- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Planning for 401k to Roth IRA conversion

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Planning for 401k to Roth IRA conversion

I'm 66 years old, retired in 2022 and won't have income coming from W-2. I'm not claiming my SS benefits (yet) and plan to start taking them at 70.

There will be a minimal income coming from investing (around 2,000).

I'm planning to make 401k -> Roth IRA conversion(s) before RMD starts.

With this plan, I will have 5 years when I will be in the lowest tax bracket.

Will I be able to simulate this conversion using TurboTax ("What If analysis")?

If so, how and when?

Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Planning for 401k to Roth IRA conversion

IF you used the Online software to file 2022, there is no "Forms Mode" in the online software, and no What If worksheet either.

That's why I said you need to use the desktop software.

Thus, if you want to attempt to use the What IF worksheet to predict next year's situation, you'd need to buy the 2022 desktop software, and install it on a full Windows (Rev 10 or higher) or MAC computer (OS Big Sur 11 or higher).

__________________

You could then download your Online data file and use that as the starting point.

Thing is, that if you had a state in your Online data file then Deluxe would probably be the minimum to buy, since you must install the state before you can open that Online datafile. If you buy the Deluxe from TTX, it will include one free state software download too.........but If you had more than one state in your Online datafile...then you have to buy the extra state(s) for another $45 each from within the program.

TurboTax® 2022-2023 CD/Download Tax Software for Desktop (intuit.com)

If you buy the Deluxe software from a 3rd party (like Amazon), it will be cheaper, but you have to be careful to buy the right Deluxe software, since it is sold in two versions, both with, and without the one free state software download. (Opinion: Don't buy the CD, buy a software download.).

Right now Deluxe 2022 is $70 from Amazon, and $80 directly from TurboTax with the one free state. Your choice as to whether it's worth it or not......and you do have to buy new softwae every year.

___________

And...and..and no, the What-if worksheet does not predict anything about what the state taxes will be.

______

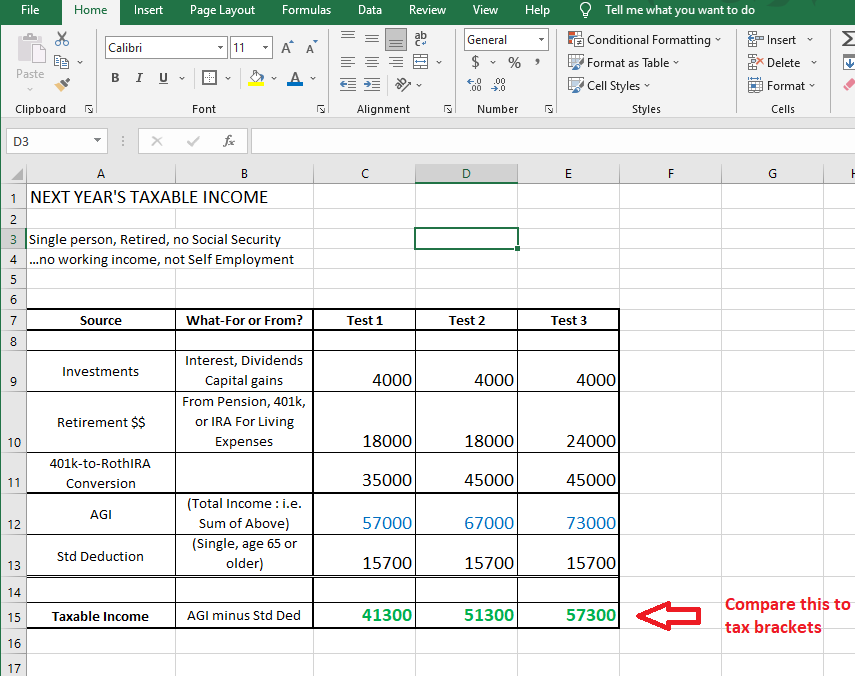

Here's a picture (down below) of just the top part of the What If Worksheet for a Single person who was age 65 in 2022, and will be 66 in 2023.......but it goes on with some 72 lines of details you can change as needed (or some more lines if you use itemized deductions) with the calculated tax assessed on line 62 (lines 63-to-71 deal with various credits or taxes you might have withheld/prepaid).

