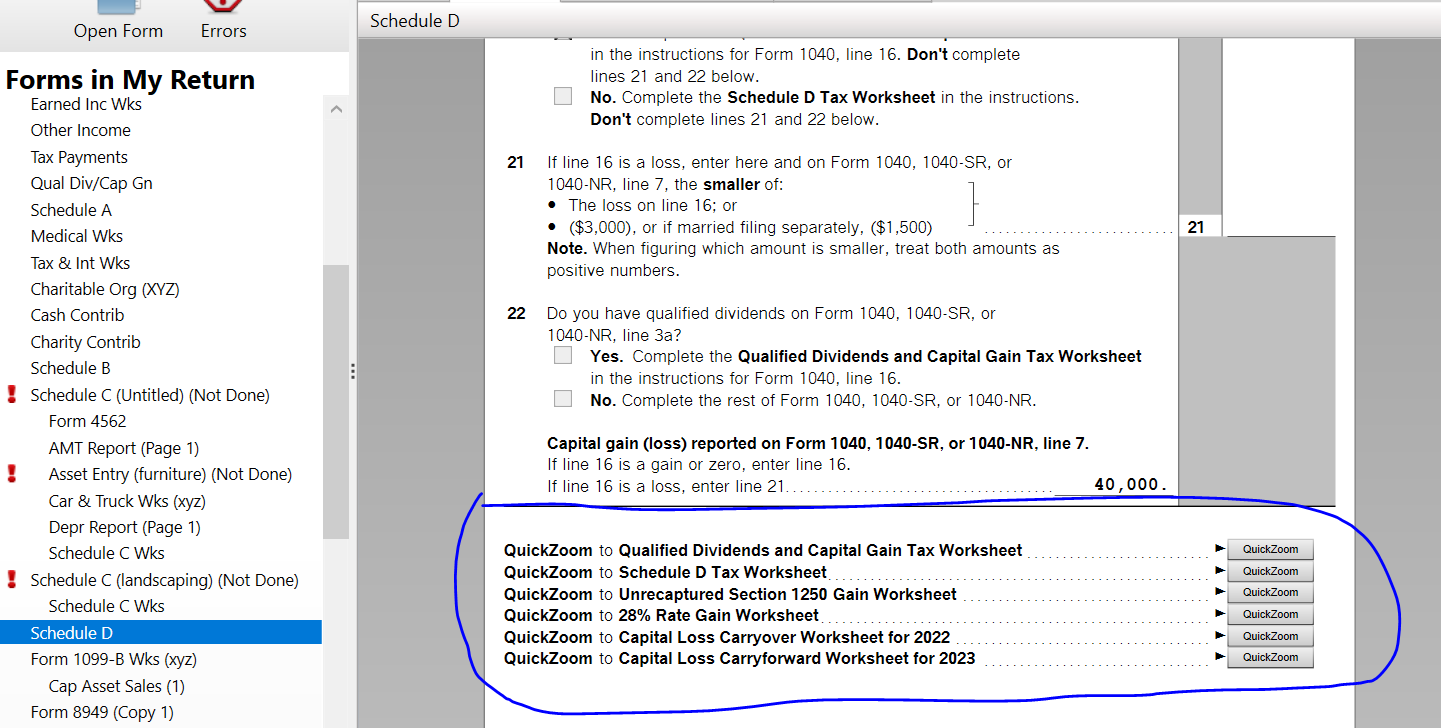

You may have capital gains distributions from your 1099b interest and dividend reporting. You may have capital loss carryovers from prior years In forms, go to the bottom of the Capital D summary worksheet like this

And quickzoom on each of the individual items on the bottom to see where the figures come from on that Sch D form.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"