- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- RMD from Pension does that cover RMD from IRA?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RMD from Pension does that cover RMD from IRA?

I get a RMD from my pension paid monthly. I also have IRA's. Does the amount I get from my pension cover what I have to take out of my IRA's?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RMD from Pension does that cover RMD from IRA?

No. For purposes of satisfying the IRA required minimum distribution rules, only distributions from IRAs count. Your pensions payments are irrelevant in this matter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RMD from Pension does that cover RMD from IRA?

No. For purposes of satisfying the IRA required minimum distribution rules, only distributions from IRAs count. Your pensions payments are irrelevant in this matter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RMD from Pension does that cover RMD from IRA?

I had a missed RMD from an IRA. How do I enter this information in the Turbo Tax software?

In addition, I had two pensions. Are they considered RMDs? I receive monthly payments from these pensions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RMD from Pension does that cover RMD from IRA?

@pipta7-97 wrote:

I had a missed RMD from an IRA. How do I enter this information in the Turbo Tax software?

In addition, I had two pensions. Are they considered RMDs? I receive monthly payments from these pensions.

Yes, pensions are RMDs. The total amount of monthly payments *is* the RMD.

First, take the missed IRA RMD ASAP so you can tell the IRS that is was taken late.

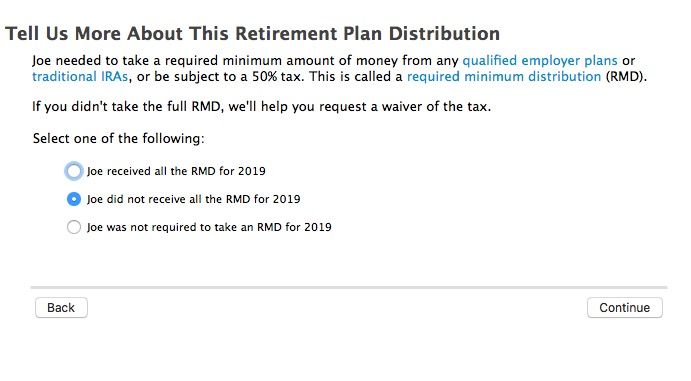

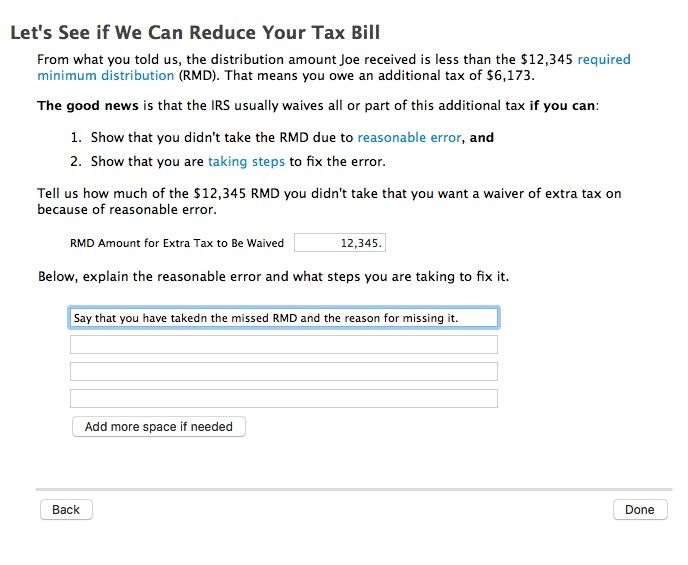

When entering the 1099-R for the pension, continue the interview after the 1099-R summary screen and it will ask if all RMD's were taken - say no.

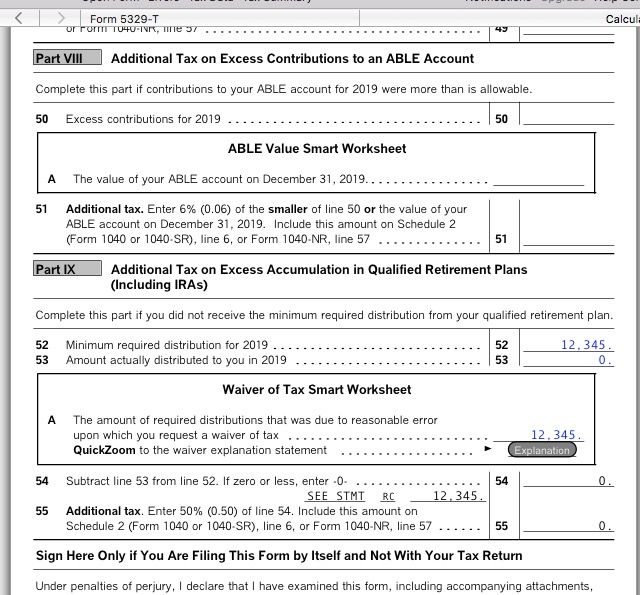

See example on screenshots below.

That will add a 5329 form with a penalty waiver request that the IRA almost never denies if the missed RMD was taken.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Mikes20222022

New Member

CzarSosa

Level 2

rcepuch

Level 2

TugBoatBaby

Level 1

KTolly

New Member