- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Where do I post my Bailey’s settlement

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I post my Bailey’s settlement

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I post my Bailey’s settlement

If you received a 1099-R for this settlement then the information on that form belongs in the retirement section of Turbo Tax. This link explains where to put the 1099-R information into Turbo Tax.

Here is a link to more information about the settlement and how to report for North Carolina state taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I post my Bailey’s settlement

I am eligable for Baikley Settlement deduction in NC. The 2019 tubutax program indicated that a question concerning the deduction would be coming, but it never did. The state return D-400 Sch S line 10 for the Bailey settlement come out as $0. Where do I enter it in the program?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I post my Bailey’s settlement

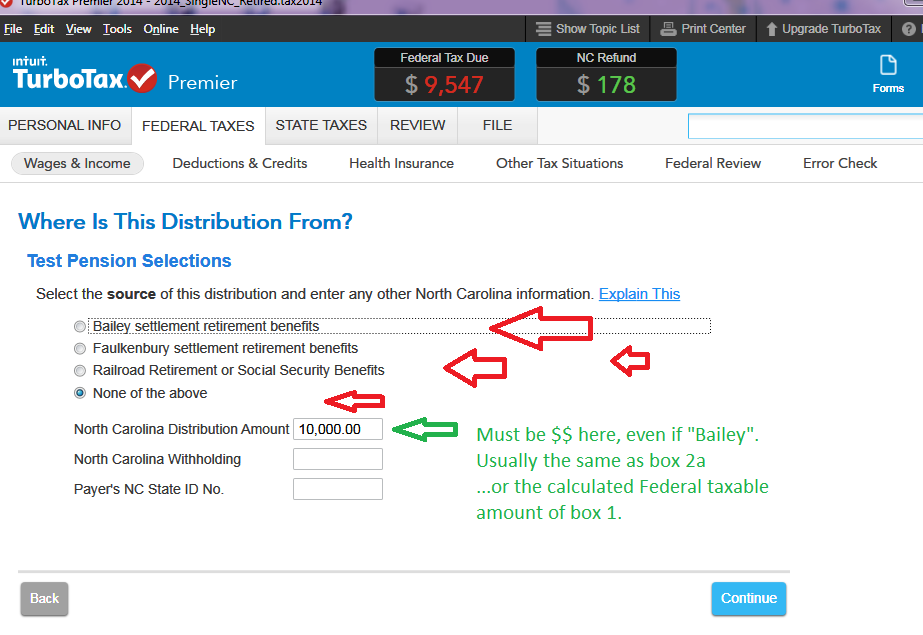

The Bailey Settlement information is all in the Federal Interview when entering 1099-R information.

1. Click on Federal in the left hand menu

2. Click"Income & Expenses" at the top of the page

3. Scroll down the to the "IRA, 401K, pensions" section

4. Click on Edit/Add

5. Find the applicable 1099-R and Edit

6. Be sure "NC" is in the "state ID box"

7. Be sure to click the box for Bailey Settlement when asked and complete the applicable information

In addition be sure in the "My info" section you have indicated ''former military".

1. Click "My Info" in left hand menu

2. Edit your information

3. Answer "Yes" to "Military" question

4. Select "former Military"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I post my Bailey’s settlement

Also, be careful in the followup page where you enter the 1099-R form...the NC distribution amount is not a zero for a Bailey settlement 1099-R or CSA-1099-R. If you enter a zero for the NC Distribution Amount, then zero will be deducted from NC income.

__________________________

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

NCSS

New Member

Beezo1951

New Member

LJS5

Level 1

mlrancourt

New Member

jholden122

Returning Member