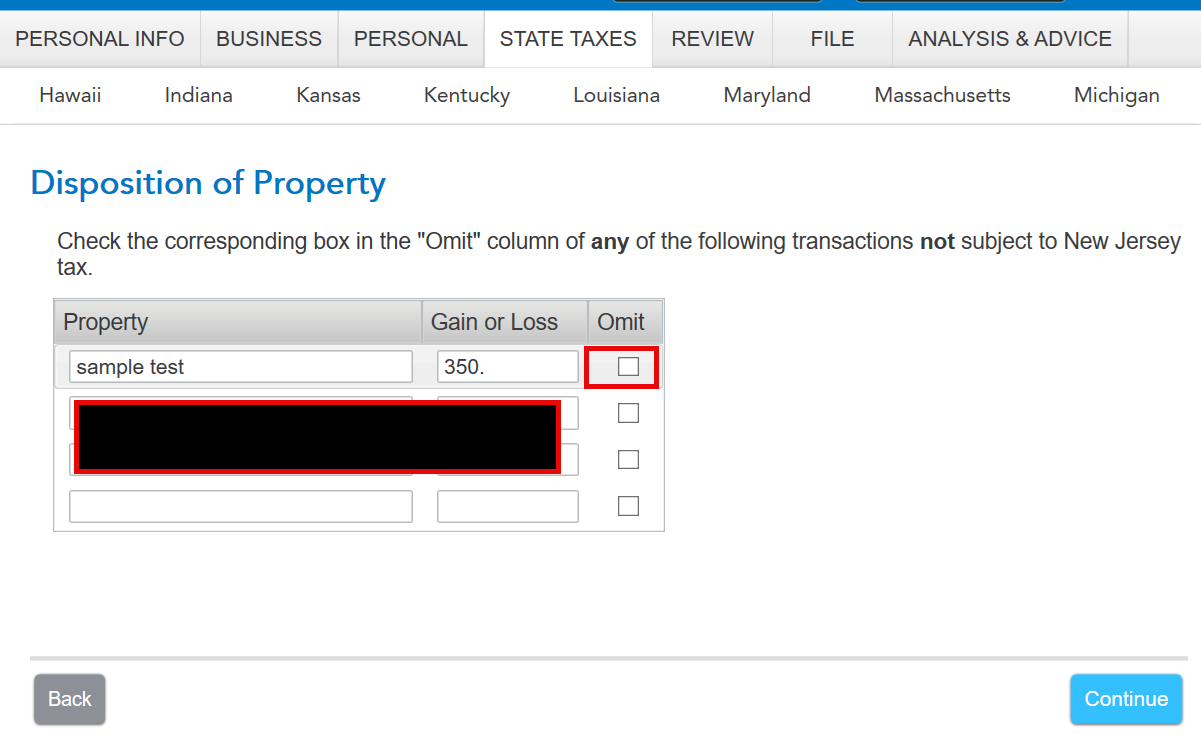

Then, on the next screen titled "Disposition of Property," you will be able to select the box to omit any income that is not taxable in New Jersey.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Omar80

Level 3

galloway840

Level 2

garys_lucyl

Level 2

erwinturner

New Member

Moonlight

Level 2