- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Where do I enter the value of my IRAs for form 8606 line 6?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter the value of my IRAs for form 8606 line 6?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter the value of my IRAs for form 8606 line 6?

Assuming that you received a distribution from your traditional IRAs in 2023 and have entered a Form 1099-R that reports the distribution, click the Continue button on the page that lists the Forms 1099-R that you have entered and TurboTax will ask you to enter the year-end value.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter the value of my IRAs for form 8606 line 6?

Assuming that you received a distribution from your traditional IRAs in 2023 and have entered a Form 1099-R that reports the distribution, click the Continue button on the page that lists the Forms 1099-R that you have entered and TurboTax will ask you to enter the year-end value.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter the value of my IRAs for form 8606 line 6?

There is no screen to enter the value of my IRAs in the section where I entered my RMD . The screen in 2022 was in Deductions and Credits but it is not there this year. Only the screen for my basis in nondeductible IRA is in the Deductions and Credits section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter the value of my IRAs for form 8606 line 6?

Be sure that you checked the IRA/SEP/Simple box when you entered your Form 1099-R showing the distribution from your IRA. Then, as you go through the follow-up questions, you should see the question regarding the total value of all of your Traditional IRAs.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter the value of my IRAs for form 8606 line 6?

Thank you dmertz. I spent about 2 hours yesterday trying to get this information from TurboTax "tax experts". Their final recommendation was to buy a different version of TurboTax where I'd be able to get in through a forms view. I can't believe the solution was so simple. Please, please, please, if you have any clout with TurboTax, ask them to put your response as the number one solution to this question in their search box. Thank you again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter the value of my IRAs for form 8606 line 6?

It's a design feature of TurboTax to allow the user in step-by-step mode to jump from topic to topic at any time. Unfortunately, this allows users to misuse TurboTax by bypassing areas necessary to complete their tax return. If have asked for TurboTax to flag an error for a blank traditional IRA year-end-value entry when TurboTax is reporting a nonzero amount on line 7 or 8 of Form 8606, but that suggestion was ignored.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter the value of my IRAs for form 8606 line 6?

I have the same issue. Cannot find any question about the total value of traditional IRAs. Correct boxes are checked. TT does recognize my QMDs but nothing about total values. Suggestions welcome and needed!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter the value of my IRAs for form 8606 line 6?

The question will appear when you enter your 1099R information.

- Open or continue your return.

- In the Federal section, select Wages & Income.

- Scroll to locate Retirement Plans and Social Security.

- Select Start or Revisit next to IRA, 401(k), Pension Plan Withdrawals (1099-R)

- Or Social Security ( SSA 1099, RRB 1099)

- make sure you check the box in the 1099R indicating this is a distribution from an IRA.

- After the information has been entered on the 1099R, you will answer questions that follow. there will be a question asking you if you made non-deductible contributions to the IRA.

- Here say yes and then the next screen asks what the basis is as of Dec 31,2022

- After this question is answered, the next screen will allow you to enter the value of your IRA 12/31/2023.

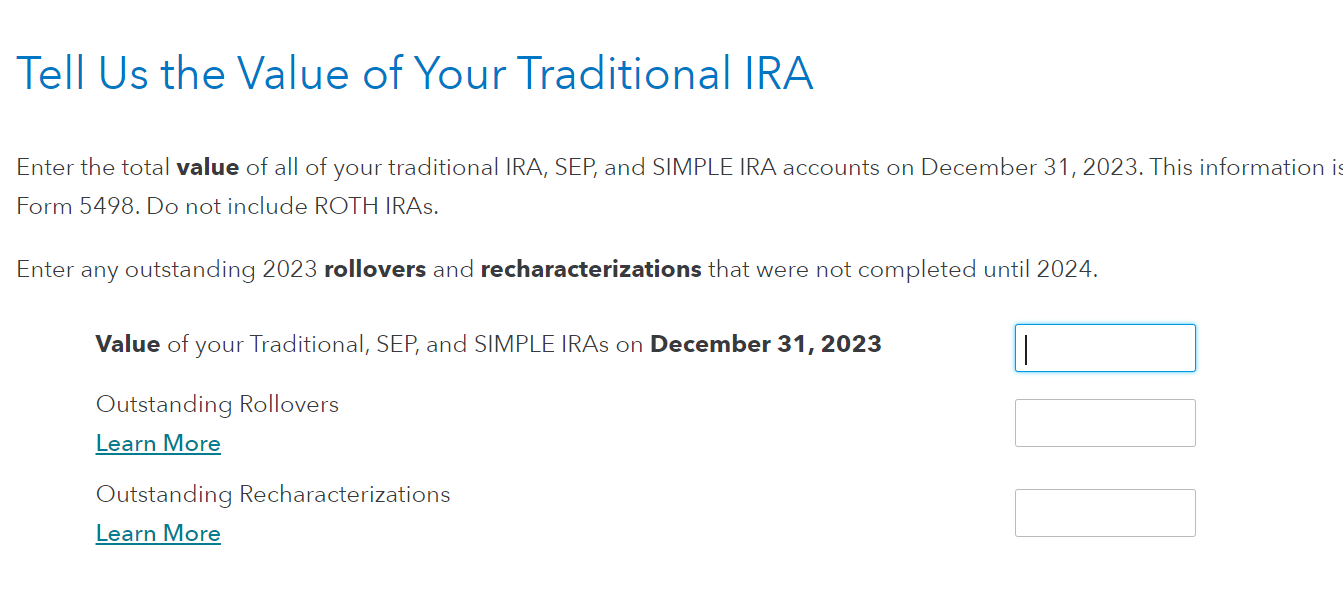

- Here is what the screens should look like. Just remember to check the Box in the 1099R entry indicating this is an IRA.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter the value of my IRAs for form 8606 line 6?

DaveF1006: Thank you for taking the time to walk everyone through this!

I have always had exactly the same issue. All of the things happen exactly as you describe (at least the first time through), and yet Line 6 of Form 8606 is not filled in. It has been this way for at least 5 years in ttax desktop. I always just plug it in in Forms view.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter the value of my IRAs for form 8606 line 6?

I see this response from a year ago for TT 2023. I'm trying to enter the end of year value of my spouse's trad IRAs and I don't get the same Q&A boxes asking for basis and value of IRAs, did something change between TT 2023 and TT 2024?

Solved: After going back and revisiting the 1099-R inputs and exploring the path "that some or all was converted to a ROTH" and then selected "didn't convert any of the money" ......... this must have re-trigger TT to ask the above questions about basis and value of IRAs on 12/31/2024. All is well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter the value of my IRAs for form 8606 line 6?

No, the basis and value question still comes up at the end of the retirement income interview. Please verify, that your Form 1099-R entry has the IRA/SEP/SIMPLE box checked:

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Click "Continue" and enter the information from your 1099-R and verify the IRA/SEP/SIMPLE box is checked

- On the "Here's your 1099-R info" screen click "Continue"

- Answer "Yes" to "Any nondeductible Contributions to your IRA?" if you had any nondeductible contributions in prior years.

- Answer the questions about the basis from line 14 of your last filed Form 8606 and the value of all traditional, SEP, and SIMPLE IRAs

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

curtis-sawin

New Member

TaxesForGetSmart

New Member

ddm_25

Level 1

levind01

New Member

driverxxv

New Member