- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

@pipta7-97 wrote:

I had a missed RMD from an IRA. How do I enter this information in the Turbo Tax software?

In addition, I had two pensions. Are they considered RMDs? I receive monthly payments from these pensions.

Yes, pensions are RMDs. The total amount of monthly payments *is* the RMD.

First, take the missed IRA RMD ASAP so you can tell the IRS that is was taken late.

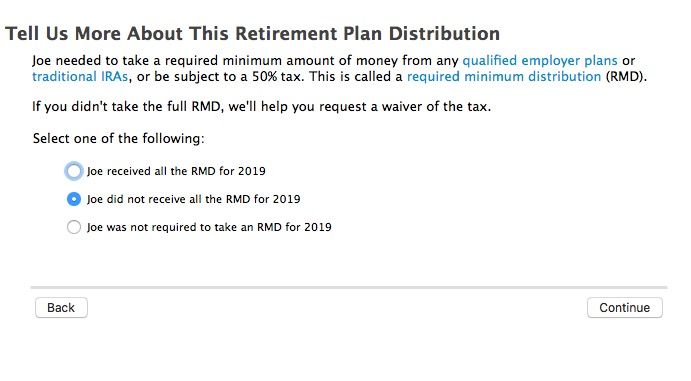

When entering the 1099-R for the pension, continue the interview after the 1099-R summary screen and it will ask if all RMD's were taken - say no.

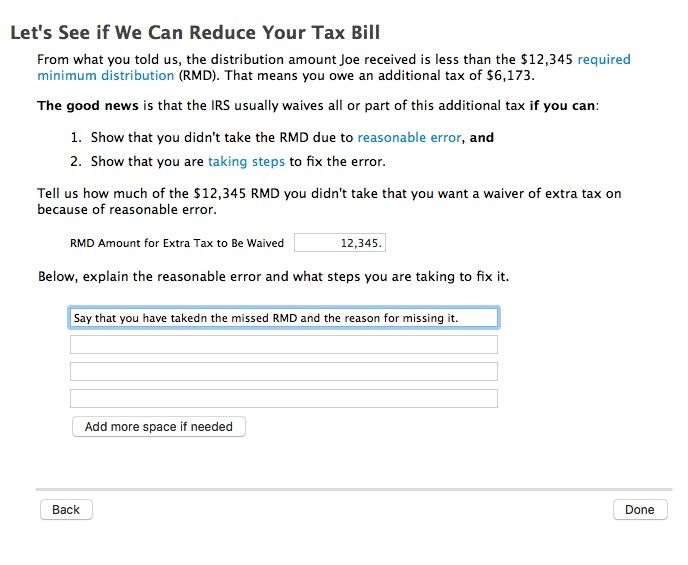

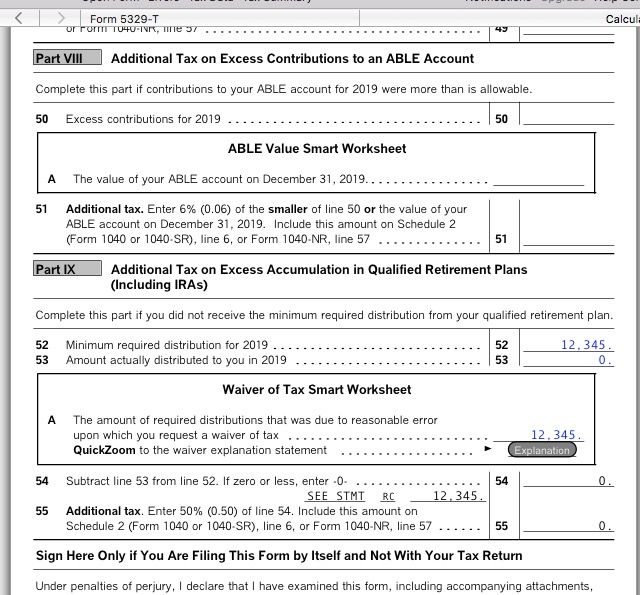

See example on screenshots below.

That will add a 5329 form with a penalty waiver request that the IRA almost never denies if the missed RMD was taken.

**Disclaimer: This post is for discussion purposes only and is NOT tax advice. The author takes no responsibility for the accuracy of any information in this post.**

March 8, 2020

1:52 PM