- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

No, you are not misinterpreting the New Jersey site. The link referenced above is a general article and not directly related to New Jersey. Each state has its own set of rules and taxation varies.

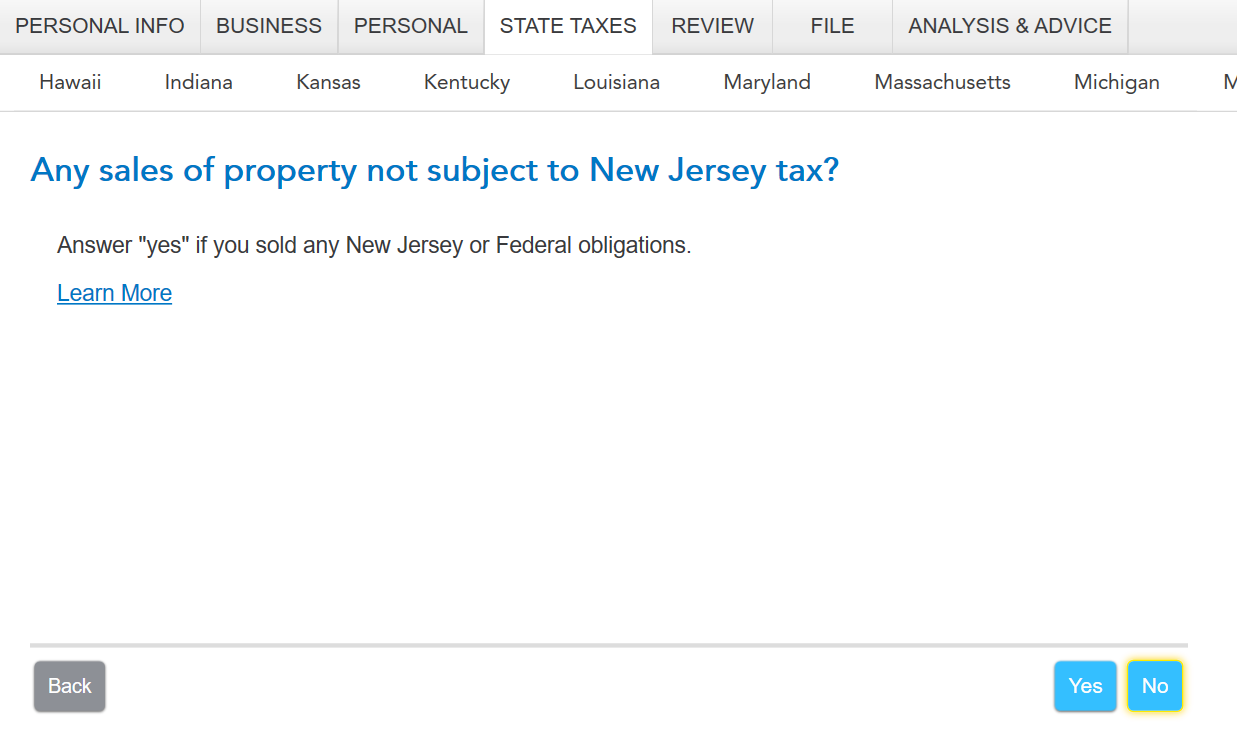

In TurboTax, you would need to go through the state interview section to make any adjustments as it relates to New Jersey. Proceed through the screens until you see the screen titled "any sales of property not subject to New Jersey tax?" Select yes.

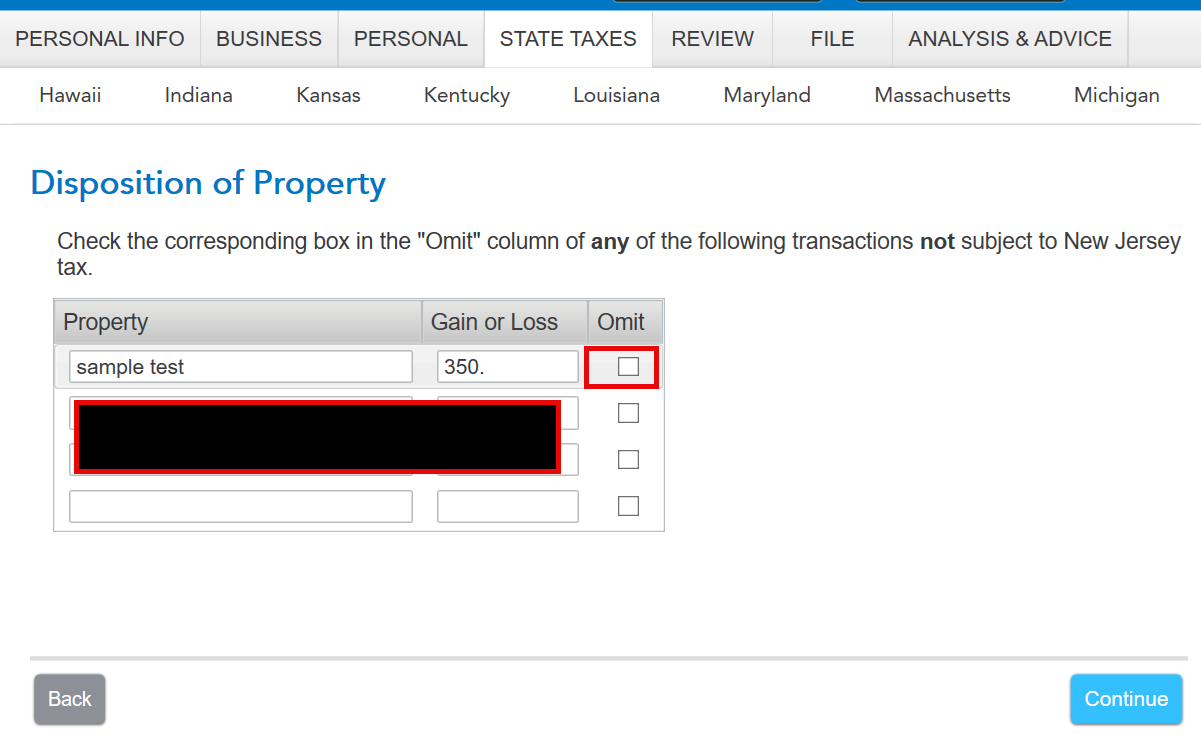

Then, on the next screen titled "Disposition of Property," you will be able to select the box to omit any income that is not taxable in New Jersey.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

May 20, 2025

11:27 AM