- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Why does TT show a much lower amount for "other withholdings" than my W-2 shows? Medicare, social security

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TT show a much lower amount for "other withholdings" than my W-2 shows? Medicare, social security

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TT show a much lower amount for "other withholdings" than my W-2 shows? Medicare, social security

The amount in box 6 of the W-2 should be 1.45% of the amount in box 5 for Medicare taxes. Is the amount on your W-2 correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TT show a much lower amount for "other withholdings" than my W-2 shows? Medicare, social security

Additionally -

A 0.9% Additional Medicare Tax applies to Medicare wages, self-employment income, and railroad retirement (RRTA) compensation that exceed the following threshold amounts based on filing status: $250,000 for married filing jointly; $125,000 for married filing separately; and. $200,000 for all other taxpayers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TT show a much lower amount for "other withholdings" than my W-2 shows? Medicare, social security

The amounts calculated on my W-2 are fine. The issue is that Turbo Tax doesn't appear to be pulling in the right box 6 numbers when calculating how much I owe. I click "Taxes you've paid" and "Withholdings". The "Other withholdings" is an amount that is 1/3 of what we (combined with my wife's W-2) actually withheld during the year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TT show a much lower amount for "other withholdings" than my W-2 shows? Medicare, social security

W2 boxes 4 & 6 for Social Security and Medicare don't go on your return and don't affect your return. They are not part of withholding and taxes paid. So ignore them. If it says you owe the extra Medicare tax that is something else. That is based on other income like if you have a lot of investment income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TT show a much lower amount for "other withholdings" than my W-2 shows? Medicare, social security

Sorry, this not making sense to me yet. Box 6, for example, is referred to as Medicare tax withheld. My paychecks are lower as a result of these Medicare payments. I don't follow how that would not affect my return - should it not impact how much Medicare taxes I owe when filing? My last pay stub actually breaks out a Medicare "surtax".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TT show a much lower amount for "other withholdings" than my W-2 shows? Medicare, social security

Boxes 4 & 6 for Social Security and Medicare are mandatory taxes. They are not part of your withholding and you don't get credit for them on your tax return. If you owe the extra Medicare tax if you have a high income W2 box 6 still doesn't apply towards that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TT show a much lower amount for "other withholdings" than my W-2 shows? Medicare, social security

"Not part of your withholding" - but they represent a reduction from gross to net pay. How does this not impact the Medicare taxes that I owe at the end of the year? Not talking federal taxes, just Medicare taxes that I owe. Shouldn't the calculation just be 1.45% + 0.9% over 250k for joint filers?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TT show a much lower amount for "other withholdings" than my W-2 shows? Medicare, social security

The medicare taxes represent a reduction in gross to net pay for your paycheck and what goes in your pocket.

The medicare taxes do not reduce the amount of income that you have to pay income tax on, which is the amount that goes on your tax return. That amount is in box 1 of your W2 and how much medicare tax or social security tax you pay does not effect that amount.

Other than that you are absolutely correct about the medicare tax formula.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TT show a much lower amount for "other withholdings" than my W-2 shows? Medicare, social security

Thanks. The bottom line is that Turbo Tax is saying I owe the entire "additional Medicare tax" of 0.9% on filing, even though we withheld all of that (at least on a single filer basis for both me and my spouse) during the year. In actuality I believe we should only owe an additional $1,350 of additional Medicare tax (I ran different numbers and that seems to always be the answer regardless of income from going to single to joint; basically that is just (200 + 200 - 250) *0.9%). Again, my pay stub has a breakout that explicitly says "Medicare surtax", and I can replicate the calcs as 0.9% over 200k. So it seems like TT is not giving us credit for that in its calculations.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TT show a much lower amount for "other withholdings" than my W-2 shows? Medicare, social security

