- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: The 1099 G for Maryland has boxes 1-5, but the form on turbotax shows only Box 1, 4, 10a, 10b...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 G for Maryland has boxes 1-5, but the form on turbotax shows only Box 1, 4, 10a, 10b, 11. The number for federal tax is also the wrong box number what can I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 G for Maryland has boxes 1-5, but the form on turbotax shows only Box 1, 4, 10a, 10b, 11. The number for federal tax is also the wrong box number what can I do?

Yes, the form 1099-G has many boxes. The different parts of it are used in different sections of TurboTax. You may not see all the box numbers in TurboTax each time a part of it is used in a section of the return. The federal tax withheld should be for box 4 unless it is a different tax year form or a substitute form that does not match the box #s. If it is a substitute form, but still for 2020, you can enter the federal withholding in the box labeled federal taxes withheld.

Since your 1099-G issued by Maryland only contains boxes 1-5, then it does contain the boxes applicable to reporting state unemployment compensation or a taxable prior year MD refund received.

For example, box 1 and 4 and 10a-11 would be used in the unemployment section of the return.

Boxes 2 and 3 would be used for reporting a taxable MD state refund.

Please review again the box for federal withholding. It should be box 4 unless the tax reporting document is for a different year return or is a substitute form.

Be sure you are using a 2020 tax reporting document for a 2020 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 G for Maryland has boxes 1-5, but the form on turbotax shows only Box 1, 4, 10a, 10b, 11. The number for federal tax is also the wrong box number what can I do?

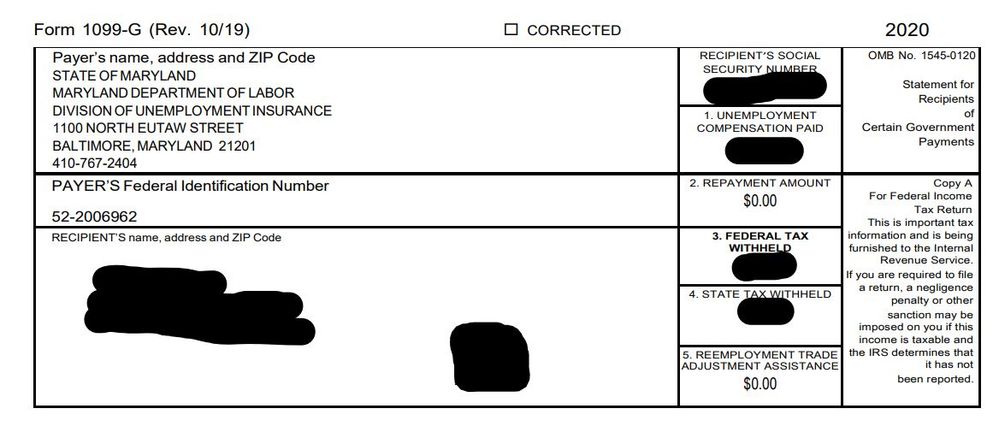

It's a 2020 - 1099-G directly downloaded from the MD unemployment site account. Box 3 is Federal Tax Withheld; Box 4 is State Tax Withheld. Not a substitute form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 G for Maryland has boxes 1-5, but the form on turbotax shows only Box 1, 4, 10a, 10b, 11. The number for federal tax is also the wrong box number what can I do?

It's not unusual for states to develop their own Form 1099-G to report unemployment benefits. To enter your form in TurboTax:

- Enter Box 3 on your MD 1099-G, Federal Tax Withheld, into Box 4 on the TurboTax entry screen.

- Enter Box 4 on your MD 1099-G, State Tax Withheld into Box 11 on the TurboTax entry screen.

See screenshot below:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 G for Maryland has boxes 1-5, but the form on turbotax shows only Box 1, 4, 10a, 10b, 11. The number for federal tax is also the wrong box number what can I do?

I believe the main issue is what do we put for box 10b as the states identification number?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 G for Maryland has boxes 1-5, but the form on turbotax shows only Box 1, 4, 10a, 10b, 11. The number for federal tax is also the wrong box number what can I do?

lol they filled out everything but that, but just decided not to comment on 10b being nonexistent on the 1099-G.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 G for Maryland has boxes 1-5, but the form on turbotax shows only Box 1, 4, 10a, 10b, 11. The number for federal tax is also the wrong box number what can I do?

Normally the state identification number for withholding is the employer identification number on the 1099G. I would enter the Maryland tax identification number into box 10b. The 1099 Series are informational reporting forms submitted to the IRS by third parties. The IRS then matches the form information to your tax return to insure all income is reported and taxed. If you do not include a 1099 received from a third party on your tax return, you will receive a notice from the IRS asking why. This is the CP2000 matching notice. If you receive this notice from the IRS, make sure and respond by the date indicate on the notice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 G for Maryland has boxes 1-5, but the form on turbotax shows only Box 1, 4, 10a, 10b, 11. The number for federal tax is also the wrong box number what can I do?

I just entered the Payers Federal Identification Number... if that’s what you’re referring to.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 G for Maryland has boxes 1-5, but the form on turbotax shows only Box 1, 4, 10a, 10b, 11. The number for federal tax is also the wrong box number what can I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 G for Maryland has boxes 1-5, but the form on turbotax shows only Box 1, 4, 10a, 10b, 11. The number for federal tax is also the wrong box number what can I do?

Yes. You may want to wait to file. The American Rescue Plan Act recently passed allows exclusion of $10,200 of income from unemployment for households with income less than $150,000. We’re working quickly to get TurboTax updated, expect the federal portion of the unemployment exclusion to be released late 3/19. Because this act was passed so recently, we are still updating changes for each state, therefore the states won’t be updated with this federal release. If you are able to wait, this may save you from having to amend your state tax return if Maryland accepts the Federal changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 G for Maryland has boxes 1-5, but the form on turbotax shows only Box 1, 4, 10a, 10b, 11. The number for federal tax is also the wrong box number what can I do?

Turbo tax has updated its software to account for the tax waiver. I only know this because I waited to file and saw the changes this past weekend. My main concern was box 10b and whether or not to input the Federal id number there. But it seems like you are suppose to use that number. Thank you all for your responses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 G for Maryland has boxes 1-5, but the form on turbotax shows only Box 1, 4, 10a, 10b, 11. The number for federal tax is also the wrong box number what can I do?

I have read everything in this message string - and several other related ones - but have been completely unable to clear the "Needs Review" message for my 1099g for Maryland Unemployment. I have tried everything I can think of but the "Needs Review" message simply will not clear. I have probably tried 25 different solutions, including deleting the 1099g multiple times and re-entering, but to no avail. HELP?!?!?!?!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 G for Maryland has boxes 1-5, but the form on turbotax shows only Box 1, 4, 10a, 10b, 11. The number for federal tax is also the wrong box number what can I do?

@DavidJames4 wrote:

I have read everything in this message string - and several other related ones - but have been completely unable to clear the "Needs Review" message for my 1099g for Maryland Unemployment. I have tried everything I can think of but the "Needs Review" message simply will not clear. I have probably tried 25 different solutions, including deleting the 1099g multiple times and re-entering, but to no avail. HELP?!?!?!?!

If there was no state income taxes withheld from your unemployment compensation then leave boxes 10a, 10b and 11 blank (empty) on the TurboTax Form 1099-G.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Sarmis

New Member

Wisco920

New Member

user17558059681

New Member

dinesh_grad

New Member

Thomas-hymes90

New Member