- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Should turbo tax calculate 10% distribution penalty on military retirement pension if under 5...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should turbo tax calculate 10% distribution penalty on military retirement pension if under 59 1/2?

1) The prior answers are from last year's Q&As...but still apply to this year (though 1 year added on to the year dates). (see added comment about Desktop vs Online software at the end)

2) As long as it is a Military pension from DFAS.

3) As long as box 7 contains a "7" for the distribution code.

4) then you can go ahead, and answer No ...because the 59.5 year rule doesn't apply to military pensions from DFAS......as long as you mark that 1099-R as noted in step 5 below>

5) you also need to make sure you tag that particular military DFAS 1099-R as being "From a Non-qualified Plan" on one of the interview pages after the main form entries, that asks about this being either a Qualified, or Non-qualified .

6) IF properly marked as noted in #5, there will be no 10% penalty applied, but it is still subject to normal Federal taxes (states vary).

__________________________

Later Notes. Tested the "online software.....For "Online" software users, for a Military DFAS pension 1099-R, the user must answer "No, this was not an early withdrawal" in the interview follow-up pages, as long as box 7 had a code "7 " in it. If you answer Yes (even if true), the Online software will improperly apply a 10% early withdrawal penalty.

(Desktop users could answer either Yes or No as long as step 5 above is marked properly)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should turbo tax calculate 10% distribution penalty on military retirement pension if under 59 1/2?

I added some additional comments for "Online" software users, after testing both the Desktop and the Online software setups.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should turbo tax calculate 10% distribution penalty on military retirement pension if under 59 1/2?

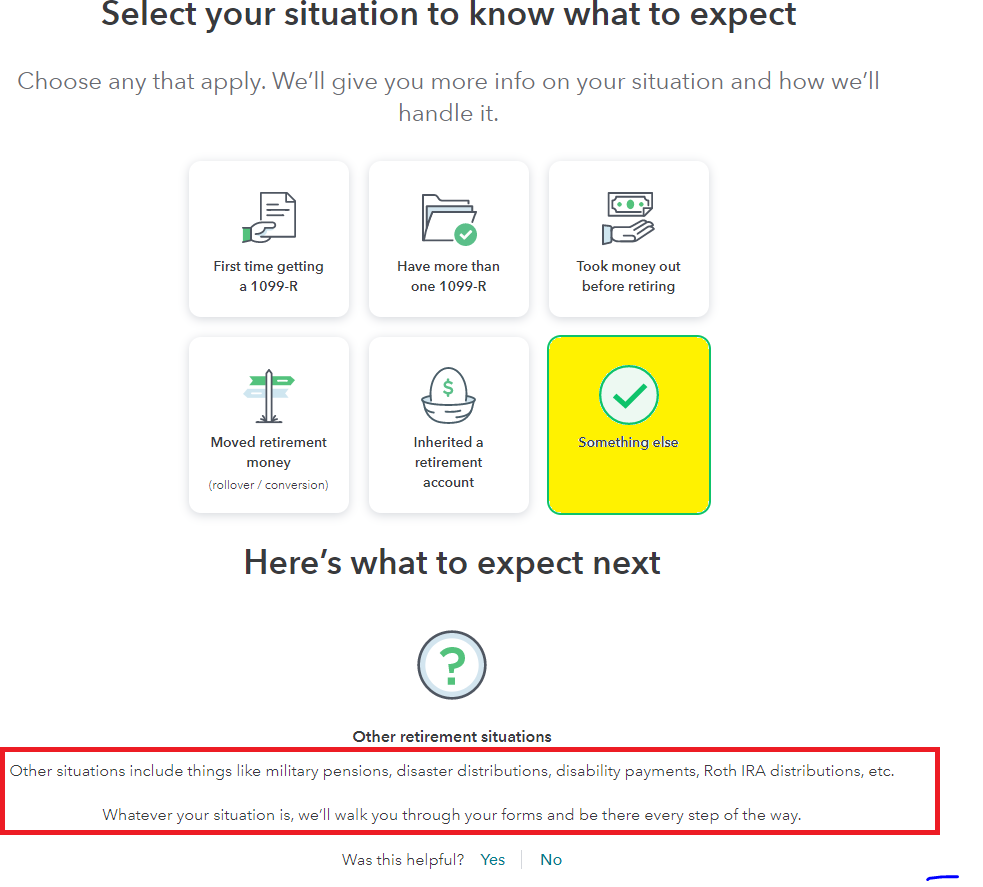

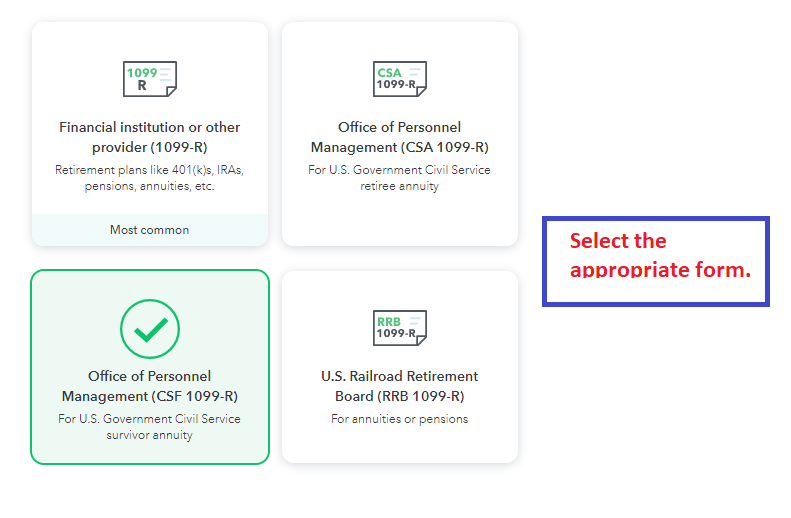

If you are receiving a military pension in regular payments each month you should follow the steps outlined by @SteamTrain. Below are images from TurboTax Online version to assist.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should turbo tax calculate 10% distribution penalty on military retirement pension if under 59 1/2?

Yes, select the appropriate form, but I'm 99% sure a DFAS military pension comes on a standard 1099R, not a CSA- or CSF- form. So, people need to be very careful to look at their actual form title, and not to select the wrong form type. I'm hoping they don't use the selection you showed in your picture.

(Yeah, probably wasn't your intent to have them make that selection... but "Select the appropriate form", could be interpreted either as a general comment, or as an instruction to make the particular selection you showed...which was what I first thought.)

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17539892623

Returning Member

Liangtwn

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

ecufour

Returning Member

Raph

Community Manager

in Events

diitto

Level 2