- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: What figure should be entered into "total 5% income", total income that you're being taxed 5%...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure should be entered into "total 5% income", total income that you're being taxed 5% on or 5% of your income?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure should be entered into "total 5% income", total income that you're being taxed 5% on or 5% of your income?

Is this for Massachusetts or another state? And is this a question in the interview or what? Please give us some context.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure should be entered into "total 5% income", total income that you're being taxed 5% on or 5% of your income?

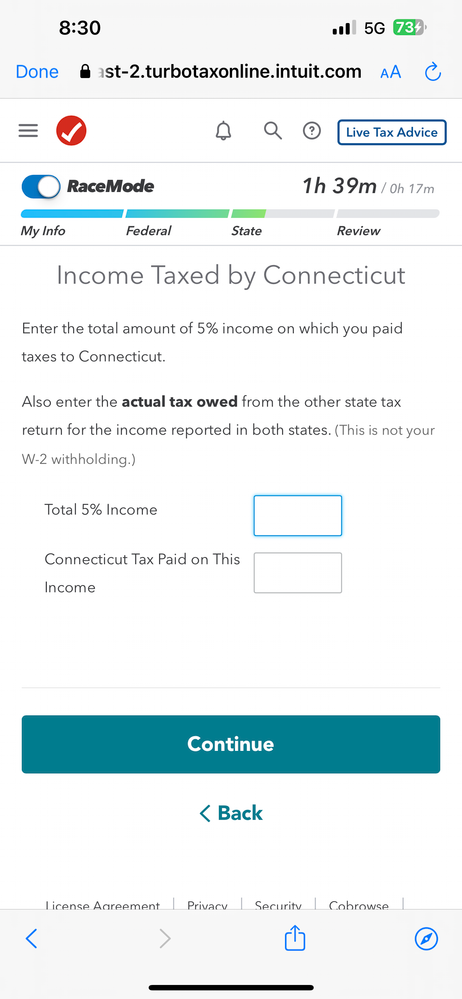

I live in mass and work in. CT. When figuring out the state credit for paying the other taxes, is where

I’m lost. It says “enter total 5% income and then below it is says taxes Connecticut taxes paid

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure should be entered into "total 5% income", total income that you're being taxed 5% on or 5% of your income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure should be entered into "total 5% income", total income that you're being taxed 5% on or 5% of your income?

Enter the total amount of income that CT taxed that is also taxed in MA. MA taxes earned income (salaries, wages, tips, commissions) and unearned (interest, dividends, and capital gains) income at 5%. That income is called "5% income" because that is the rate it is taxed at.

In the second box you will enter what the CT tax on that income from the nonresident CT return actually is. This number is not necessarily the withholding or what is owed at filing. It is the "Total Tax" line the "CT Tax Summary" found in online versions using these steps. If you are looking at the actual CT forms it is line 16 on the CT form 1040NRPY.

1. Select "Tax Tools" in the left hand menu

2. Select "Tools"

3. Select "View Tax Summary"

4. Select "Preview My 1040" in the left hand menu

5. select "CT Tax Summary"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure should be entered into "total 5% income", total income that you're being taxed 5% on or 5% of your income?

It asks for the total amount of 5% income on which taxes were paid to CT. Isn't this what is listed on the W-2 from CT? If not, where do we get that figure from? Is it Line 11 of our Federal 1040 which is also Line 1 of the CT-1040 NR/PY?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure should be entered into "total 5% income", total income that you're being taxed 5% on or 5% of your income?

This number is not necessarily the withholding. See Line 7 of CT 1040NRPY for the amount to enter in the first box (5% income)

The second box is the "Total Tax" line of the CT Tax Summary. If you are looking at the actual CT forms, it is line 16 on the CT form 1040NRPY. @attackmom

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure should be entered into "total 5% income", total income that you're being taxed 5% on or 5% of your income?

Thanks but that is not the question I asked. I know how to get the "CT tax paid on this income". What I asked was the following....

The MA return asks for the total amount of 5% income on which taxes were paid to CT. Isn't this the wages that are listed on the W-2 from CT? If not, where do we get that figure from? Is it Line 11 of our Federal 1040 which is also Line 1 of the CT-1040 NR/PY?

For example, I did a Roth conversion this year. No taxes were paid to CT on that. Where exactly do we get that figure from? Please do not answer if you do not know the answer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure should be entered into "total 5% income", total income that you're being taxed 5% on or 5% of your income?