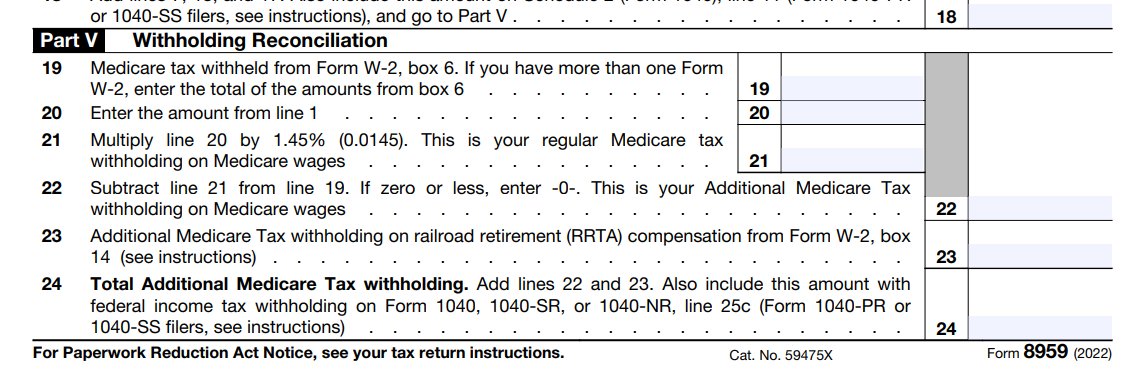

I went ahead and filled out form 8959 so that I can try and better understand what's happening. My row 24 is coming out exactly in line with what TT is classifying as "Other withholdings". I know this amount is for Additional Medicare Taxes... shouldn't line 7 be reduced by row what's in line 24 (which turns out to be exactly $1,350!)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TT show a much lower amount for "other withholdings" than my W-2 shows? Medicare, social security

Bump. Still not sure if I'm just mistaken or Turbo Tax is not accurately capturing the additional medicare tax I already paid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TT show a much lower amount for "other withholdings" than my W-2 shows? Medicare, social security

Your total medicare tax withholding on Form 8959 will be used to offset your total tax liability on Form 1040 24 since your total Tax Payments which include additional medicare tax on line 25c of Form 1040 are factored in when computing your remaining tax liability or refund.

Since Form 1040 has changed, it might be confusing to see where the amounts on Form 8959 flow to on your Form 1040.

Please review the below:

- The amounts on Form 8959 line 24 (screenshot below), will flow to Form 1040 line 25c (Other Forms) which is within the Tax Payments section.

- Line 7, Part 1, of Form 8959 shows the additional medicare tax on medicare wages which is multiplied by .9%.

- The sum of Part 1, Part 11, and Part 111 is totaled on line 18 (total additional medicare tax). This total flows to Schedule 2 (Additional Taxes)

- This total of all additional taxes on Schedule 2 will flow to Line 23, Other Taxes, and will increase your total tax liability on line 24 of Form 1040.

Working through Form 8959

Form 8959 consists of three parts. Each part includes a short calculation to figure out how much Additional Medicare Tax you owe if any. You complete only the part of the form that applies to the type of income you received. Fill out:

- Part I if you received W-2 income

- Part II if you received self-employment income

- Part III if you received RRTA

If you had more than one type of income, such as W-2 income and self-employment income, you will have to complete all sections that apply. Once you complete Form 8959 and figure out the total Additional Medicare Tax you're responsible for, the final section of the form subtracts the tax you paid through paycheck withholding as shown on your W-2. The result shows if there is any Additional Medicare Tax due—which ultimately gets reported on your 1040 form.

Review the screenshot below:

Review the information in the link below as well:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TT show a much lower amount for "other withholdings" than my W-2 shows? Medicare, social security

Thank you! Is there a way to see the filled out forms in Turbo Tax BEFORE I file? All I have is the payments estimated by TT and it looks wrong based on the math, however I can't confirm without reviewing the forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TT show a much lower amount for "other withholdings" than my W-2 shows? Medicare, social security

Yes, you can review your tax forms before you pay and before you file; however, TurboTax CD/download gives you more options than TurboTax online. If you are using TurboTax CD/download, you can switch to Forms mode (select Forms in the upper right of your screen) and in the left margin you can review all of the Forms associated with your return including Schedule 2 and Form 8959. Schedule 2, line 11 contains the additional Medicare tax.

If you are using TurboTax online, follow these steps to review the Forms available for preview before paying which is limited to Form 1040, and Schedules 1, 2, and 3, if applicable:

- Open or continue your return.

- Select Tax Tools in the left menu (if you don't see this, select the menu icon in the upper-left corner).

- With the Tax Tools menu open;

- Select Tools.

- Next, select View Tax Summary in the pop-up.

- Then Preview my 1040 in the left menu.

- To get back to the step-by-step instructions, just click Back in the left margin.

In TurboTax online, you won't be able to review Form 8959 until you pay.

You mentioned in a prior post that you believe you have already paid the entire additional Medicare tax. Box 6 on your W-2 includes the 1.45% Medicare tax withheld on all Medicare wages and tips shown in box 5, as well as the 0.9% Additional Medicare Tax on any of those Medicare wages and tips above $200,000. Thus, to make sure TurboTax has included all of your Medicare tax payments, if you have not already done so, just double check that your W-2 entry in TurboTax for box 6 matches what you have on your W-2. Moreover, Part V on Form 8959 is where you reconcile your Medicare tax withholding with any additional Medicare tax you may owe.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cdtucker629

New Member

dabbsj58

New Member

lewholt2

New Member

user17558684347

Level 1

g30anderson

New Member