- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Where do I enter income taxes already paid when I took a RMD in 2021?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter income taxes already paid when I took a RMD in 2021?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter income taxes already paid when I took a RMD in 2021?

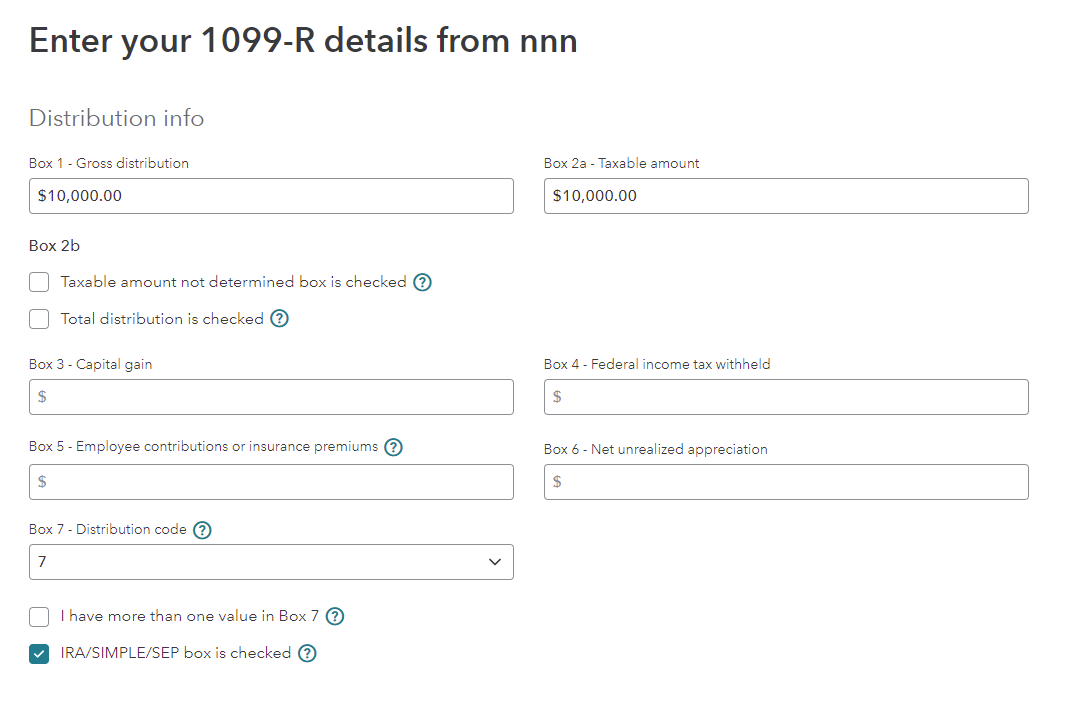

Taxes withheld on your RMD are reported on box 4 (for Federal tax) and box 14 (for state tax).

When entering your form 1099-R in TurboTax, you can enter the amount of tax withheld in the appropriate boxes of the entry form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter income taxes already paid when I took a RMD in 2021?

Where do I find the "appropriate boxes" so I can enter the taxes withheld when I took a RMD?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter income taxes already paid when I took a RMD in 2021?

Are you asking about the screen in the program? The answer is still Box 4.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter income taxes already paid when I took a RMD in 2021?

I know what the taxes withheld were because I can see the amount on my 1099 Form. Box 4. I need to know where these numbers are on my Turbotax form that I am attempting to fill in. Should these amounts appear on Line 26b and 26c of my tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter income taxes already paid when I took a RMD in 2021?

@bluenose41 wrote:

I know what the taxes withheld were because I can see the amount on my 1099 Form. Box 4. I need to know where these numbers are on my Turbotax form that I am attempting to fill in. Should these amounts appear on Line 26b and 26c of my tax return?

Federal income taxes withheld from the Form 1099-R will be included on the Form 1040 Line 25b

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter income taxes already paid when I took a RMD in 2021?

I have the same problem !! I have turbotax premier. I entered the RMD withholding for Federal, but for State - I could not find the location (turbotax did not ask) to enter the "State Tax Withheld" (line14).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter income taxes already paid when I took a RMD in 2021?

