- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: TurboTax Bug Related to 401k Excess Deferral

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Bug Related to 401k Excess Deferral

In 2019 I withdrew excess funds from my 401k because of over funding in 2018. I accounted for the full deferral on my taxes last year.

I have a 2019 1099-R. I lost $220 in value when removing these excess funds from my 401k. For some reason TurboTax keeps saying that I have reported gains and will need to amend last year's taxes. Is this a bug and/or default message users always get?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Bug Related to 401k Excess Deferral

On my 2018 Taxes I created a 1099-R as I did not have actual one, coded excess withdrawal as P, and used the full deferral amount.

On my 2019 Taxes I coded the 1099-R as P using the amounts listed on the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Bug Related to 401k Excess Deferral

@brandonpearman wrote:

In 2019 I withdrew excess funds from my 401k because of over funding in 2018. I accounted for the full deferral on my taxes last year.

I have a 2019 1099-R. I lost $220 in value when removing these excess funds from my 401k. For some reason TurboTax keeps saying that I have reported gains and will need to amend last year's taxes. Is this a bug and/or default message users always get?

For 2018 you enter the 1099-R with the code P. The box 1 amount will be added to your wages (you say that yiu already did that for 2018) . If the box 2a is a negative number (a loss) then you enter that this way per the IRS. You enter that the loss on your 2019 tax return if the excess was returned in 2019.

If you reported the returned contribution in 2018 as wages and you had a loss the IRS instructions say to:

[quote]

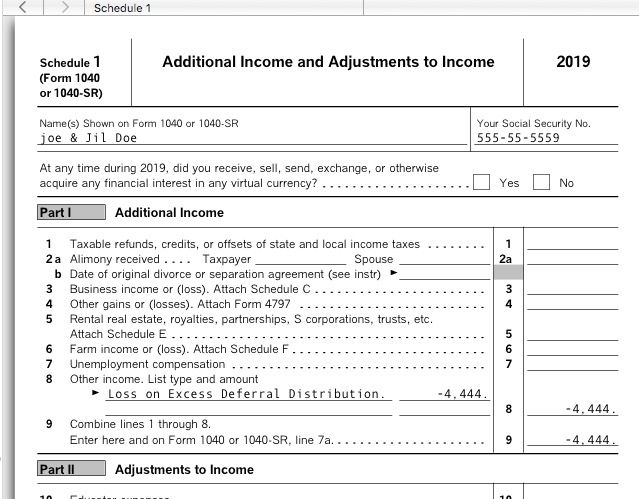

Report a loss on a corrective distribution of an excess deferral in the year the excess amount (reduced by the loss) is distributed to you. Include the loss as a negative amount on Schedule 1 (Form 1040 or 1040-SR), line 8, and identify it as “Loss on Excess Deferral Distribution.”

[end quote]

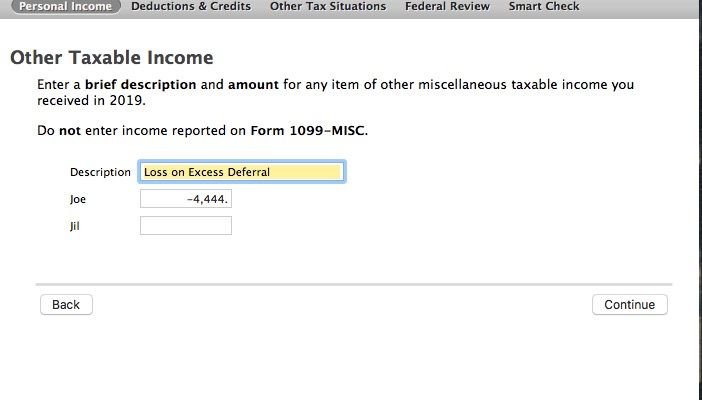

Enter it under Income -> Less Common Income -> Miscellaneous Income -> Other Reportable Income, and enter it a a negative number (-1234) and add a description . That will put it on schedule 1, line 8.

For information see IRS Pub 525 page 10

https://www.irs.gov/pub/irs-pdf/p525.pdf

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17558059681

New Member

mulleryi

Level 2

mulleryi

Level 2

gtchen66

Level 2

johntheretiree

Level 2