SO IT IS LINE 7 OF THE CT NR/PY FORM THAT WE ENTER? WHICH IS ALSO LINE 11 OF THE FEDERAL 1040 AND LINE 1 OF THE CT NR/PY FORM?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure should be entered into "total 5% income", total income that you're being taxed 5% on or 5% of your income?

We do not know your situation so I will tell you what is needed. Clearly you made money in both CT and MA. I am assuming that you live in MA and want a credit for the income that is being double taxed by CT. If you simply worked in CT, then your w2 wages are the answer. If you have other CT income, like a rental house, add that CT income.

MA taxes earned income (salaries, wages, tips, commissions) and unearned (interest, dividends, etc) income at 5% with some exceptions to capital gains on page 12. See 2023 Form 1 Instructions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure should be entered into "total 5% income", total income that you're being taxed 5% on or 5% of your income?

I am on the question in Turbotax for Massachusetts state filing, Income Taxed by Rhode Island. I live in Massachusetts and worked in RI during 2024. There are 2 questions on the form:

Income Taxed by Rhode Island

Enter the total amount of 5% income on which you paid taxes to RI

Also enter the actual tax owed from the other state tax return for the income reported in both states. (this is not your w-2 withholding)

Total 5% Income ________________

Rhode Island Tax Paid on this Income_________________________

1. Is Total 5% Income total income from RI or combination of RI and MA(wages,salaries). OR is this the total income to be taxed on after deductions and exemptions on RI form. Example: Line one of the state form, salary wages from fed form is $70000. After exemptions and standard deductions the RI taxable income on line 7(RI form) is $30000. Is one of these amounts what I put for 'total 5% income'?

2. RI Tax Paid on the income - Is this the actual amount I paid to RI or what I actually owe them. Example I paid $150 in state taxes but after filling out the RI 1040NR form I do not owe RI anything and will be getting a refund. So what goes in this box $150 or $0?

Thanks,

Donna

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure should be entered into "total 5% income", total income that you're being taxed 5% on or 5% of your income?

Just realized I posted this question under taxes > retirement, should this be reposted under taxes > state taxes?

Thanks Donna

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure should be entered into "total 5% income", total income that you're being taxed 5% on or 5% of your income?

As an additional piece of information to my above post, I file married filing jointly. My wife works in Mass and I work in RI. So wages, salaries, etc is a combo of both our incomes. Does that matter in filing the RI 1040NR or filing out response to the 2 questions in turbo tax, 5% income and total tax for the RI credit? Trying to include as much information as possible.

Thanks,

Donna

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure should be entered into "total 5% income", total income that you're being taxed 5% on or 5% of your income?

1. Worked in RI, that is all of your RI income, enter wages. But you said not paying tax on it which means zero taxable income.

2 .The tax liability. Look at your RI return to find the tax liability. You said no tax, so no tax liability.

3. Normally, you work in RI and pay taxes to get the credit in MA. Perhaps it is a new job and you are below the income level to be taxed.

You won't get a credit on MA when you had no tax elsewhere.

MA taxes earned income (salaries, wages, tips, commissions) and unearned (interest, dividends, etc) income at 5% with some exceptions to capital gains on page 12. See 2024 Form 1 Instructions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure should be entered into "total 5% income", total income that you're being taxed 5% on or 5% of your income?

Thank you for your quick response.

My husband did pay taxes for work in RI, approximately $150. After filling out the RI 1040NR form it shows that he will owe no taxes an receive the $150 back as a refund. So you are saying because of this we will not get any credit thru MA because we didn't pay anything to RI. So the questions in the interview of turbotax are for the worksheet purposes, the form on the mass 1040 tax credit line will be 0.

But just to understand for the future what numbers should go into those 2 interview questions?

1. 5% income, is this just the RI income? Or the combined RI and MA income minus deductions and exemptions on the RI 1040nr form which includes husband and wife incomes since filing jointly.

2. Is the question 'RI tax paid on this income' the amount of tax we are liable to pay to RI? My husband did pay $150 in taxes but after filling out the form it shows he is not liable to pay anything. So what would go in this box for the turbotax question, $0 or $150

Thank you,

Donna

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kac42

Level 1

steve-knoll

New Member

SB2013

Level 2

hojosverdes64

New Member

in Education

Propeller2127

New Member