You will have to plan to spend a few hours looking at all the lines to decide which need to be changed and to understand where everything is.

(Sometimes it's simpler to guesstimate...like if you had wages of $45,000 in 2022, and replace that with $45,000 of Traditional 401k-to-RothIRA conversion, and everything else the same (No pension?), your Federal tax liability will be about the same .....liability being the total tax assessed before considering any withholding or estimated tax payments.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Planning for 401k to Roth IRA conversion

Sure...if you use the Desktop software every year. After preparing the current year's data in the normal software, you can then use the What-If worksheet where you can transfer the current year's $$, into a second column for predicting the next year's situation...then change all the values for each of the next year's $$ categories to see what the tax hit ends up being for the additional amounts you want to convert, remove W-2 income, and can also check a box to use the next year's expected tax rates.

Issues?

1) IF the 401k is a traditional pre-tax 401k, then most, or all of the $$ transferred to ROTH IRA will add to your other income (pension?) which bumps up your AGI and taxable income ....so it may not all be at the lowest tax rate...the actual % tax bracket will then depend total taxable income (after deductions)...and even that will vary too depending on what your filing status is (MFJ, or single?)

2) You are not taking SS yet, but if you are also getting a pension to live on, and have started making Medicare payments too, if your income is too high for any one year (including those 401k-to-Roth conversions), then you could get hit with higher Medicare part B and D premiums the next year. How much, again depends on whether you are single or married.....so pre-planning and dividing up the conversions over several years is usually preferable.

You can see the Medicare IRMAA tables here:

_________________

To get the What IF worksheet, after you fully fill in the current year's taxes in the desktop software, you need to switch to Forms Mode to be able to search for and open the What If worksheet. Then work on that in Forms mode to plan and see the effect of varying the next year's 401k-to-Roth IRA conversion amounts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Planning for 401k to Roth IRA conversion

There are so many moving parts here, you may want to see a financial planner. Creating taxable income by doing Roth conversions will affect your medicare premiums and the taxability of social security (when you take it). You are going to have some withdrawals already for living expenses, so you will have to plan carefully so that the extra you take out for conversion does not put you into too high a tax bracket.

Just as an example, if you are single and need $40,000 per year after tax to live, you will already be withdrawing $50,000 and pay 12% tax on everything over $15,000. If you withdraw another $40K for conversion, that will be taxed at 22%. However, if we suppose you receive $1000 per month in SS benefit, then at age 70 you would only need to withdraw $16,000 per year to make ends meet, which will almost be tax-free, or taxed at 10% or 15% instead of paying 22% now.

Also, I learned this when my mother developed dementia. If you need to go into a nursing home, you must be "poor" for Medicaid to pick up the cost. That means you get to keep $3000 and a car, and everything else goes to the government. You turn over your assets, your pension and SS benefit, and only then, Medicaid will pick up the remainder. But, as long as you turn over the RMD of your traditional IRA to the nursing home, you get to keep the principal of the IRA to use for whatever you want, or leave it to your kids. But because Roth IRAs have no RMD, you have to turn over the entire amount before you get your nursing home covered. It's years or decades away, but it's something to be aware of. There's probably an argument that you need a well balanced portfolio of pre-tax assets, Roth assets, and non-protected investments. good luck.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Planning for 401k to Roth IRA conversion

Thank you Opus 17.

I know most of what you wrote and understand the "prerequisites" for the traditional IRA->Roth IRA conversion to make it have sense.

- have enough money to cover living expenses until RMD

- have enough money to pay taxes for the conversion

Also, I need to ensure it doesn't affect my Medicare too much.

Ideally, I would like to stay in 12% tax bracket.

Knowing my moderate income from my existing investment, I would like to be able to run numbers.

I definitely know if I don't have such a conversion done before SS starts and then RMD, I will be hit by a much bigger tax and Medicare.

My main question remains: how do I get last year's return in Forms View if I used the Online version of TurboTax and don't have a downloaded version?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Planning for 401k to Roth IRA conversion

IF you used the Online software to file 2022, there is no "Forms Mode" in the online software, and no What If worksheet either.

