- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

The question will appear when you enter your 1099R information.

- Open or continue your return.

- In the Federal section, select Wages & Income.

- Scroll to locate Retirement Plans and Social Security.

- Select Start or Revisit next to IRA, 401(k), Pension Plan Withdrawals (1099-R)

- Or Social Security ( SSA 1099, RRB 1099)

- make sure you check the box in the 1099R indicating this is a distribution from an IRA.

- After the information has been entered on the 1099R, you will answer questions that follow. there will be a question asking you if you made non-deductible contributions to the IRA.

- Here say yes and then the next screen asks what the basis is as of Dec 31,2022

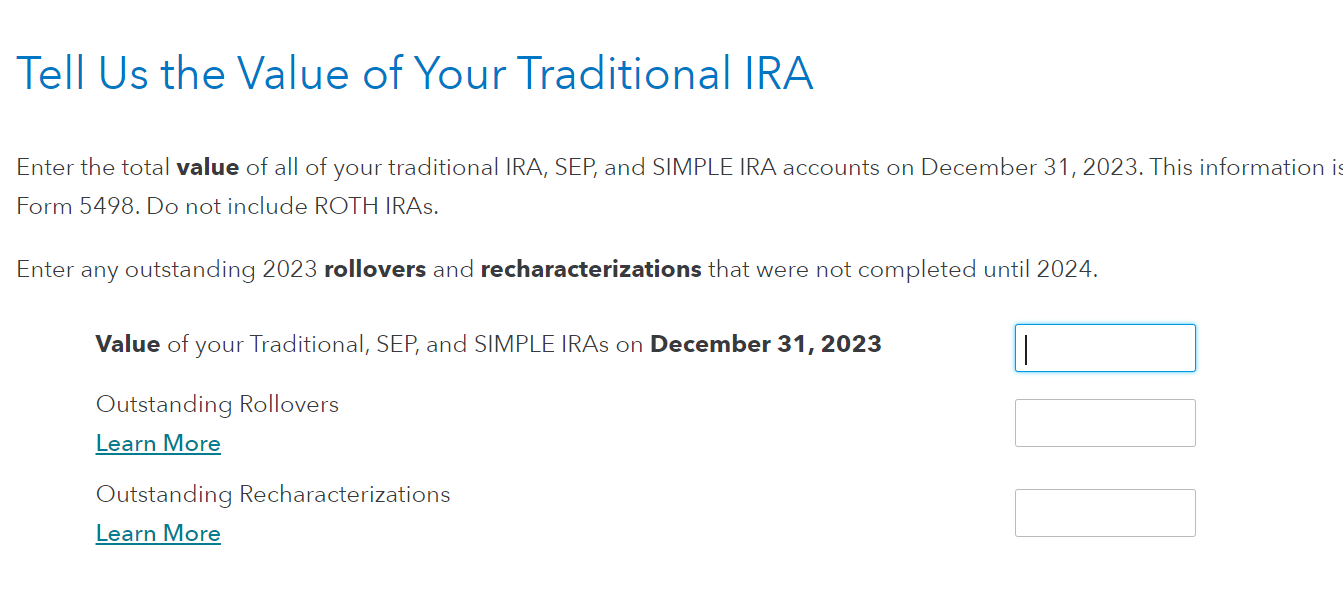

- After this question is answered, the next screen will allow you to enter the value of your IRA 12/31/2023.

- Here is what the screens should look like. Just remember to check the Box in the 1099R entry indicating this is an IRA.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 4, 2024

2:27 PM