- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Enter your 1099-R as issued in your Federal return. If you had State Tax withheld on your distribution, the amount would be in Box 14. This will flow into your State return.

Many people don't have any State Tax withheld on a Retirement Distribution, if they know their state does not tax such distributions.

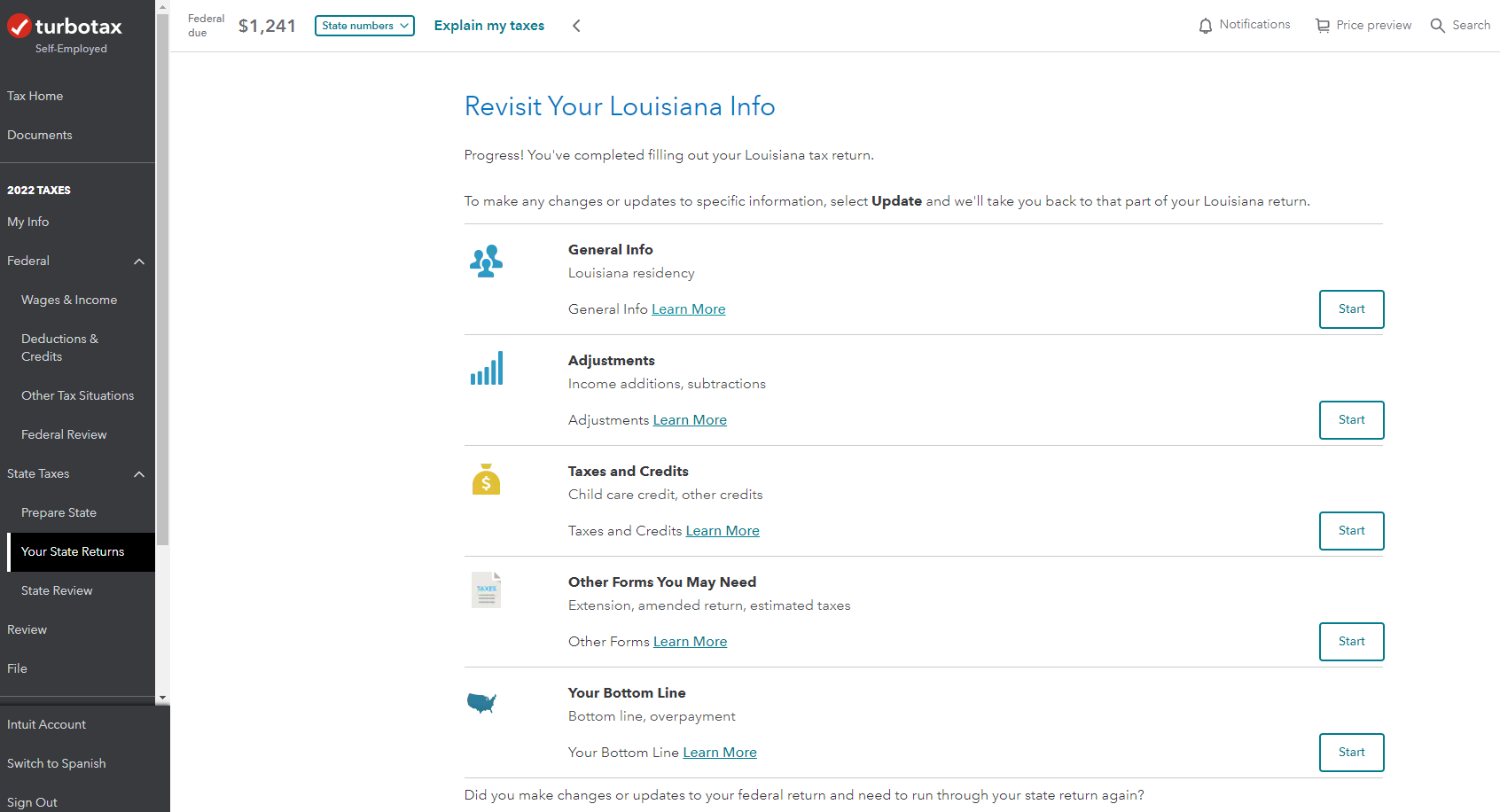

When you are in your State interview, you may see that the amount was automatically excluded from State Income, or you may need to indicate in the Adjustments area that it is non-taxable.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 28, 2023

5:29 PM