- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Will Turbo Tax automatically use to 1040-SR if appropriate? Friends are saying we should have gotten more back and Turbo Tax has failed us again. Doesn’t it look for all?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Turbo Tax automatically use to 1040-SR if appropriate? Friends are saying we should have gotten more back and Turbo Tax has failed us again. Doesn’t it look for all?

Where did it add it as income? What line? Line 30 is only if you didn't get the full amount or qualify for more. sounds like the IRS sent you the 2800 last year but you tried to claim it again on line 30.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Turbo Tax automatically use to 1040-SR if appropriate? Friends are saying we should have gotten more back and Turbo Tax has failed us again. Doesn’t it look for all?

I'm a senior with 20/20 vision and the tiny print in the help section is horrible. I have to copy it and paste in a word processing program to be able to read what it says. I've worked on computers since the 70's, but a lot of people don't know how to do workarounds.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Turbo Tax automatically use to 1040-SR if appropriate? Friends are saying we should have gotten more back and Turbo Tax has failed us again. Doesn’t it look for all?

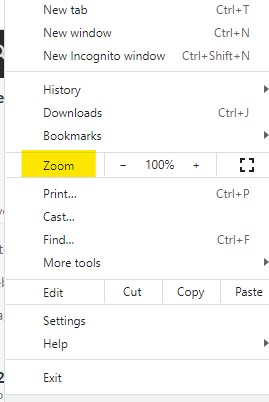

On the desktop program, you can increase the size of the fonts in the bottom right-hand corner. Each help box can be adjusted also, the font adjustment is at the top of the ''On-Demand Tax Guidance'' box. See the image below. @Herself

For the Online version, you can increase the webpage size from your browser's settings.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ashleynicolerose88

New Member

edgelser2

Level 3

troybren

New Member

rmilling3165

Level 3

in Education

kerkar

Level 3