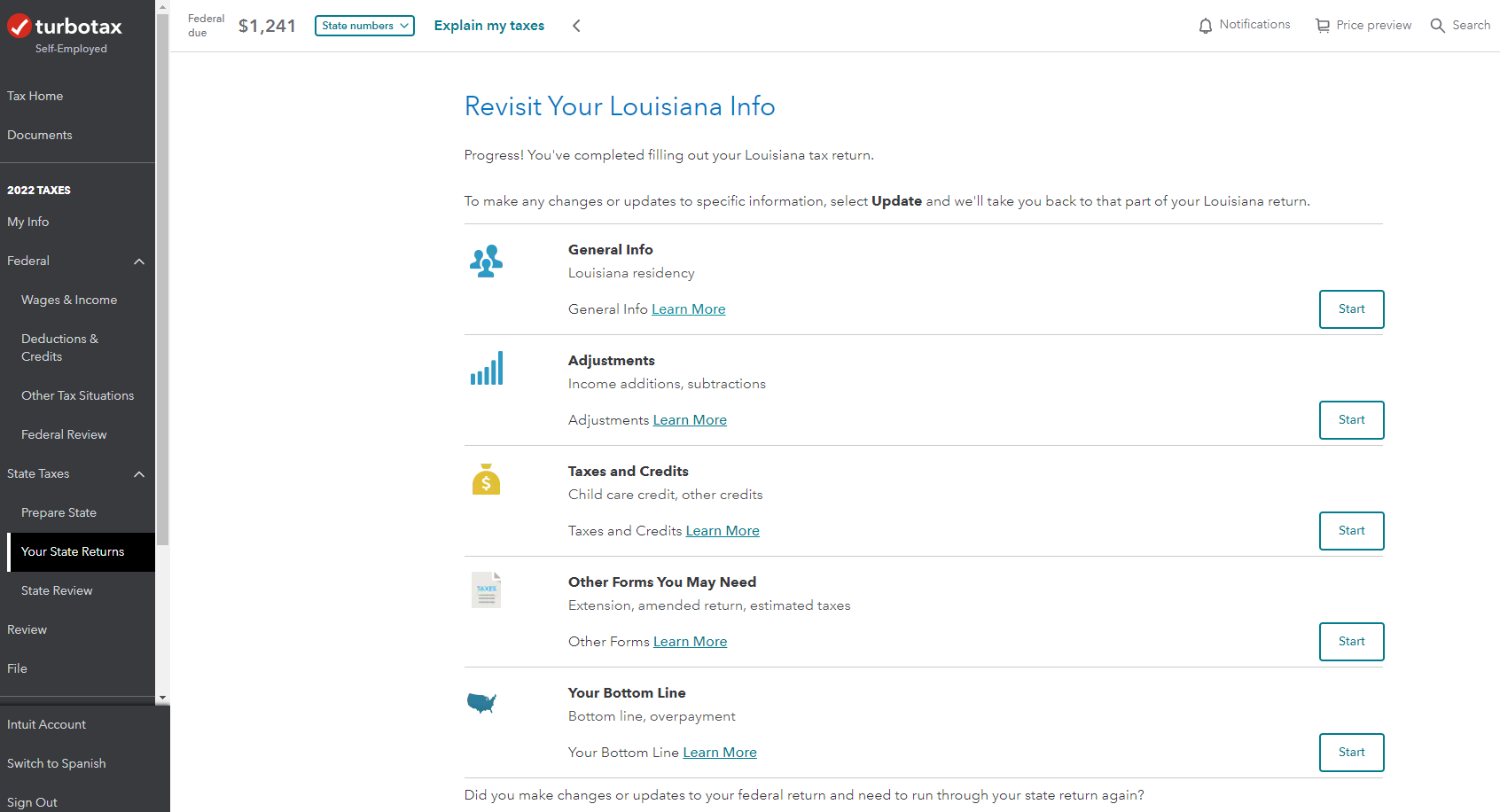

Enter your 1099-R as issued in your Federal return. If you had State Tax withheld on your distribution, the amount would be in Box 14. This will flow into your State return.

Many people don't have any State Tax withheld on a Retirement Distribution, if they know their state does not tax such distributions.

When you are in your State interview, you may see that the amount was automatically excluded from State Income, or you may need to indicate in the Adjustments area that it is non-taxable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kim-gundler

New Member

Tsmooth2494

New Member

Tsmooth2494

New Member

jacelynwillis

New Member

April-Wren

New Member