- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: What does this error mrean "Box 20 Code Z has been selected but no Section 199A income has be...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this error mrean "Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A" ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this error mrean "Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A" ?

Code Z on a partnership in box 20, represents sec 199A self employed information. Those are achieved through your active work in the business, rather than being a passive partner. Do you have anything in box 14, for the self employed income? Are you an active partner?

The statement A is derived from the other information in your k1- which seems to not be there.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this error mrean "Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A" ?

Revisit the Schedule K-1 section of TurboTax and edit the Schedule K-1, then be sure to step all the way through. When you select code Z in box 20, leave the Enter Amount box blank and step past the We see you have Section 199A income to where TurboTax will ask for the types of code Z entries related to the Qualified Business Income from the partnership shown on the code Z statement included with your Schedule K-1. After you make the dollar-amount entries for each of these, TurboTax will automatically prepare the missing statement.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this error mrean "Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A" ?

Nothing in Box 14

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this error mrean "Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A" ?

I did leave that "Z: field blank and it did not work. I actually was told to change the Z to a "AH" and that worked. wether it is correct or not I do not know

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this error mrean "Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A" ?

That is an acceptable solution, The code you entered doesn't change your tax return and doesn't require additional information to be entered.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this error mrean "Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A" ?

I'm trying to enter Box 20 Code Z information into the tax return of an LLC owner of the LLC which submitted the K-1 that (properly) includes Box 20 Z information (and an accompanying Statement A). In TTX Business, on the Box 20 screen there's a box to check if Box 20 contains Code Z. I check that box, click continue, and instead of sending me to a screen to enter Statement A information, TTX kicks me back to the K-1 list. Bug?? How to report??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this error mrean "Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A" ?

I am lost here with the same problem. I have a K1 for which there are no entries in any box except for box 20. In Box 20 code Z, it says STMT. In the Statement, everything is mostly 0, but I see an entry "SECTION 199A UBIA OF QUALIFIED PROPERTY" with a value of 1. Is this just too small to bother reporting? I think this is wanting there to have been some actual income, but there is none to report on this K1... As such, I'm stuck in a state where TurboTax thinks I have an error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this error mrean "Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A" ?

Follow these steps and i shall lead you out of the abyss and into the light:

Here is the order that should appear in your return in Box 20

- if there is a Z, select Z in the drop down and leave the $ blank.

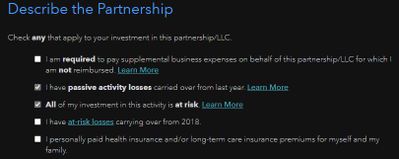

- Next screen asks about the risk. indicate you are at risk

- Then there will be a screen that appears that says, We see that you have 199A income.Here you have three choices to make. pick one that is applicable to you.

- Next screen will say we need some information about your 199A income. at the very bottom is a selection that says xxx has UBIA of qualified property. When you select that, then the screen will prompt you to put in a $ amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this error mrean "Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A" ?

I have followed those steps but get am still getting the same problem. I cannot currently Efile. I've provided screenshots. Either the steps provided are not correct or there is a bug in the turbotax software that should be addressed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this error mrean "Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A" ?

TurboTax is indicating that you have not entered any items of Qualified Business Income. UBIA is not QBI. You need to indicate items of income by marking one or more of the other boxes on the last page and entering the corresponding items of income such as business income from the boxes on the K-1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this error mrean "Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A" ?

There are no other numbers on the K-1. There is a code AA with $1 but nothing else on the rest of the K-1. Boxes 1-3 are empty and the only Z code with an amount in UBIA of qualified property with $12 as i had input in the screenshot. I've doing Box 2 = $0 but that did not work either.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this error mrean "Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A" ?

You might have to simply omit the code Z entry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this error mrean "Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A" ?

I had the same question and was very thankful for your answer. It worked!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this error mrean "Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A" ?

So thankful for your explanation. It worked!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rtoler

Returning Member

SB2013

Level 2

ilenearg

Level 2

basedday

New Member

astan2450

New Member