That's why I said you need to use the desktop software.

Thus, if you want to attempt to use the What IF worksheet to predict next year's situation, you'd need to buy the 2022 desktop software, and install it on a full Windows (Rev 10 or higher) or MAC computer (OS Big Sur 11 or higher).

__________________

You could then download your Online data file and use that as the starting point.

Thing is, that if you had a state in your Online data file then Deluxe would probably be the minimum to buy, since you must install the state before you can open that Online datafile. If you buy the Deluxe from TTX, it will include one free state software download too.........but If you had more than one state in your Online datafile...then you have to buy the extra state(s) for another $45 each from within the program.

TurboTax® 2022-2023 CD/Download Tax Software for Desktop (intuit.com)

If you buy the Deluxe software from a 3rd party (like Amazon), it will be cheaper, but you have to be careful to buy the right Deluxe software, since it is sold in two versions, both with, and without the one free state software download. (Opinion: Don't buy the CD, buy a software download.).

Right now Deluxe 2022 is $70 from Amazon, and $80 directly from TurboTax with the one free state. Your choice as to whether it's worth it or not......and you do have to buy new softwae every year.

___________

And...and..and no, the What-if worksheet does not predict anything about what the state taxes will be.

______

Here's a picture (down below) of just the top part of the What If Worksheet for a Single person who was age 65 in 2022, and will be 66 in 2023.......but it goes on with some 72 lines of details you can change as needed (or some more lines if you use itemized deductions) with the calculated tax assessed on line 62 (lines 63-to-71 deal with various credits or taxes you might have withheld/prepaid).

You will have to plan to spend a few hours looking at all the lines to decide which need to be changed and to understand where everything is.

(Sometimes it's simpler to guesstimate...like if you had wages of $45,000 in 2022, and replace that with $45,000 of Traditional 401k-to-RothIRA conversion, and everything else the same (No pension?), your Federal tax liability will be about the same .....liability being the total tax assessed before considering any withholding or estimated tax payments.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Planning for 401k to Roth IRA conversion

The only thing you could do with the online version would be to make a new test account with a different username and password ( it can be linked to the same email address) and use that test account to play around with the numbers. You would be looking at 2022 tax calculations, but so far there are no significant differences for 2023. Since the online version only requires you to pay when you are ready to file, and you won’t be planning to file this test, tax return, it won’t cost you anything to play around. Just be sure that you don’t accidentally file it, and that you don’t use it as your starting position for your 2023 tax return.

In general, the desktop program is much more flexible regarding multiple tax scenarios, tax planning, and so on. However, if you have already filed your 2022 return, it won’t make much sense to buy another copy of 2022 just for practice purposes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Planning for 401k to Roth IRA conversion

Thank you so much for this detailed explanation.

This looks pretty complicated, time-consuming, and it is not free.

Taking into account that I was planning to do multiple conversions (at least, 5), AND to see the impact of these conversions in the future, this is not a very efficient way of handling such a task.

Thank you again for your time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Planning for 401k to Roth IRA conversion

Well, if you wanted to keep it simple, I would just create a simple spreadsheet, either in tax software you might have (EXCEL) or even on a sheet of lined paper. Something like shown below. then you can compare the final line of taxable income to the tax brackets for 2023.

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

_________________

Yeah, you'd have to update the Std Ded line every year, and check each year's tax brackets, but this keeps it simple. Not worth worrying about going from 10% to 12% tax, but 12% to 22% is a significant jump.....and you have to remember that only the $$ that go over each break point are taxed at the higher rate....so if you accidentally go a few hundred or a thousand over into a rate you don't want to be in for a particular year, it won't be too much of a hit.

And you haven't really indicated what you are living on until age 70....if the $$ are coming from your personal savings (i.e. NOT from a 401k, Pension or IRA)...then those $$ go nowhere on the spreadsheet. And it's unlikely you can live on $2000/yr from investment income.....Perhaps 2,000/month (24,000/yr) in certain living locations....it is a bit squeaky, but in the right situation???

____________

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

howjltx

Level 3

dlipps

Level 3

meg-han77

Level 1

HOB2

Level 1

lzarybnicky

New Member